Prices

July 19, 2018

Finished Steel Imports Slow in June and July

Written by Brett Linton

Imports of foreign steel continue at a brisk pace, despite the Section 232 tariffs placed on steel imports from every country in the world except Australia (no quota), South Korea (with quota), Brazil (with quota) and Argentina (with quota). Since the Section 232 tariffs began at the beginning of May, and most foreign mill lead times are 3-5 months for delivery, we should start to see reductions in imported tons during the months of July, August and beyond.

However, with the sharp rise in domestic spot steel pricing, the spread between domestic and foreign steel is wide enough to accommodate paying freight, trader margin and the 25 percent tariff and still have some products that are priced below domestic numbers. The key for most steel buyers now is whether the domestic number will see some weakening, causing prices to falter and to chip away at any spread that exists between new foreign offers and those of domestic steel mills.

Another issue is what happens should the U.S., Mexico and Canada come to an agreement on NAFTA by Labor Day, as Commerce Secretary Wilbur Ross suggested in recent comments? If that happens, we can assume imports from Canada and Mexico would no longer be subject to tariffs.

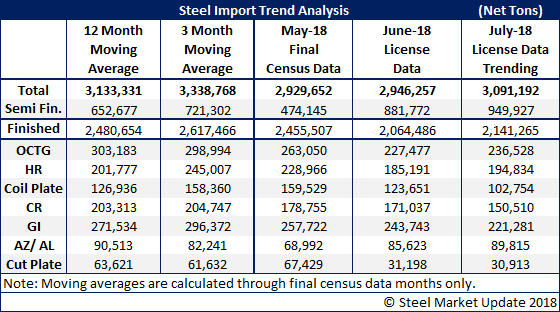

The U.S. Department of Commerce released license data for June and July 2018 on Tuesday. The data suggests imports for June will total 2.9 million net tons and the trend for July, through July 17, is for the month to come in closer to 3.1 million net tons, most of the growth being in semi-finished steels (slabs and billets, but mostly slabs), which are purchased by domestic steel mills. The graphic below provides more details on license data by product.

2015-2018 Jan-July Monthly Average Comparison

Steel Market Update dove a little deeper into the data and found that the monthly average (January-July) in 2018 is 170,000 tons below what we saw in 2015. At the same time, the 2018 average is 307,000 tons higher than what was reported during the first seven months of 2016 (anti-dumping determinations were made then and President Trump had not yet threatened the steel industry).

June & July Comparison

We also wanted to do a quick comparison of finished steel imports (we removed semi-finished) and found the following:

• June 2016 = 2,280,574 net tons

• June 2017 = 3,006,640 net tons

• June 2018 = 2,064,486 net tons

• July 2016 = 2,480,783 net tons

• July 2017 = 2,896,410 net tons

• July 2018 = 2,141,265 net tons

So, for both June and July, we are seeing reductions in finished steel imports.

Brazil and South Korea are large exporters to the United States and both countries have quotas that are already completed for 2018 on some products. Where there is tonnage left on other products, their export will be at much lower levels than what was exported in the first four months 2018. Therefore, we believe U.S. imports will continue to trend lower, which over time will reduce supply and prop up prices.

At the same time, the 25 percent tariff will begin to impact demand in the United States. We could see lower orders by service centers and OEMs moving into late fourth quarter and early first quarter 2019. This would be a drag on pricing.

If NAFTA is approved and the 25 percent duty is removed, that would most likely be a net negative for steel prices, especially by the end of the calendar year.

SMU’s Price Momentum Indicator is at Neutral, and we do not yet know what direction prices will head come late third- and into fourth-quarter 2018.