Prices

May 23, 2019

Hot Rolled Futures: Big Price Move Down Leads to Shifting Market Sentiment

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

The hot rolled steel market remains cautious but optimistic with domestic producer prices coming in at even larger discounts to foreign producer prices following a month of steep HR spot price declines. HR spot prices have declined over $40/ST since the beginning of May.

This has contributed to a shift in the market consensus that the HR futures market prices might be getting oversold. We have just recently seen more buyer inquiries along the HR futures curve, which until recently had been limited. Some of this shift is probably due to the fact that HR spot prices have declined almost $300/ST since last July ($915/ST to $620/ST).

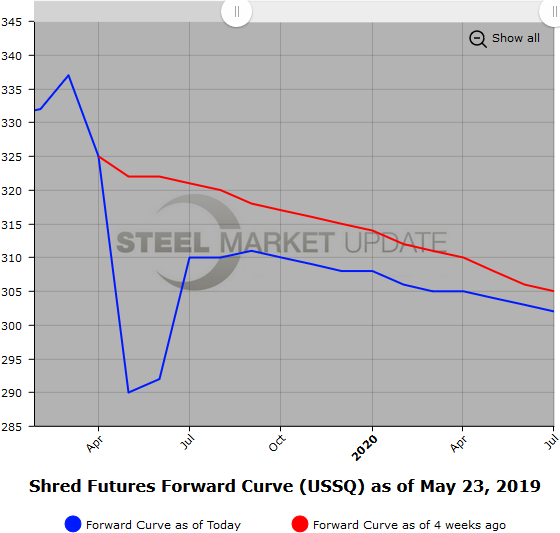

Since May 1, the futures curve has seen big shifts down in the forward curve. Q3’19 HR futures prices have dropped $60/ST, falling from $640/ST to $580/ST. Q4’19 HR futures prices have dropped $54/ST, falling from $641/ST to $587/ST. Q1’20 HR futures prices have dropped $44/ST, falling from $641/ST to $597/ST.

There is a large discount between May’19 HR future ($641/ST) and the Jun’19 future ($584/ST), a difference of (-$57/ST). However, the price differential between the Jun’19 HR (spot +1 month) future and May’20 HR future is $26 contango ($584/ST /$610/ST). The upward sloping futures curve reflects an expectation of a bottoming pricing cycle.

The price decline in May up to this latest steep drop was driven by a number of market concerns:

- SMU’s declining buyer sentiment Index.

- Steep drop in the May PMI data.

- Production is at long-term highs for the domestic market.

- Increasing global HR steel production and exports.

- Uncertainty around the length of time U.S. steel tariffs would remain in place.

- Additional HR capacity/supply coming online.

- Mill lead times softening.

- Narrowing margins due to sharply declining HR prices.

- More recently, declining prices for domestic scrap, which has declined over $60/GT for prime scrap in the last two months, contributing to lower HR prices.

- Uneven input costs—a supply pinch has pushed spot iron ore prices to near-term highs (mid $90/MT) narrowing some mill margins.

- Deep HR pricing discounts at service centers in conjunction with weakening order books at the mills.

The question is, are all these concerns priced into the futures? No clear signals for the time being.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

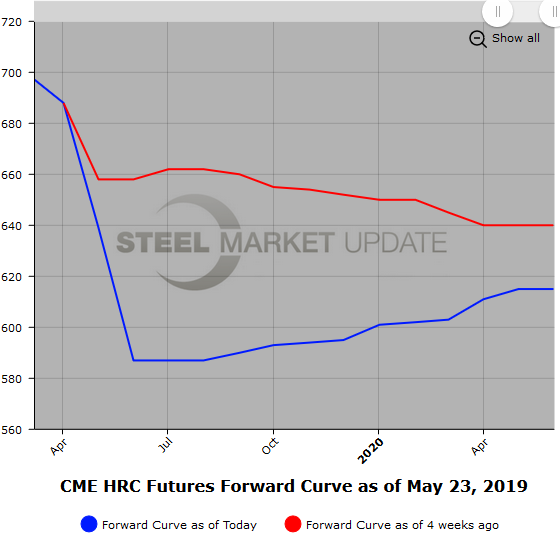

BUS spot prices dropped over $38/GT as May prices settled. Jun’19 BUS futures have declined about $15/GT this month and are currently offered around $320/GT, a slight premium to the latest index value ($312.25). Early market comments suggest BUS for June will come in at down $10/GT to sideways for prime scrap. However, recent strength in LME steel scrap prices could pull domestic prices higher along with softer manufacturing forecasts if the latest PMI report has any teeth.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

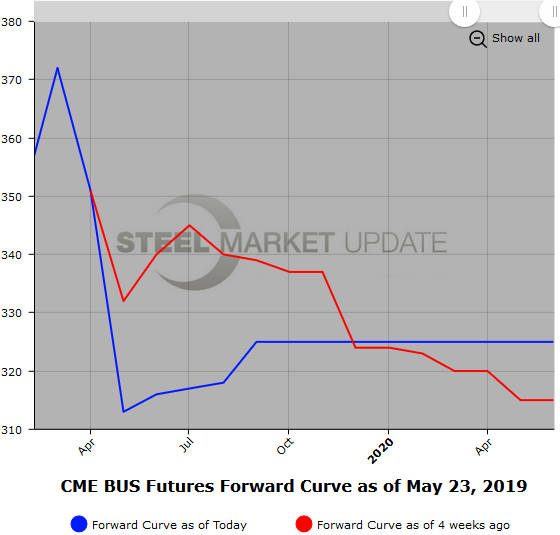

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.