Prices

August 8, 2019

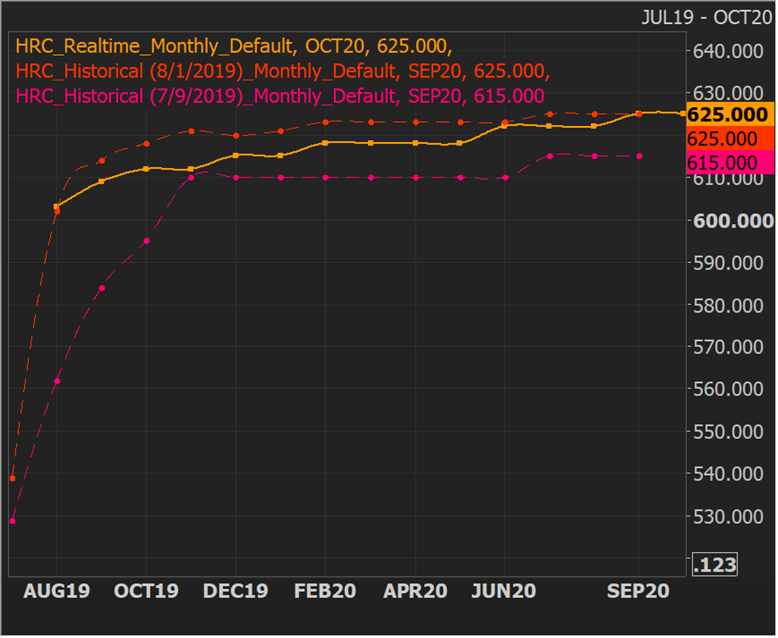

Hot Rolled Futures: Snoozing

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge at www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

The HRC market is quiet. And it is not “quiet” in a way that inspires calm and peace. Its manner is more leaning to the kind of “quiet” that hides restlessness, confusion and unease. There are many who are trying to explain this period of eerie silence by attributing it to people being out-of-office! It is understandable that it is summer and some people are on vacation. However, since we are not all blessed with European vacation policies, we have to ask: What’s going on?!!

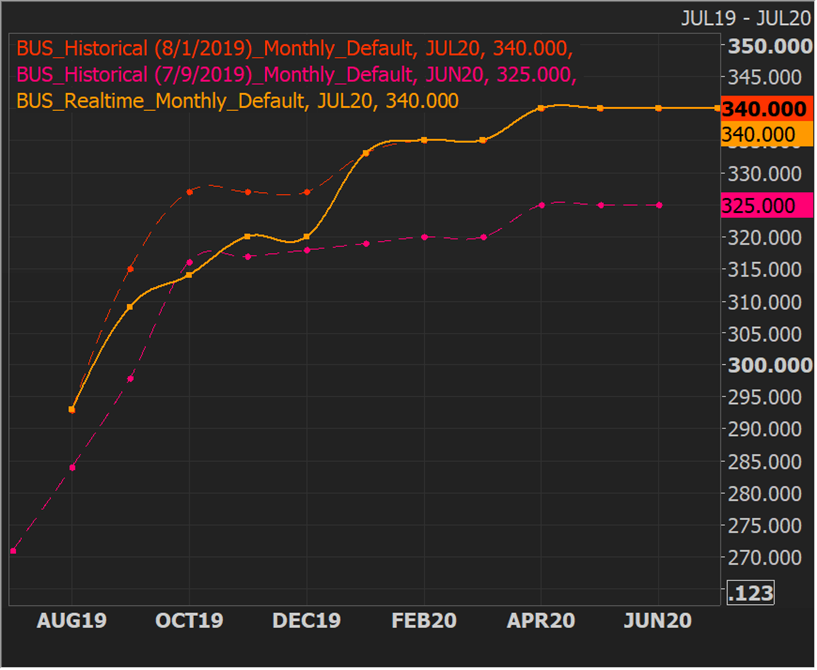

The forward curve has become range bound. The curve still has a positive carry (forward months above the front month), but it may not be quite as attractive as it was 4-6 weeks ago when buying the nearby and selling the deferred seemed like a great trade to some. The range bound action isn’t limited to HRC. The scrap market isn’t doing much different, except its month-over-month gains in physical market are somewhat reflected in the forward curve movement. The chart below shows the orange line (today close) as having moved higher than a month ago (July 9). The line also highlights that the sentiment around scrap was more positive at the beginning of the month of August than what it shows now!

And somewhere between the two charts is a probable explanation for the lack of conviction (and hence inactivity). The reality is that while sentiment on scrap softened, iron ore markets in Asia too were doing poorly. This weaker international market on raw materials led to some confusion around how the U.S. HRC market may continue to see positive gains despite all the negativity around demand.

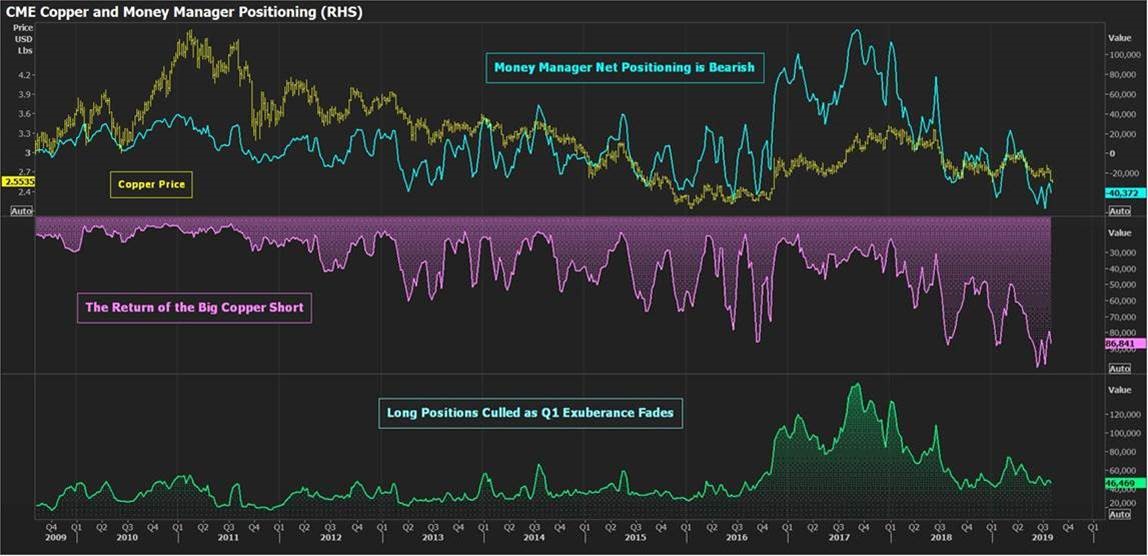

Source: Eikon Reuters

The HRC sellers are frozen and not stooping lower to hit the bids. The low distributor inventory levels and lack of international offers/import penetration keeps the sellers from aggressively selling the forward curve. Important to note that bearishness in iron ore is not divorced from broader concerns globally around industrial demand. This chart above shows what is happening in copper, another market that has high industrial demand exposure. Money managers in this market have been cutting their positions aggressively as they fear an economic downturn.

This leads us to the question: What should we be doing? And what is the game plan if you’re managing steel exposure? As we all know, at any given time there are many factors that are changing for our market: end-user demand, raw material prices, output from U.S. and international mills, forward outlook, and sentiment, to name a few. Lack of clarity on which way these forces push the market can lead to periods of inactivity. As a market participant, you should right now be checking how much “excess” supply or “demand” you see in your business and not let the “quiet” market lull you into complacency.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.