Prices

September 1, 2022

Hot Rolled Futures: Double Double Toil and Trouble

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

There is no shortage of toil and trouble around the world. It seems that each day we are greeted with something new to worry about. Russia/Ukraine. EU natural gas and electricity prices. Oil prices rising on supply worries. Oil prices falling on a potential deal with Iran. Steel prices falling too rapidly. Steel prices rising too quickly. The Fed is going to raise rates higher than previous expectations. Inflation is out of control. Wait, no, inflation seems to be peaking. Who knows?!?! It’s tiring but never boring!

Steel and related ferrous market futures try to bake in all the current news and reach a current market price for all the months on the curve. But we find it interesting that the curve sometimes reacts differently to similar kinds of news.

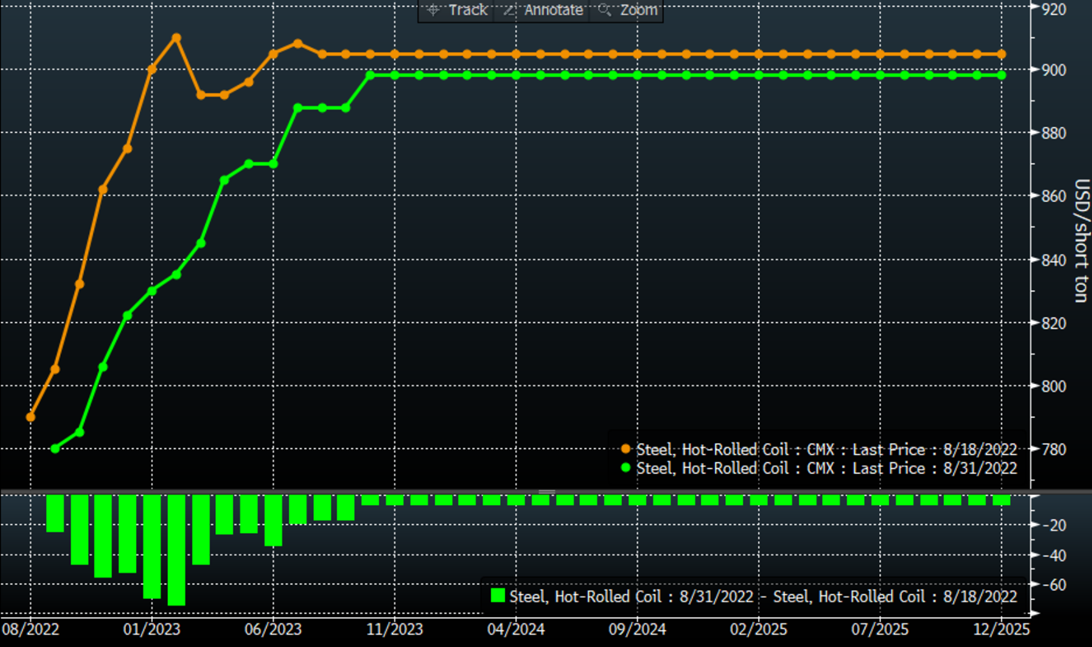

The chart below is a current curve (green), and one from before the SMU conference. We found it interesting that the curve moved up significantly when Nucor announced its price hike ($50 per ton I believe), but then gave the entire move back and then some.

Fourth quarter traded as high as $920-930 per ton after the Nucor announcement. However last week we had the SMU conference, and Cliffs announced a $75 per ton increase on the last day of the event, and the curve did not seem to care. What gives?

Honestly, we aren’t sure, but we can speculate on a couple of reasons. First off, some of the price forecasts were pretty low for 2023. Perhaps some of that bearishness wore off on the attendees and there was less belief that we can have a big upward move if prices are going to be that low in 2023. Secondly, the indices aren’t really moving up. Third, the Cliffs increase came at a time when the international markets were still weakening.

European prices fell by over 100 Euro over the past month before several mills announced price hikes this week. As much as we’d like to believe that we live on an island, price moves overseas do impact our markets.

China has been wavering with some big infrastructure stimulus packages announced, but weakness in their property markets appears to be offsetting the better infrastructure spending. So, we’d suggest that the lack of follow-through could be due to less than rosy forecasts at the conference, as well as more “macro” worries.

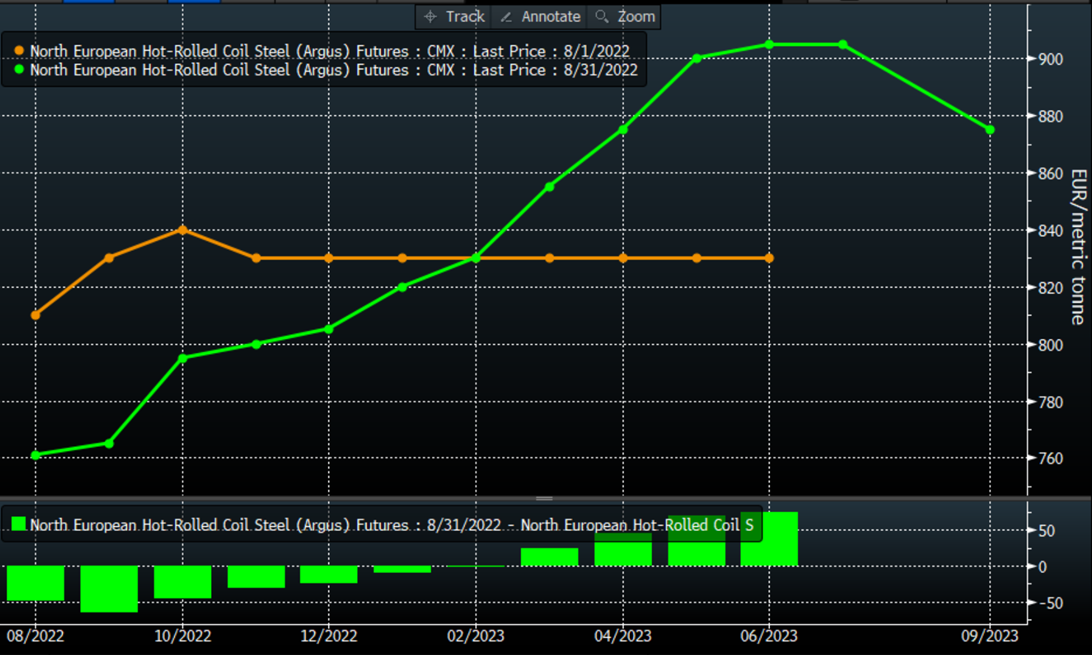

Speaking of Europe, check this chart out:

This is the kind of thing that gets futures traders excited. We mentioned the significant weakness in spot European prices, and the green line shows that being reflected in the nearby months. But perhaps most interesting is the move into a “contango” (a term that is most certainly in the “Ministry of Silly Words” archives), but it simply means that prices are higher in farther out months vs nearby months.

So why did European steel futures move into a contango? We are thinking that the market probably knows that the low level of prices and steel mill margins likely means production cuts are on the way which would restrict supply, and there is also significant cost inflation taking place there – so perhaps the futures market is “baking in” some combination of the two.

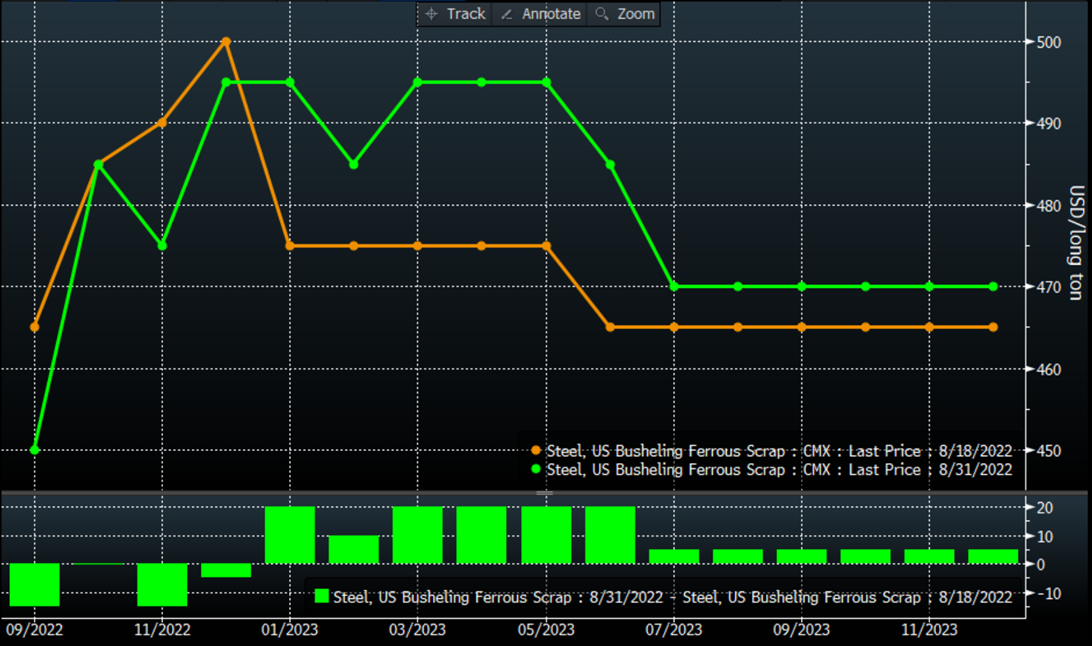

The busheling curve did not change much from pre-SMU conference levels to date but firmed a bit farther out in the future. There were some presentations that were more bullish on scrap, so that could have influenced traders.

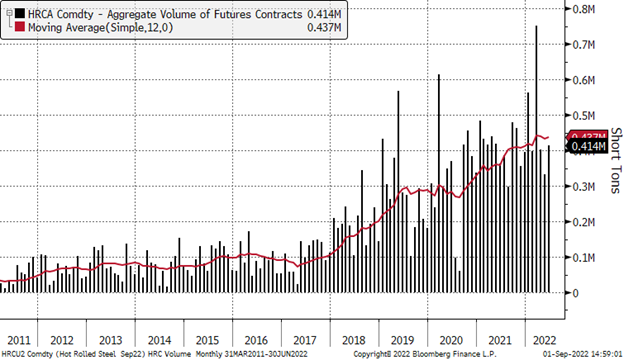

Volumes on the HRC contract have trailed off over the past few months. We aren’t totally clear on the reasons why, but it could simply be the dramatic cross current of events just has people sitting on their hands until firmer trends develop. With those observations we will close for the week, and hope that everyone has a great long weekend!

By Tim Stevenson, Founding Partner & CEO, Metal Edge Partners, LLC

612-310-7164

tim@metaledgepartners.com

www.metaledgepartners.com

Disclaimer: The information in this write-up does not constitute “investment service”, “investment advice”, or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.