Market Data

December 22, 2021

GDP Growth Slows to Just 2.3% in Third Quarter

Written by David Schollaert

Steel Market Update is pleased to share this Premium content with Executive members. For information on upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

U.S. gross domestic product (GDP) expanded at an annual 2.3% rate in the third quarter, up from the prior estimate of 2.1% but still at the slowest pace in more than a year, according to the Bureau of Economic Analysis (BEA). The economy slowed in the third quarter because of the Delta variant, which had ripple effects on global supply chains and consumer spending.

The third review by the BEA was slightly better than its first estimate, but the revision was still well below the solid GDP gains in the first (6.3%) and the second (6.7%) quarters. The small upward revisions from the second GDP estimate reflected a slightly better performance for consumer spending, which grew at a tame 2.0% rate in Q3, versus a 12% surge in the April-June quarter, and the slowest mark since the depths of the pandemic in the same quarter of 2020.

Presently, forecasts are pointing to improved growth in the fourth quarter. Household spending is expected to pick up sharply, aided by a boost in consumer spending due to the holidays. Some forecasts predict fourth-quarter growth that could be the strongest of the year, barring any major disruptions from the new Omicron variant of COVID. GDP data for the fourth quarter won’t be released until the end of January.

All told, economists believe the economy could grow by roughly 5.5% for the year. If those estimates stand, it would be the domestic economy’s best showing since 1984 when it rebounded from a double-dip recession, and a notable shift from the 3.4% decline last year due to the pandemic.

The BEA’s third review of the country’s real GDP in the third quarter reflected increases in personal consumption expenditures and private inventory investment, which were partly offset by a downward revision to exports. Imports, which are a subtraction in the calculation of GDP, were revised downward.

Personal consumption, the largest component of U.S. GDP comprising about two-thirds of overall economic activity, was revised up to 1.35% in the government’s third look at the third quarter, versus 1.18% in the prior analysis. The result, although improved, was still the weakest pace since the first quarter of 2019.

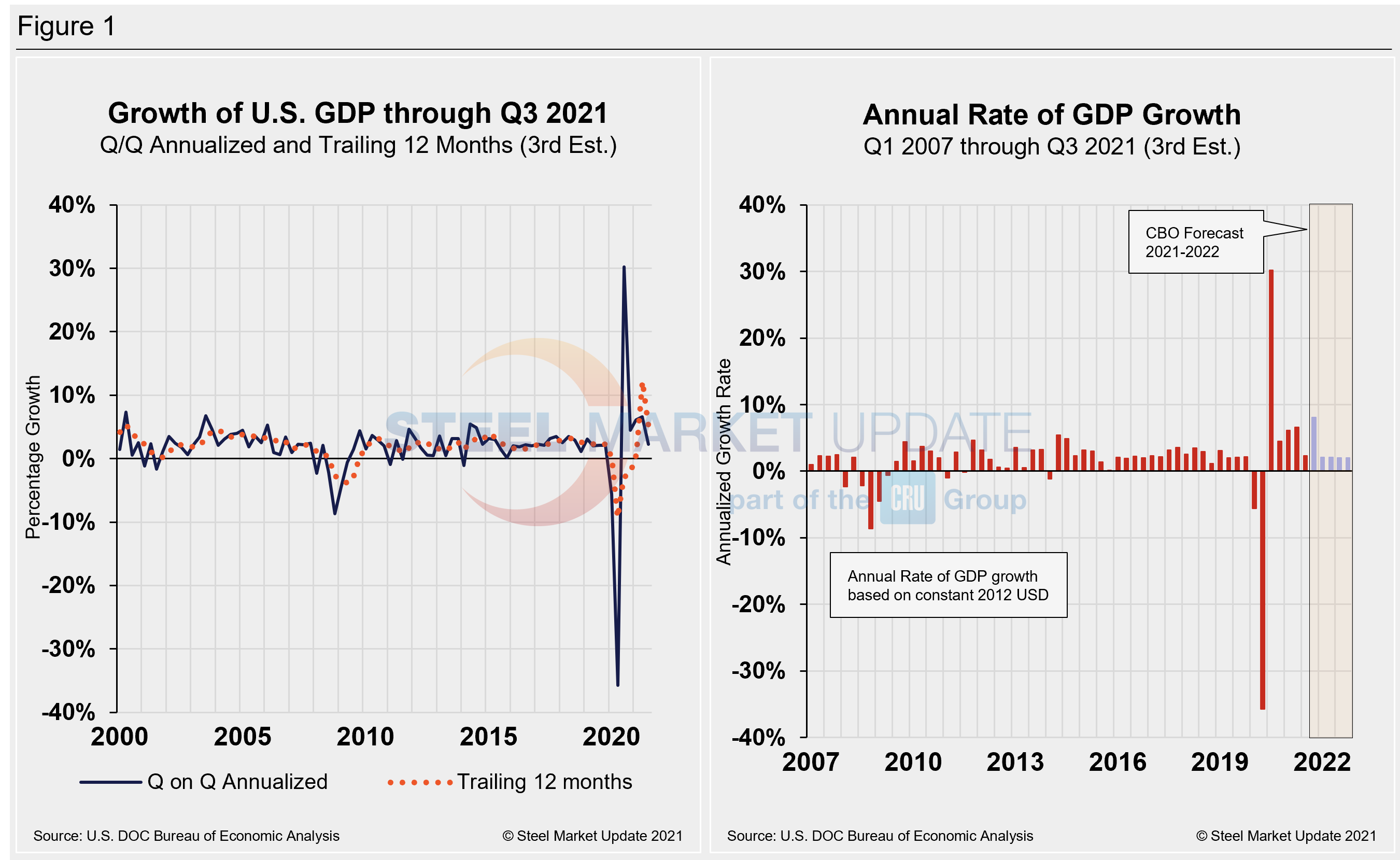

The Department of Commerce’s third and final look at U.S. GDP in Q3 totaled $23.20 trillion, an 8.4% or $461.3 billion increase from the previous quarter, measured in chained 2012 dollars on an annualized basis. Below in Figure 1 is a side-by-side comparison of the growth of U.S. GDP and the annual rate of GDP, both through Q3 2021. In the first chart, you’ll see the contrast between the trailing 12-month growth and the headline quarterly result. The chart on the right details the headline quarterly results since Q1 2007 including the Congressional Budget Office’s GDP projection through 2022. On a trailing 12-month basis, GDP decelerated to 4.95% in the third quarter, a steep fall from 12.23% in Q2, but still a vast improvement from -9.27% in Q2 2020 at the height of the pandemic. For comparison, the average in 47 quarters since Q1 2010 has been a growth rate of 2.06%.

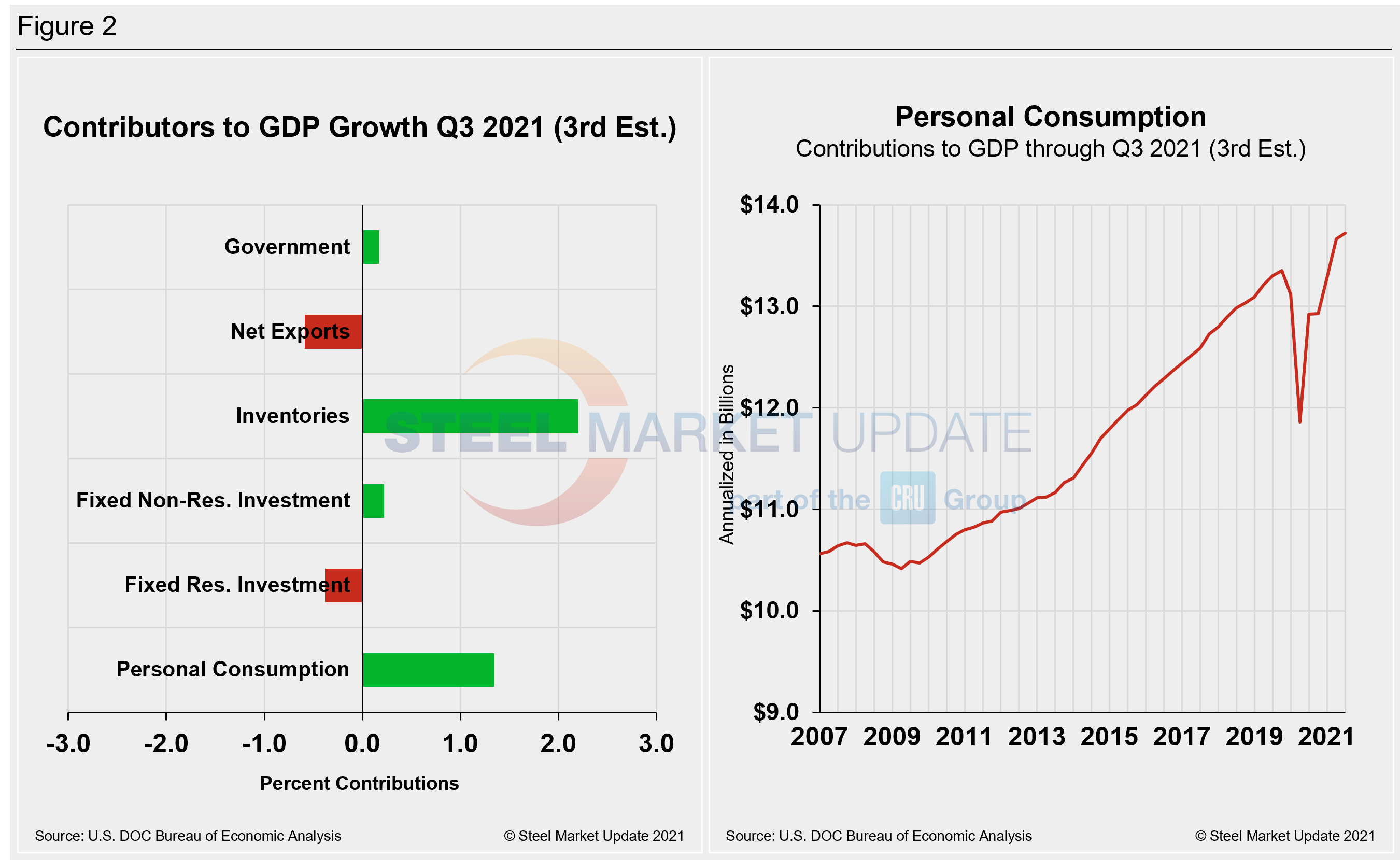

Shown below in Figure 2 is a side-by-side comparison of two charts. On the left is the mix of the six major components in the GDP growth calculation, while the chart on the right puts a spotlight on personal consumption, a measure of consumer confidence and spending engagement. The most notable change and major source of GDP fluctuation is personal consumption, which saw a negative 24.01% contribution a year ago after the onset of COVID, followed by a positive 25.44% contribution in Q3 last year as the economy reopened. Personal consumption jumped from 1.58% in Q4 of 2020 to 7.42% this Q1, edging up to 7.92% in the second quarter. The slump to 1.35% in Q3’s third and final review offers yet another snapshot of an economy still dealing with the effects of the pandemic. The extreme shifts the U.S. economy has faced over the past 12-18 months can be seen in the big swings in personal consumption.

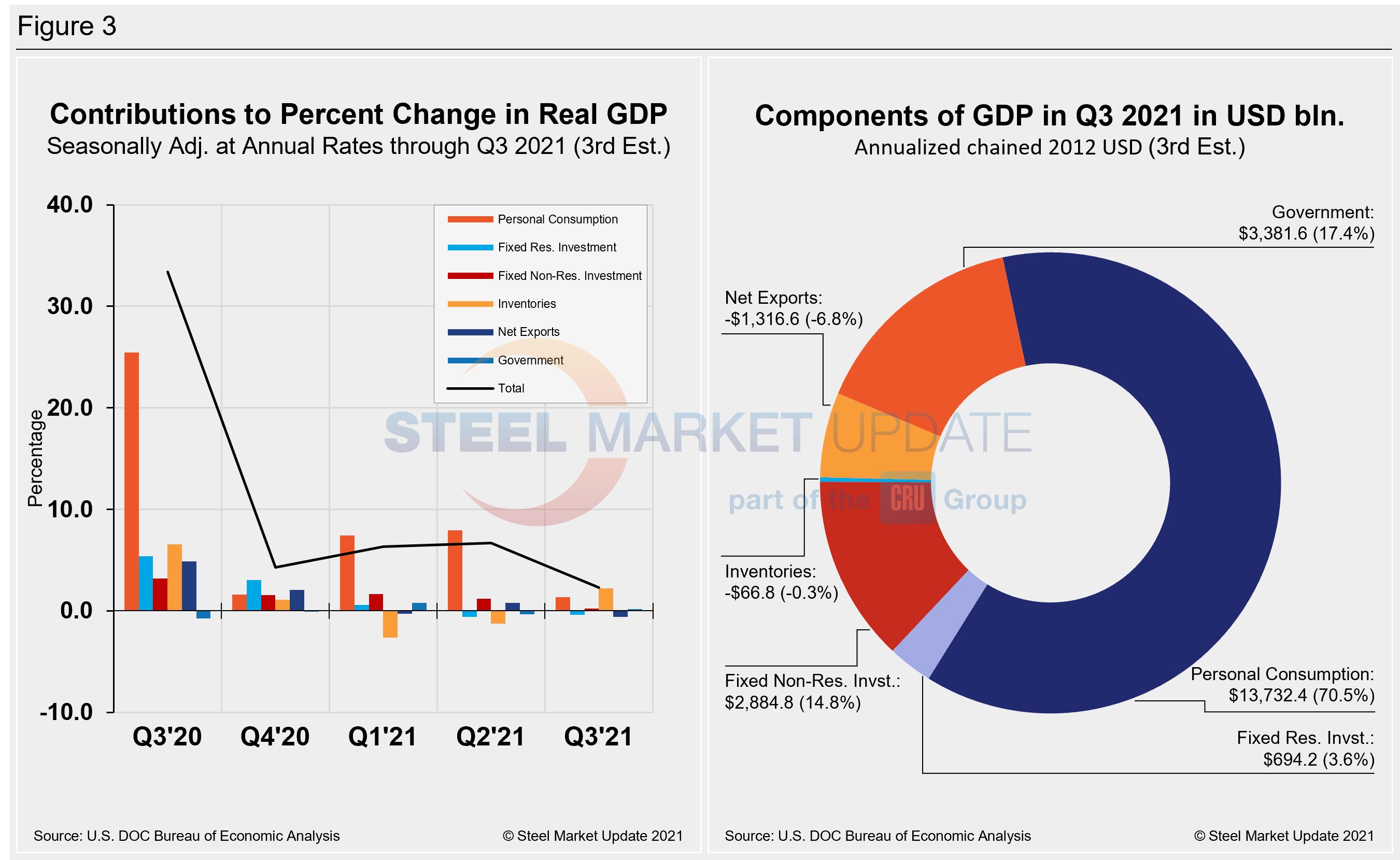

Quarterly contributions of the six major subcomponents of GDP since Q2 2020 and the breakdown of the $23.20 trillion economy in BEA’s final review of Q3 GDP are both shown in Figure 3. The chart on the left is detailed out for cross-comparison with Figure 1 above. The chart on the right shows the size of the other components relative to personal consumption.

SMU Comment: U.S. economic growth slowed in the third quarter, nearly undoing the positive momentum seen in the first two quarters of the year. Despite the disappointment seen in Q3, the fourth-quarter outlook remains optimistic, as historic GDP progress is still expected for the full year. Despite the encouraging news surrounding Omicron’s downgraded severity, the market is keeping a wary eye on its threat to the country’s economic growth.

By David Schollaert, David@SteelMarketUpdate.com