Prices

May 19, 2022

Hot Rolled Futures: The Beatings Will Continue Until Morale Improves

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management. Prior to that, he led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

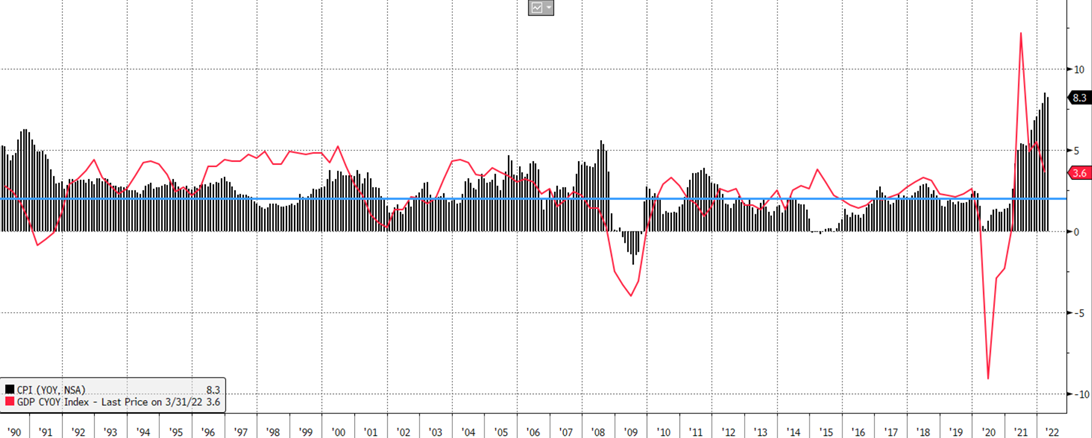

There has been quite a bit of unfortunate economic news as of late. Of course, inflation is top of mind for traders and investors, as the CPI has hit a multi-decade high. This puts the Fed in a tough spot as they appear to be “behind the curve” and need to bring this under control via rate increases. Of course, the bond market isn’t stupid, and is doing the Fed’s work for them to some degree.

The 10-year Treasury yield has surged from 1.4% in December to a current 2.85%. Mortgage rates have also seen a major increase. Some are saying that bonds now look over-sold and are due for a rally, but it’s hard to see yields coming significantly lower given the inflation problem – unless we go into recession.

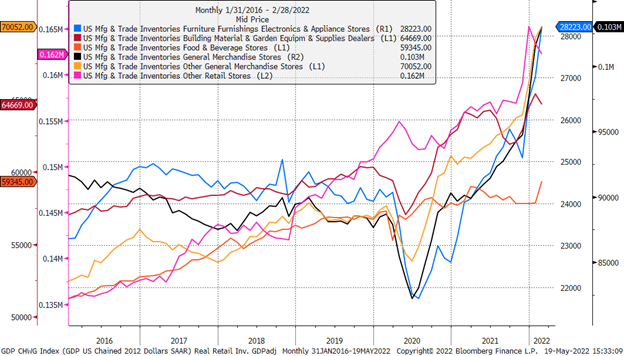

Some of the more bullish economists have been saying that we can’t have a recession, because we haven’t had a big buildup in inventories. While we certainly hear plenty of those anecdotes in the manufacturing economy, something else seems to be afoot in the consumer economy. Take a look at the chart below, which shows retail inventories (real, not nominal dollars) in a number of categories. Keep in mind that the consumer is a much higher proportion of GDP than manufacturing.

Some major retailers have had some cautionary comments about consumer behavior over the past week. Target stores cut their earnings guidance significantly, and noted that they have excess inventories of TVs, electronics, and home furnishings. They also said that they’ve seen a significant change in the last 60 days, noting that purchases in the above categories have slowed dramatically, and also in apparel. They are having to find outside warehouses to store excess goods in some bulkier categories. The consumer was flush with stimulus money for quite some time coming out of the Covid-related economic slowdown, but it appears that inflation and the lack of new stimulus dollars may be causing some behavioral changes.

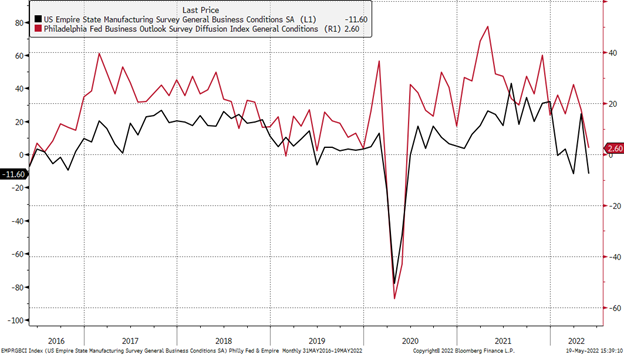

Switching to the manufacturing economy, a couple of the regional Fed indexes have also declined significantly lately. We aren’t ready to call this a trend, as these indexes are inherently volatile, but it does cause some concern.

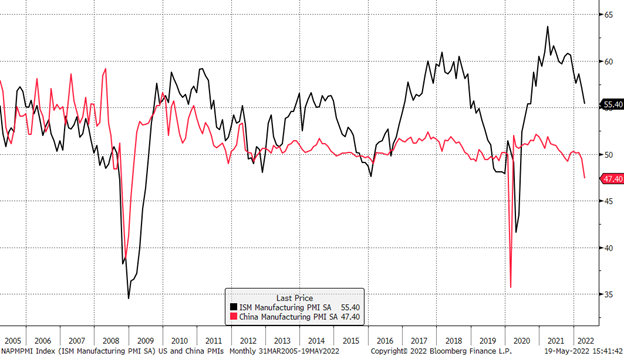

Speaking of manufacturing, here is a quick chart of the US and Chinese Manufacturing PMIs. Note that the latest reading out of China is the lowest we’ve seen since 2005, other than the huge drops we saw during the 2008-2009 financial crisis and the Covid collapse we saw in 2020.

So, lots of cheery news to share this week! The one thing that comes to our mind when looking at the Chinese PMI chart is that if/when they can get their Covid cases under control and emerge from the shutdowns, might they pump some stimulus into the economy to get things moving again? This could be an upside risk to commodities if this were to happen. And oil is at $108/barrel with China being very weak. What happens if they push the gas pedal again?

On to a review of the futures markets. HRC was not immune to the negative economic news and saw significant pressure through most months in 2022. Drops of $50 to nearly $100/ton occurred in a number of the 2022 months.

Busheling futures also softened, though less so than HRC. As we mentioned in our last write up, perhaps there is some support for scrap given that we do have several mills in startup at the moment, so demand for scrap could keep these prices more supported in 2H 2022, though we do hear that June may see another drop.

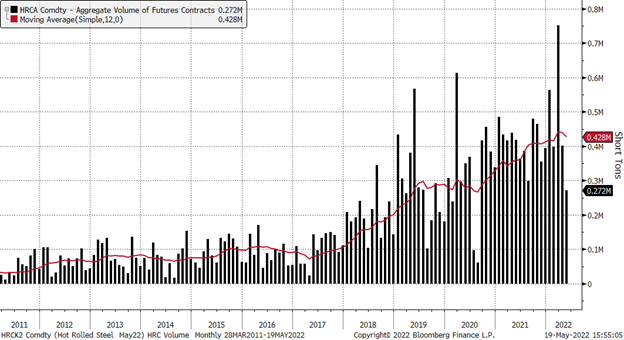

Volumes on the HRC contract pulled back in April after a huge (likely conflict driven) surge in March. The May numbers are obviously just a partial month. The trend still appears to be on the upswing as more entities look to hedge the price risks in their business. We also continue to see more HRC options activity despite the high volatility premiums embedded in the prices.

Overall, the spooky macro environment continues to provide plenty of reasons for volatility to continue. Participants in the markets can use these tools to try to manage their price volatility and plan for the future, as one never knows when the next Black Swan will decide to fly over. The recent economic data has been concerning for sure, and only time will tell if the consumer pullback will be large enough to cause us to tip into recession. Sorry for the dire tone to the article this week, and remember – don’t shoot the messenger! Thanks for reading.

Disclaimer: The information in this write-up does not constitute “investment service”, “investment advice”, or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.