Prices

July 7, 2022

Hot Rolled Futures: Probing for a Price Floor in a Thin Summer Market

Written by Jack Marshall

The following article on the hot-rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

After a brisk bout of futures activity in HR to close out the first half of 2022, we are experiencing much lighter volumes in early July as many participants take vacations and take their time reassessing forecasts for the remainder of the year.

Some of the drivers of this pause include:

• Spot HR continues to decline on average about $50 per short ton (ST) per week

• Lead times continue to contract, albeit at a slower rate. (We are nearing levels last seen in January, or ~4 weeks.)

• Inflation concerns persist driving additional caution on new business

• Scheduled summer manufacturing furloughs

• Declining metallics prices

• Persisting supply chain issues due to the rocky global political climate and Covid shutdowns

• Decelerating demand in China

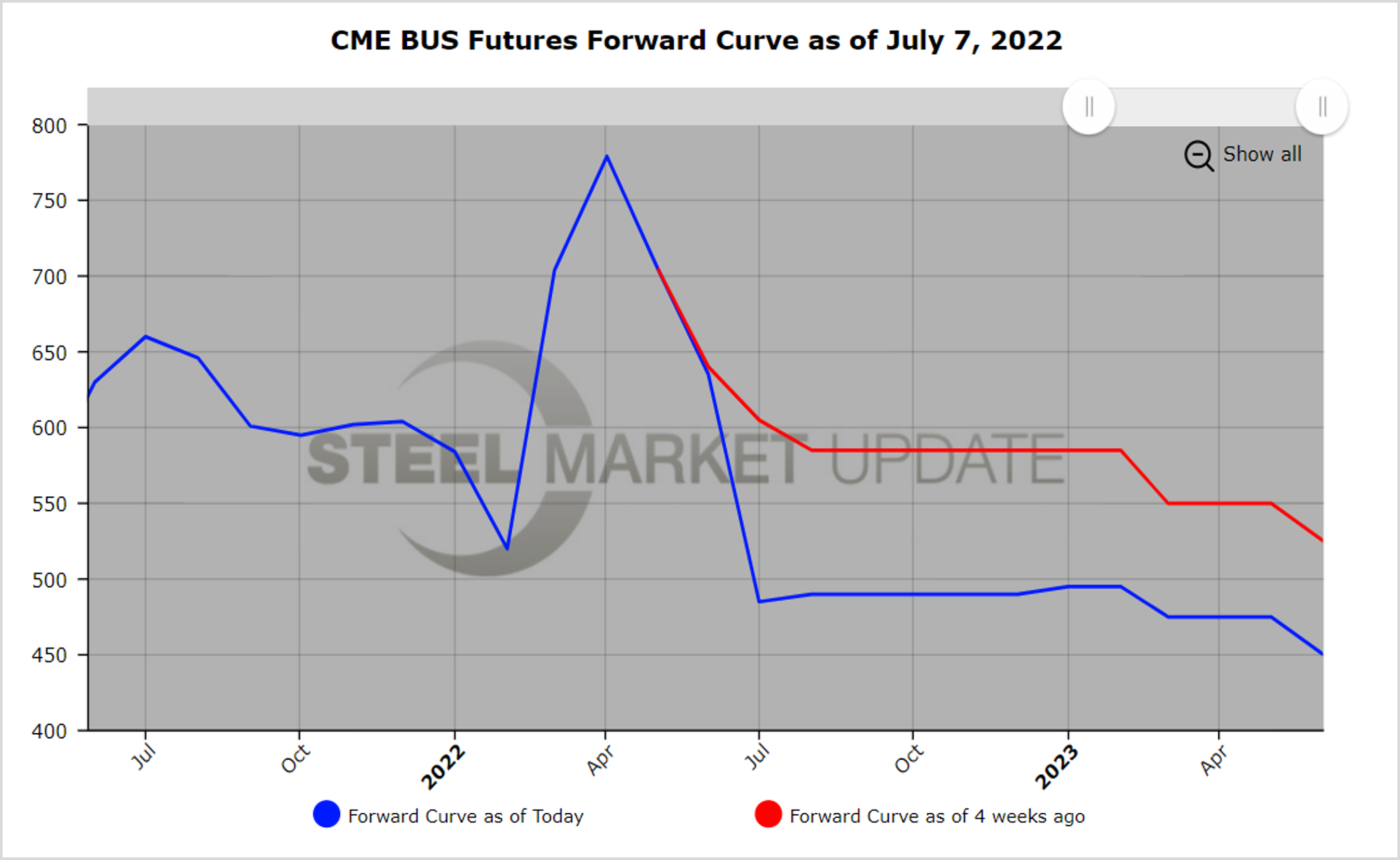

The current shape of the futures curve, which is basically flattening just below the $900/ST level, has left a lot of folks side-lined looking for further clues from the economic data and the Federal Reserve to determine strategy going into the last two quarters of 2022.

A bit of softness in latter half of 2022 HR futures prices and firm 1H’23 bids point to a slight contango going into the latter half of the curve (2H’22 863 val versus 1H’23 880 val as of 6 July 2022). In the last month, the Q3’22 average prices have declined by almost $130/ST ($1000/ST to $872/ST). The Q4’22 has declined in the last month by roughly $63/ST ($918/ST to $854/ST). And the Q1’23 and Q2’23 have both declined by about $20/ST ($900/ST to $880/ST) on a settlement-to-settlement basis.

While the curve prices have all moved lower in the last month, the shape of the curve has shifted as the further out futures dates have declined at a lesser rate, leaving the following change in the quarterly calendar spreads over the last month:

• Q3’22 versus Q4’22 backwardation has contracted from $84/ST to $17/ST ($67/ST)

• Q4’22 versus Q1’23 calendar spread has gone from backwardation to contango, from $18/ST backward to a -$26/ST contango ($44/ST)

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features. You can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

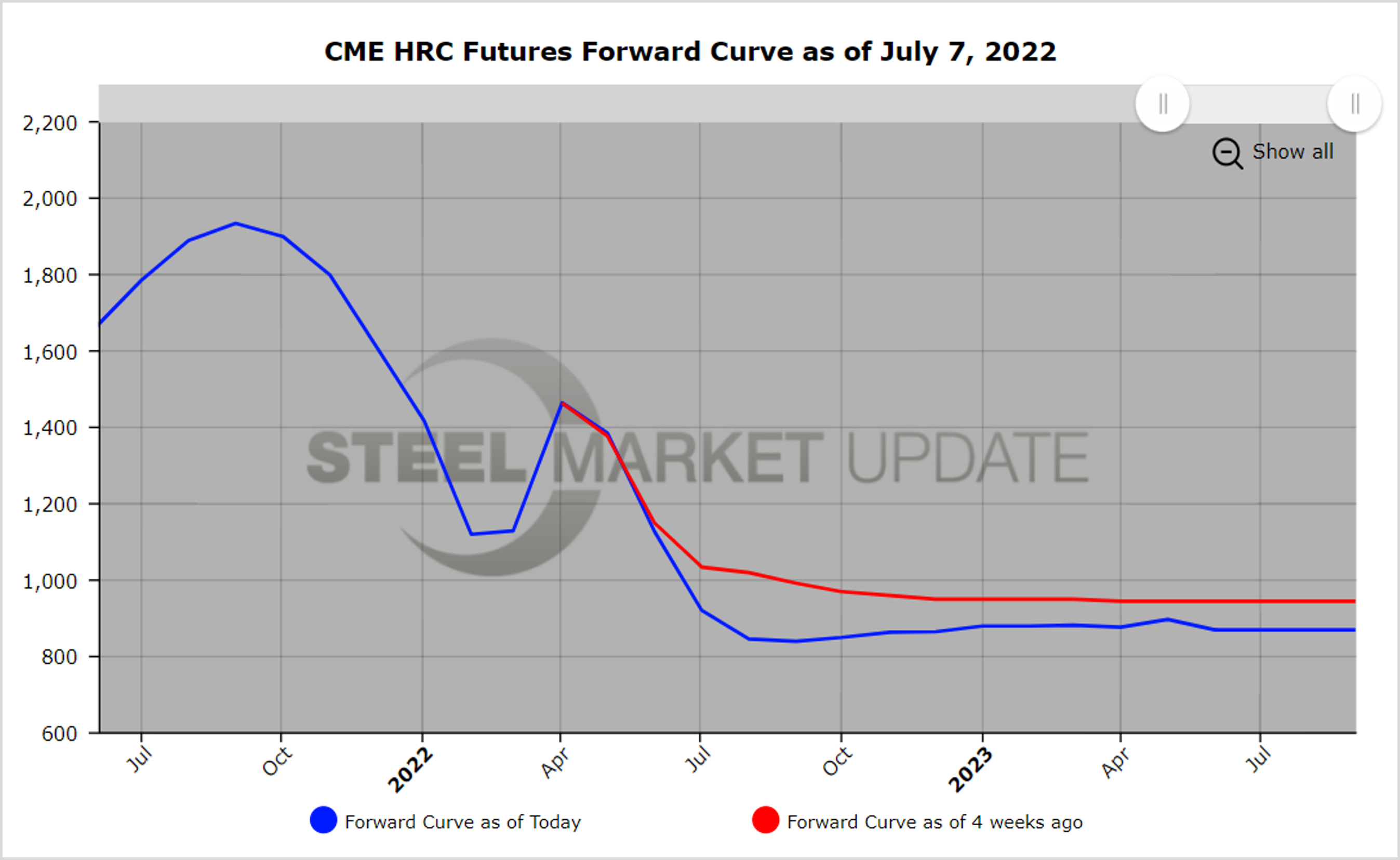

BUS futures settled in Jun’22 at roughly $635 per gross ton (GT) after a healthy decline from the previous month. Soft demand, strong flows of scrap, declining prices of metallics alternatives, and decent mill accumulation of all forms of scrap going into the summer period of auto manufacturing furloughs has seen steel mill bids for BUS drop precipitously. The market chatter has Jul’22 BUS falling about $150/GT ($485/GT). 2H’22 BUS, which settled just under $600/GT just a month ago, is now offered at $500/GT. The BUS curve is basically flat out through Cal 2023.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features. You can do so by clicking here.