Analysis

September 22, 2022

Final Thoughts

Written by David Schollaert

Well, I guess it’s the official outage and idling season. In the month of September alone we’ve confirmed a half dozen or more maintenance outages (some pulled forward) and temporary idlings. Why? It sure looks like some steelmakers are trying to deal with declining demand and uncertain market conditions.

The hope? Somewhat of a stopgap measure to keep prices from falling even lower.

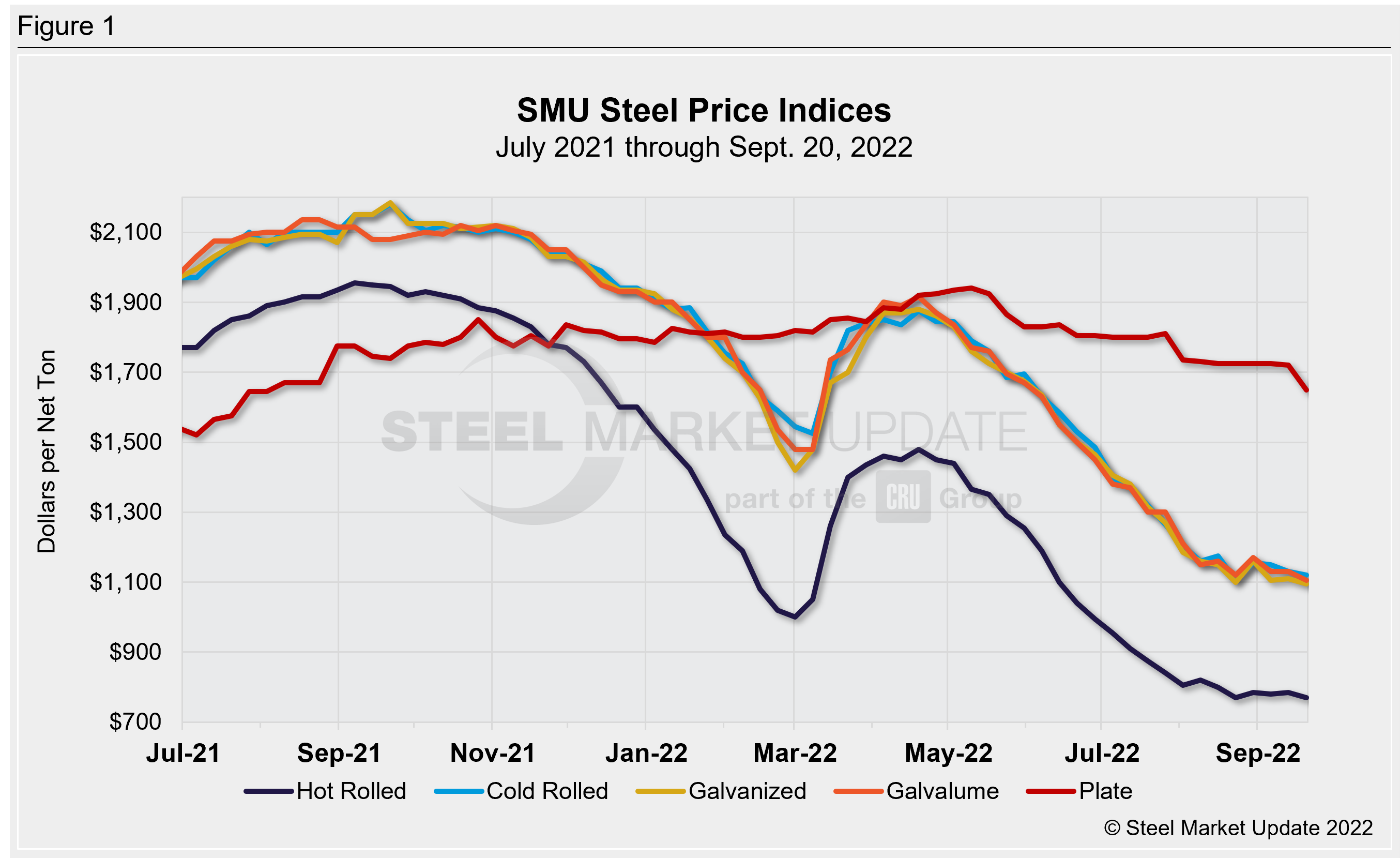

Hot-rolled coil prices most recently peaked at $1,480 per ton ($74 per cwt) on April 19 and have been largely falling ever since. We were at $770 per ton as of Sept. 20. That’s the lowest we’ve been in nearly two years before we saw prices explode higher in 2021.

Here is another way to look at it. We’re down $710 per ton since mid-April – that’s a decline of about $32 per ton per week since. The rate of decline has been fast and sharp. Right now, prices seem to be sideways to down, hovering between $770 and $785 per ton over the past month and trying to find some direction (Figure 1).

And it’s not just hot rolled. We’ve seen prices across the board start following the same downward trend. Especially for cold rolled, galvanized and Galvalume. Plate prices may have been bucking the trend, but there is underlying pressure for prices to come off more. We just saw Nucor announce on Monday a $120-per-ton price cut on discrete plate prices. That figure is more in-line with where we’ve heard others have been selling.

There is still a lot of debate about where prices will bottom and when, or if they have already. But you wouldn’t think prices could continue to fall a whole lot longer at this rate. Otherwise you’re probably getting close to breakeven costs for some older mills.

But some would say that downward pressure looks like its gaining momentum, hence the idlings and some of the pulled-forward outages.

The list of maintenance outages includes NLMK USA, for upgrades to its electric-arc furnace (EAF) sheet mill in Portage, Ind., US Steel’s Big River Steel Works in Osceola, Ark., SSAB America’s plate mill in Montpelier, Iowa, as well as US Steel’s No. 3 blast furnace at Mon Valley Works. The latter two were pulled forward by more than a month, coinciding with declining market conditions.

US Steel has already temporarily idled the No. 5 tin line and the No. 8 blast furnace, both at Gary Works in Indiana. And if the latest reports are true, it plans to keep the No. 3 blast furnace at Mon Valley Works down following the completion of its maintenance program.

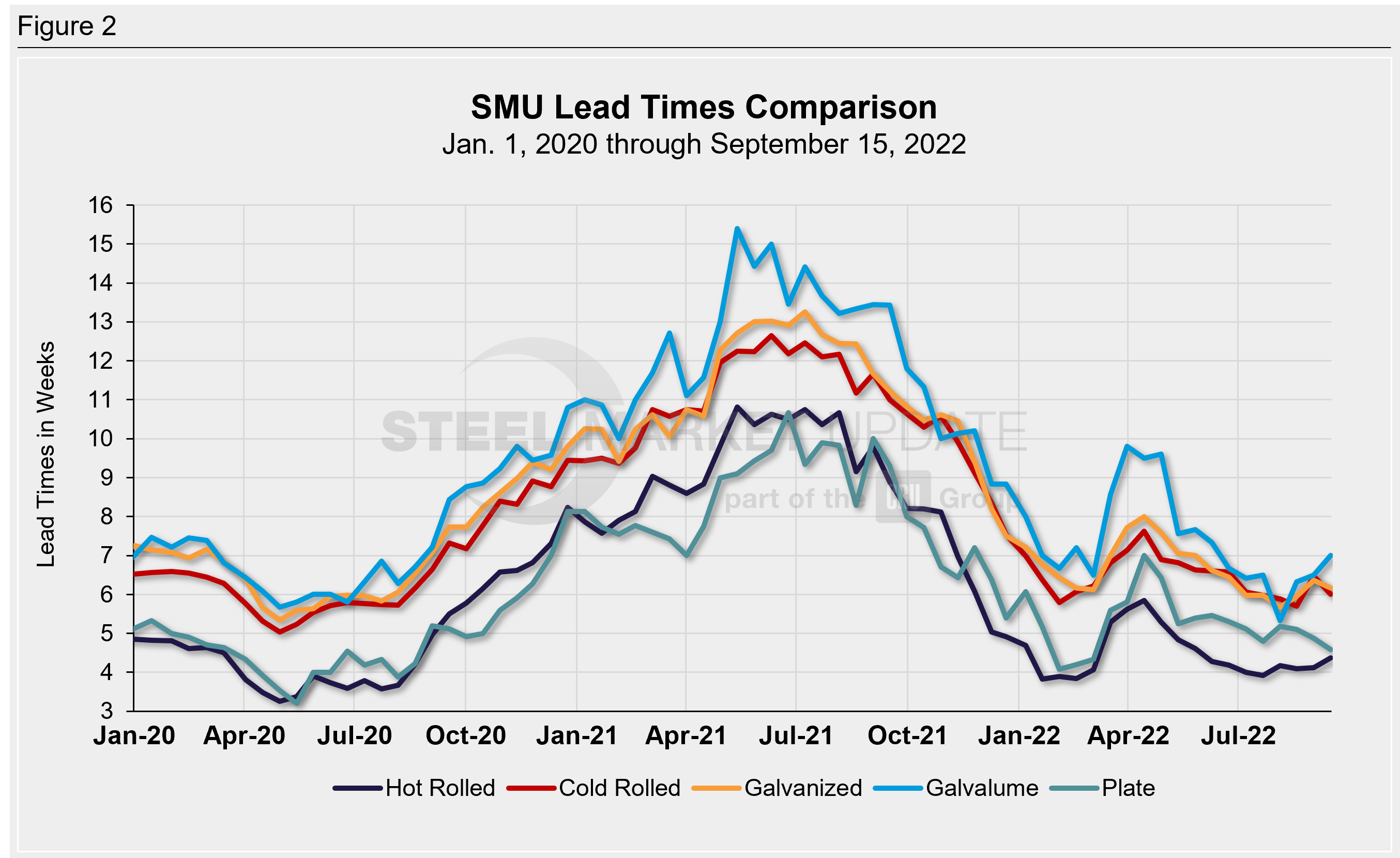

And we’ve seen the scaled-back production displayed in lead times over the past couple of weeks. Lead times have been inching up because of said outages and idlings, but prices have yet to really respond.

Lead times are right around the 4.5-week mark (Figure 2), not too far off from where we were back in mid-February before the war in Ukraine sent lead times sharply higher. And in mid-July, we were just under four weeks.

So despite slightly higher lead times, we’re still at some of the lower price levels we’ve seen over the past couple of years.

Buyers, meanwhile, continue to refrain from buying, unless its project-specific or to fill gaps. That trend is unlikely to change in the near-term as inventories still seem to be running a bit long, a little more than two months for sheet.

Those dynamics are likely to keep buying limited and demand subdued in the interim. The main problem with that approach? If buyers wait too long, a rush to buy could have a boomerang effect on price and lead times. But most speculate that the fourth quarter is likely to bring more of what we see now, wavering prices and mostly hand-to-mouth buying.

By David Schollaert, David@SteelMarketUpdate.com