Market Data

December 5, 2023

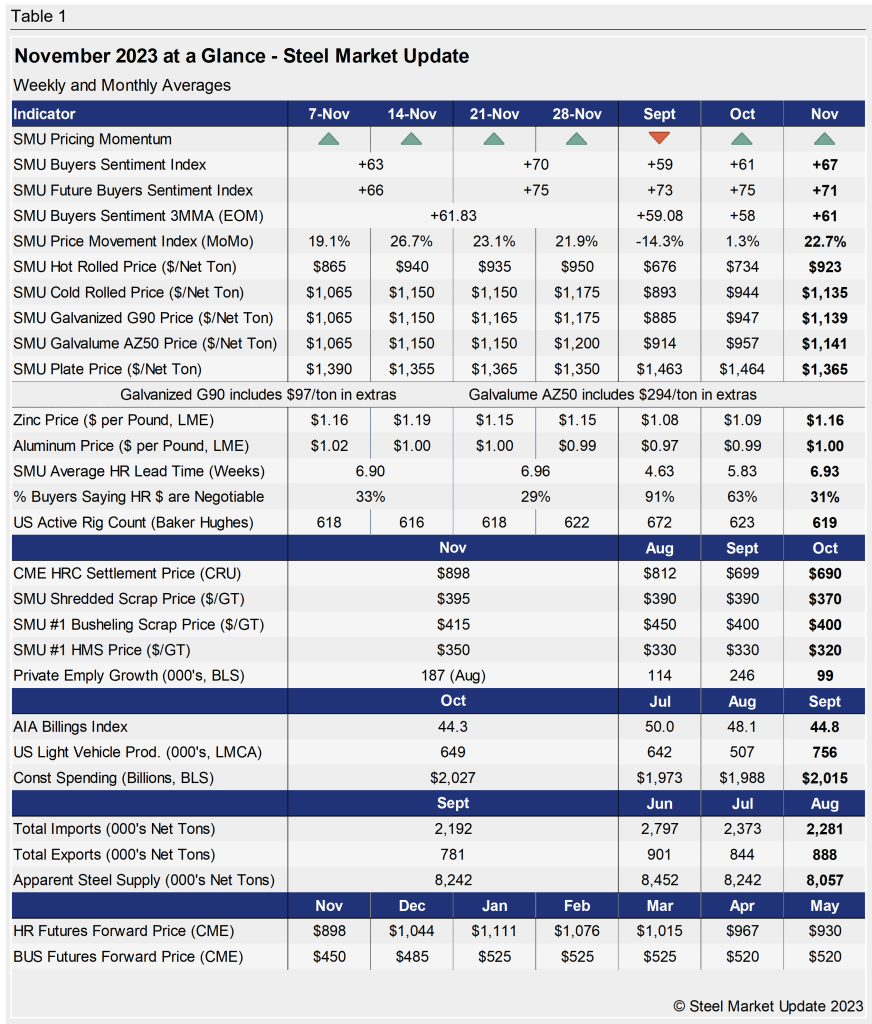

SMU's November at a glance

Written by David Schollaert

Steel prices continued to rally last month on the back of repeated mill price increases after tags reached a 2023 low of $645 per ton in late September. Hot-rolled coil (HRC) prices ended November at an average of $923 per ton ($46.15 per cwt), rising by $140 per ton during the month.

The SMU Price Momentum Indicator for sheet products continued pointing Higher throughout November after shifting from the Lower in September. The trend remained in place as tags kept rallying in response to repeated mill price hikes throughout November.

The Price Momentum Indicator on plate, which had been pointing lower since September, shifted to Higher largely in response to mill increase notices at the close of the month. Despite the improvement, signs of weakness due to waning demand persist.

Raw material prices have fluctuated somewhat but were again mostly sideways last month, except for scrap. Scrap prices improved on average in November, up between $15-30 per ton. Despite some movement mid-way through the month, zinc and aluminum spot prices were largely stable, remaining within historical levels. You can view and chart multiple products in greater detail using our interactive pricing tool here.

The SMU Steel Buyers Sentiment Index remained positive and continued to recover a bit, edging up during the month. Current Buyers Sentiment rose from +61 in October to +67 on average in November. Future Sentiment hovered at an average of roughly +71, down slightly from the prior month’s reading of +75.

Our Steel Buyers Sentiment 3MMA Index (measured as a three-month moving average) had been eroding over the past four months, falling to +58 in October, but recovered to +61 on average last month.

Hot rolled lead times averaged 6.93 weeks in November, up from 5.83 weeks the month prior. SMU expects lead times to hover around current levels, but market chatter suggests they could increase a bit more through December and into the first quarter of 2024 as inventory management takes precedence at the year-end. A history of HRC lead times can be found in our interactive pricing tool as well.

About 31% of HRC buyers reported in November that mills were willing to negotiate on prices, down noticeably from roughly 63% in October as mills drove prices higher.

Key indicators of steel demand are still showing some signs of weakness overall and are nowhere near the bullish levels some had shown earlier in the year. While there are some backlogs in the energy and construction sectors, and the UAW strike on Detroit’s “Big Three” automakers ended, demand in December and into early 2024 seems controlled, especially as buyers appear to be pushing back on a bit on the most recent round of mill price hikes.

See the chart below for other key metrics for November: