Prices

April 4, 2024

HRC futures: A lot of change lurks beneath the surface

Written by Daniel Doderer

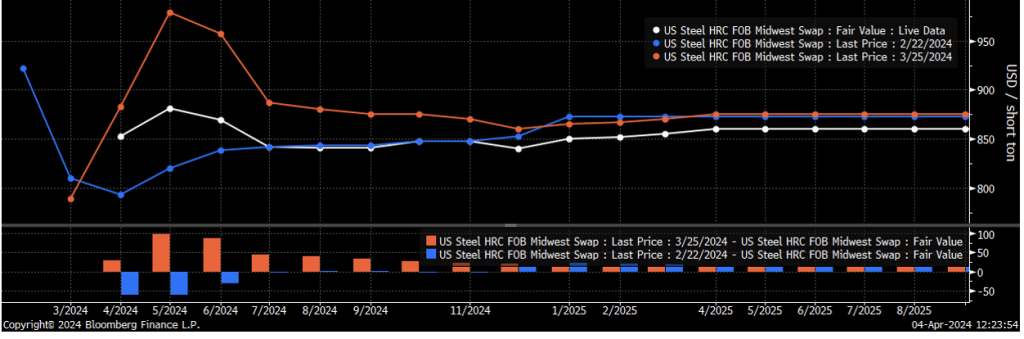

It has been six weeks since Flack Global Metals wrote our last SMU column, and if you simply look at the futures curve from then (blue) until now (white), you could argue that very little has changed. April and May are trading ~$50 higher than they were at that point, but the rest of the curve is essentially unchanged. However, for anyone who has been monitoring the futures and physical markets, this is obviously not the case. So, what actually happened?

Going into the end of February, spot prices were falling sharply, following the collapse observed in futures prices throughout January. While spot prices caught up to the paper market, the curve was essentially stuck in the $800-850 range, eagerly waiting for the next shoe to drop. Then, right on time, buying on the forward curve began when rumors of significant physical market purchases and impending mill price hikes made the rounds. By the time the announcements did finally occur, futures were well on their way to a $200 rally. This rally culminated in the May contract settling at $979 on March 25 (orange, above) and an additional price announcement a few days later.

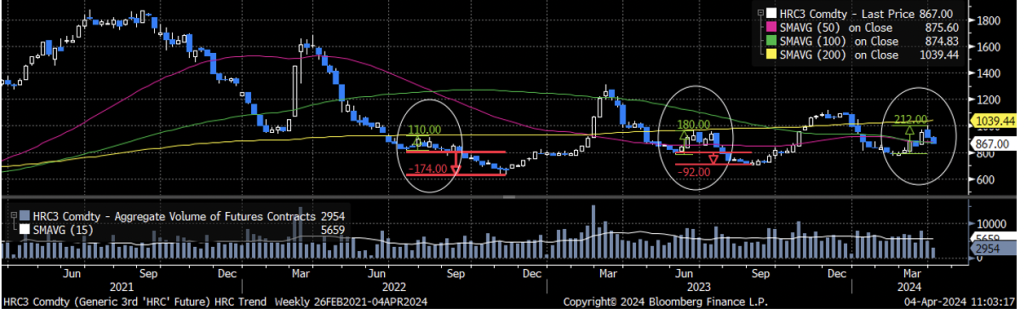

Recently, we’ve observed a narrative unfolding in a strikingly familiar manner. The chart below shows the rolling 3rd month future going back to March of 2021.

In 2022, we were coming off a shocking rally driven by raw material availability and cost concerns stemming from the fallout of the Russian invasion of Ukraine. From April to July, there was a significant and consistent selloff in the market, leading to a local bottom around $800. This occurred while the physical market was declining rapidly, yet still maintaining a price over $100 higher than the futures market. After the $110 rally in futures driven on the belief we had bottomed failed, the downward momentum resumed nine weeks later as the physical market weakened. This pushed futures below $800, ultimately bottoming below $650 in November.

Then, in the summer of 2023, we saw something similar. After an impressive rally in Q1’23, the market was all sellers from March through May before we seemed to find a bottom for futures around $800 (when physical was more than $100 above the futures market and falling). Thinking a bottom was in place, this time, mill price hikes preceded a rally in the futures that nearly drove them $200 higher. However, these “stop-the-bleed” announcements failed to result in a meaningful physical market rally as demand did not match the financial expectations. Eight weeks later, we fell through $800 before ultimately bottoming at $718 in early September.

What has occurred over the last two weeks since the futures market peaked certainly rhymes with what we’ve seen before. Futures reached steel’s psychological r* (for all the econ heads out there) at $800 in February. And the market appears to have been carried away in a “If it isn’t going down, it has to go up” type of mentality.

Since peaking, we have seen steady and consistent selling in the futures market as the physical market appears to be in a stalemate between buyers and mills while reported transactions (albeit on lighter volume) continue to occur well below the latest announced price. From here, lead times remain depressed, mill cost support has fallen, and recent demand indicators have experienced downside surprises – all suggesting there is additional downside risk to futures and physical prices. At the same time, we are just now entering maintenance season with more than 300,000 tons of production coming offline, and a trade decision with Mexican tariffs will occur in less than two weeks. Both could have meaningful implications if demand starts to materialize more in line with market expectations. One thing that we know for certain, however, is that when we write our next column things will have certainly shaken loose.