Analysis

May 9, 2025

Steel exports rose in March, but remain weak vs past years

Written by Brett Linton

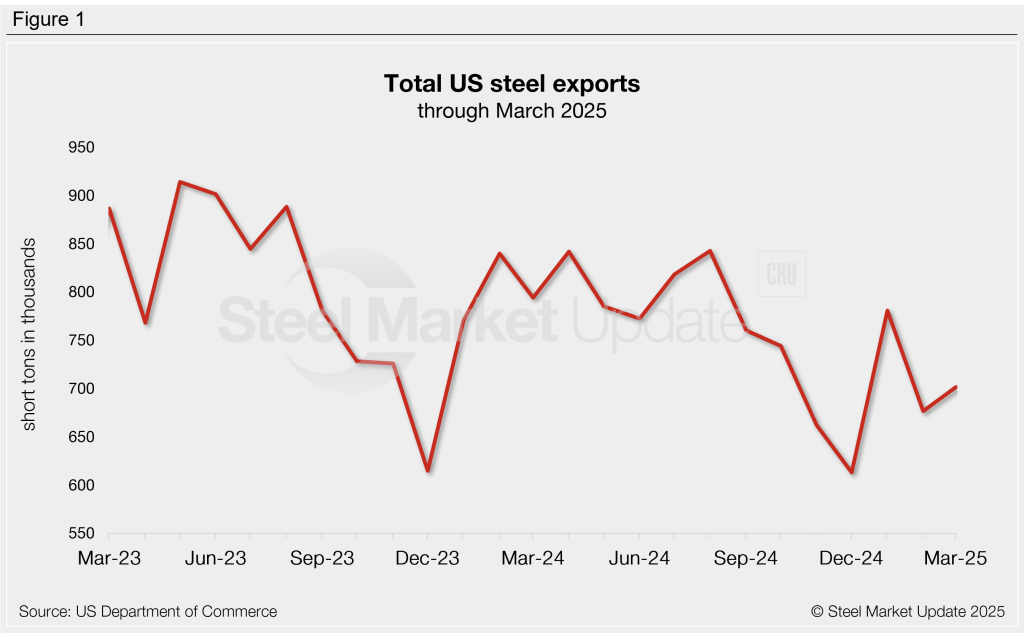

The volume of steel exported from the US increased marginally from February to March, according to the latest US Department of Commerce figures. Although up month over month (m/m), export levels have generally trended downward over the past year.

Steel exports rose 4% m/m in March to 701,000 short tons, recovering from one of the lower rates seen over the past two years (Figure 1). March trade was 9% below the 2024 monthly average of 770,000 st, 12% lower than the same month last year, and 21% lower than March 2023 volumes.

The bulk of US exports are sent to U.S.-Mexico-Canada Agreement (USMCA) trading partners, with just over half of March exports going to Mexico and 41% to Canada. Other notable destinations, each accounting for 1% or less of March exports, included the Dominican Republic, Brazil, France, the United Kingdom, Argentina, Colombia, and the Bahamas. For detailed information on specific product or country exports, visit the International Trade Administration’s Steel Mill Export Monitor

Monthly averages

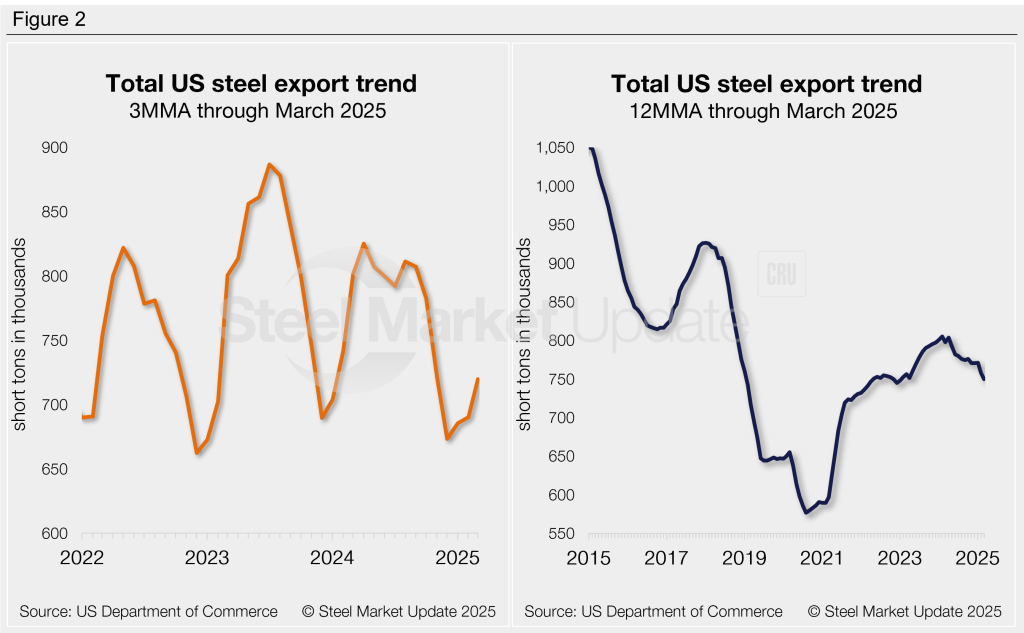

Analyzing steel exports on a three-month moving average (3MMA) basis can better highlight underlying trends by smoothing out monthly fluctuations (Figure 2, left). After peaking in July 2023 at a five-year high of 887,000 st, 3MMA export volumes declined by the end of 2023 following typical seasonal slowdowns. Volumes partially recovered through mid-2024, though not to the highs seen in 2023, then fell to a two-year low in December 2024. The 3MMA has increased each of the last three months, rising to 720,000 st in March. This rate is notably lower than the same time last year (801,000 st).

Exports can be annualized on a 12-month moving average (12MMA) basis to better illustrate long-term trends by eliminating seasonal variation (Figure 2, right). From this perspective, annualized exports have declined over the past year, though they remain elevated compared to 2019-2022 levels. The 12MMA slipped for the second-consecutive month in March, now down to a two-year low of 750,000 st. Compare this to the five-and-a-half-year high of 805,000 st recorded just over one year ago.

Exports by product

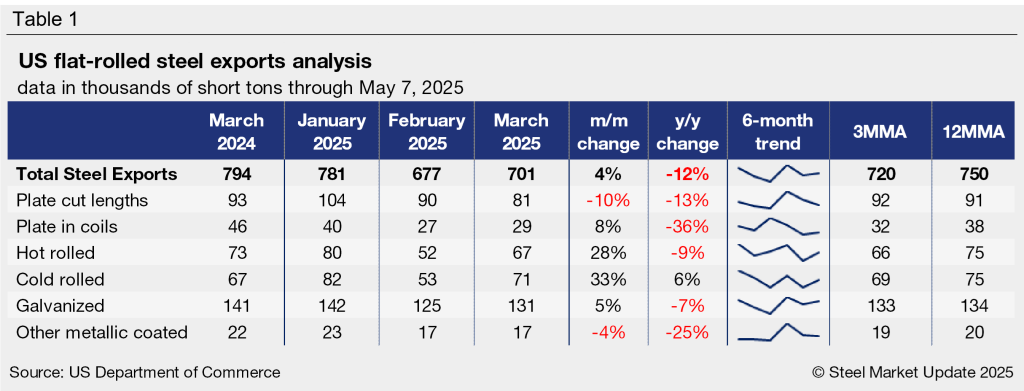

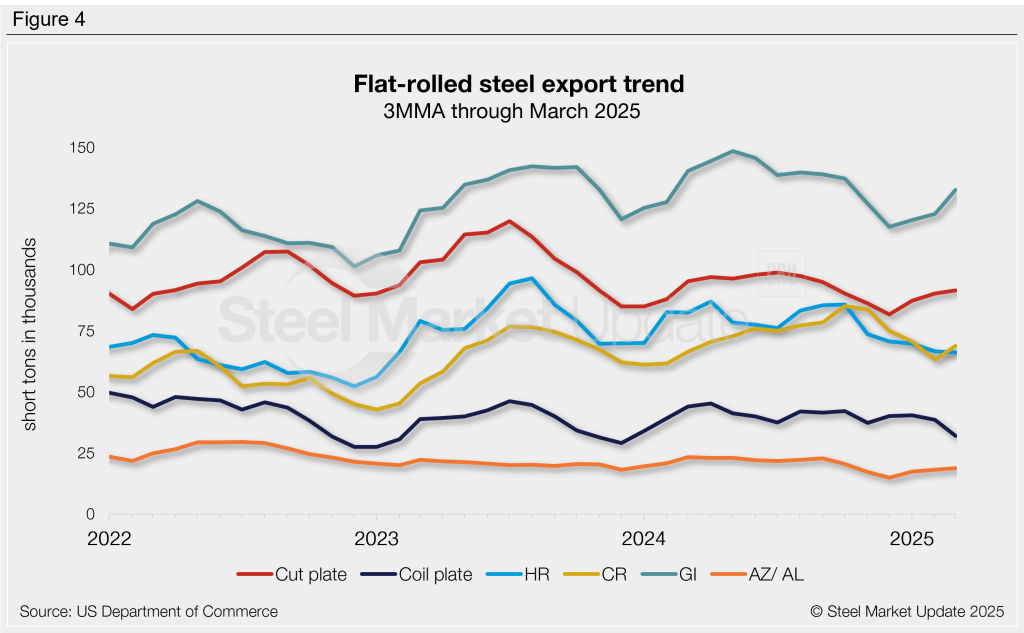

Flat-rolled steel exports increased in March for four of the six sheet and plate products we track. However, export volumes for five of these products were lower than levels seen one year prior.

For almost all products, March exports were below their 3MMA and 12MMA rates. The only two exceptions were hot-rolled coil and cold-rolled coil, which were above their respective 3MMAs. Significant movements from February to March include:

- Hot-rolled sheet exports rebounded 28% m/m after hitting a 26-month low in February.

- Cold-rolled sheet exports increased 33% in March, recovering from a 14-month low.

- Exports of coiled plates rose 8% in March following February’s 16-month low.

- Other-metallic coated exports fell 4% in March and are 25% lower than levels seen one year ago.

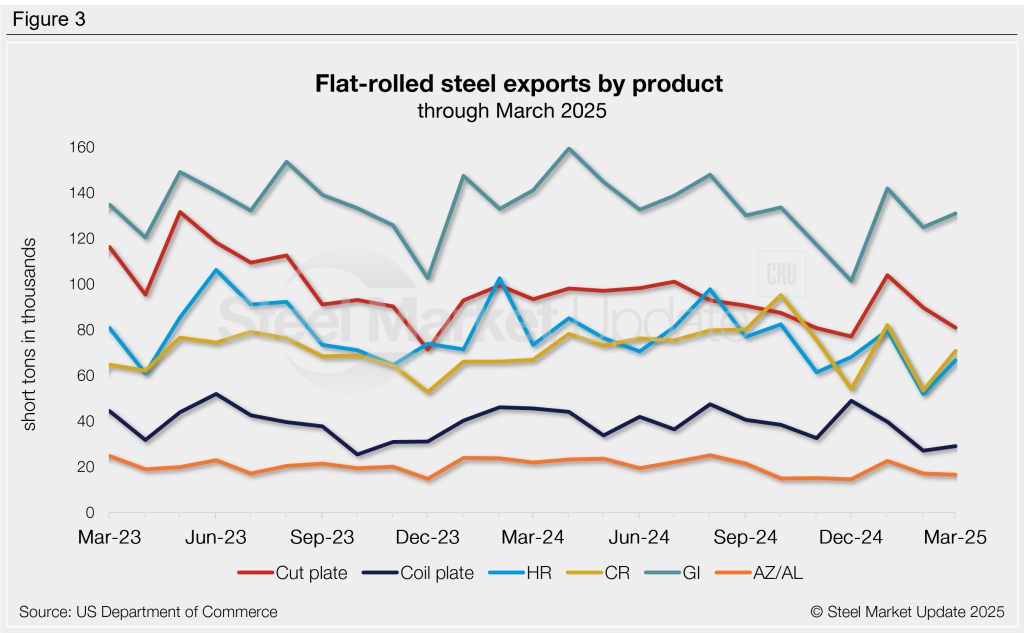

Figure 4 shows a history of exports by product on a 3MMA basis, providing a higher-level view of export trends by filtering out month-to-month noise.

SMU members can view historical steel trade data on the Steel Exports page of our website.