Government/Policy

September 20, 2018

Meter's Running on Section 232 Tariffs

Written by Tim Triplett

The United States’ Section 232 steel tariffs are adding to the government coffers as the increase in calculated duties on steel rose by 4,300 percent in second-quarter 2018.

Earlier this week, Steel Market Update was asked if we knew how much revenue has been coming from the Section 232 tariffs on steel. We were intrigued by the question, so we reached out to trade attorney Lewis Leibowitz to see if he could help.

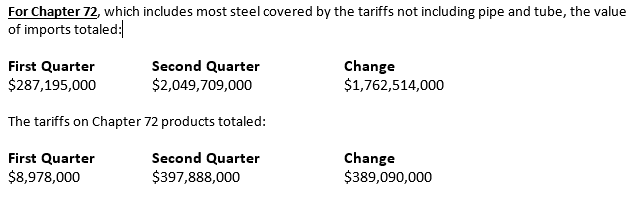

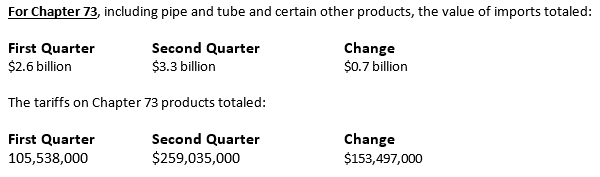

Leibowitz looked at the available data for “Chapter 72,” which includes most of the steels covered by the tariffs (not including pipe and tube). He compared the data from the first quarter, before the tariffs were applied, against the revenues generated in the second quarter. He also went a step further and looked at “Chapter 73,” which includes pipe and tube and some other products.

Data is only available through the month of June. Some countries were exempt from the tariffs during a portion of the second quarter (Mexico, Canada, Europe). Therefore, the numbers for the third quarter should be much higher.

This is what Leibowitz found:

Import values from the first to the second quarter increased by a healthy $1.76 billion or 613 percent. The increase in calculated duties was $389,090,000 or 4,300 percent. The effective duty rate for Chapter 72 went from 3 percent in the first quarter to 19.4 percent in the second quarter.

The difference in import value was $700 million, or a 26.9 percent increase, compared to an increase in calculated duties of 146 percent. The average duty rate for Chapter 73 was 4.0 percent in the first quarter and 7.8 percent in the second quarter. The effective rate will climb further as the tariffs apply to more countries.

Many countries were exempt from the tariffs until June 1, so tariff revenues stand to increase significantly in the future.

Where does the money go? A tariff is essentially a tax that, when collected, goes directly into the general budget.