Prices

June 2, 2016

Hot Rolled Futures: Feeling Toppy?

Written by Jack Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Andre Marshall and Jack Marshall of Crunch Risk LLC. Here is how they saw trading over the past week:

Financial Markets:

We are testing the highs, literally. The S&P is right up against the 2105-2210 resistance, old tops, which are from May 15th 2015 and before. We are last 2103 on the June future. The old high is sitting at 2134. Tricky part is this. The most recent rally has lasted a bit and it is due for a breather, some would say 70-100 pts back down before we can regroup. Problem I have is this. Everyone knows the Fed is gearing up for further rate increases in June or July and if we fail to take out the high and we have a retracement coincided with Fed rate hikes, erghhh! Feelin queasy! If in the end we fail to take out the high. Could we be living the peak turn?! Now that I’ve said it, it can’t be. Holy Portfolio!

Crude chart looks good actually, we are hovering around $50/bbl., last $49.19/bbl. and the support trend looks solid. We could retrace all the way to just above $44/bbl. and still have the current support trend line. Crude is such a World growth sentiment product so don’t count out a further immediate rally if China expansionary plans spark unforeseen growth.

Copper meanwhile looks depressed and reflects other industrial commodity futures that have come off or gone into further backwardation. We are last $2.07/lb. on the July future and probably headed to test old lows at $1.95/lb. zone.

Steel:

Recent developments in the futures market and beyond have tempered some views in the U.S. regarding the sustainability of HR price levels above $600 ST. The current shape of the domestic US HR futures curve reflects the sentiment of the weak global steel demand and excess global steel supply, rightly or wrongly, Some others factors to that end:

•Improving domestic flat rolled steel supply, reflected in the latest production and capacity utilization data,

•U.S. steel production has reached a 16 month high as mills run at a 75.9% capacity utilization rate,

•The import window is back open, and economics allow some moderately tariffed materials to import in as well as the non-tariffed sources,

•Recent developments in Asia have pushed steel prices and steel input prices in Asia to retreat dramatically,

•Improving supplies of obsolete scrap in the U.S, after a strong price run-up, have merged with moderating scrap demand from Turkey (due to Chinese Billet imports) leaving more potential supply going forward and potentially lower scrap prices in June and July – first pitch from mills is down $20-30 obsolete and down $10 primes depending on region. We’ll see how the dealers respond with lead times north of 5-12 weeks and metal margins in stratospheric territory north of $350 / ton v. ton (hist. avg. approx.. $220-240 ton v. ton).

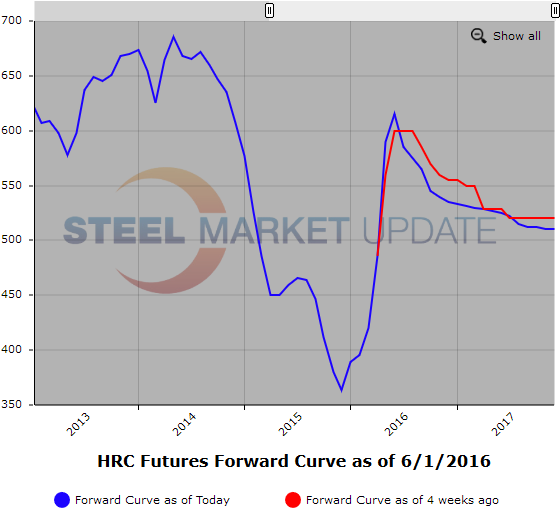

The Futures curve has steepened over the last week as a result. HR Q3’16 prices have retreated from recent highs of $580/ST last Thursday to $570/ST today while the spot price has risen approximately $10-15/ST to around $630/ST. Meanwhile Q4’16 traded at $550/ST on Tuesday v. $540/ST and $539/ST yesterday, or a $10-11/ST decline.

Note the current backward slope of the futures curve between spot (SMU HR average index $630/ST) and the HR Q3’16 trade price of $570/ST reflects a steep $60/ST discount. These latest Q4 ’16 trades are a $91/ST discount. The discount is even greater when compared to recent domestic published mill prices for HR spot of approx. $630-660/ST. Hard to imagine anybody pulling the import lever on HR material when HR futures prices are so discounted. Once a formula CRU index discount is factored in, even if modest, import prices still can’t compete with a domestic solution. So, if low futures prices contribute to modest import demand, at least for those who know the alternative, and service center stocks continue to drop, where does that put us later in the year when Service Center stocks have maintained at low levels, or even dropped further?

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

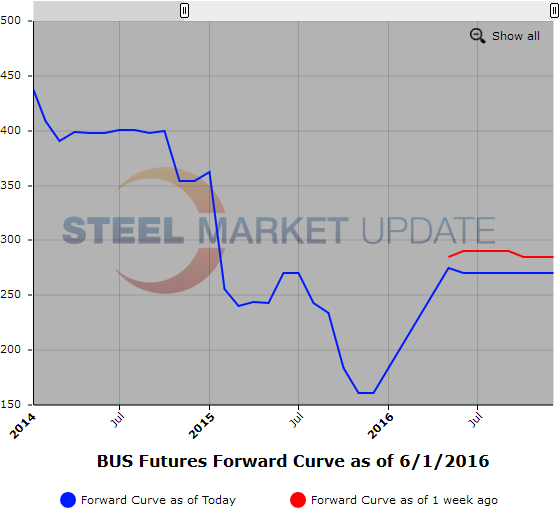

Scrap

A $41/MT drop in CFR Turkish scrap prices yesterday was actually already anticipated due to cheap Chinese billet arriving on Turkish shores, curtailing scrap purchase appetite. That said The Turks are one of the few countries ideally situated for U.S. import orders and will need to come in for June to procure scrap for sheet orders. As mentioned, domestically expectation is down $10-30/GT for June depending on type/region.

Despite recent impressive lead times, dealers will have to fight their fear of World Armageddon to not take advantage of domestic mills, who are enjoying 5-12 week lead times depending on product! Don’t forget the Elephant in the room, BRS (Big River Steel), they’re gonna a need a lotta scrap before they even become a presence in steel prices end year. This should be supportive of scrap prices sometime in the Summer if their start-up schedule is accurate (even delayed a lot).

Another graphic is below, but of the BUS Futures Forward Curve.