Prices

April 4, 2019

Hot Rolled Futures: Uncertainty Assured

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

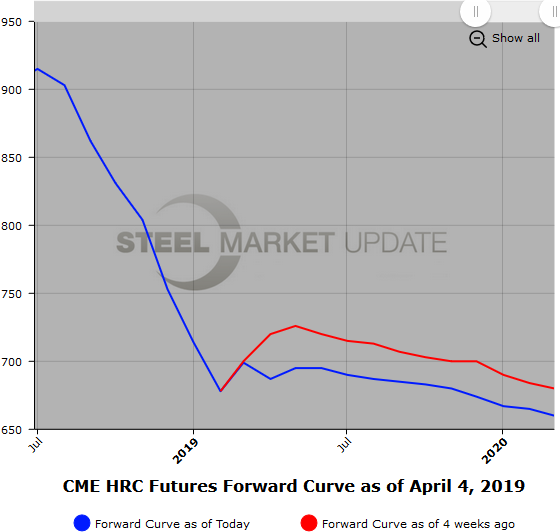

In the last month, the CME U.S. Midwest HR future front month price has declined over $40/ST. Latest indexes indicate spot HR is trading around $690/ST in spite of the recent mill price increases for HR. The HR futures curve has shifted lower with the near date prices declining about twice as much as the 12 month futures. In the last month, the Q2’19 HR future price has declined from $729/ST to $692/ST (-$36/ST), the Q3’19 HR future price has declined from $718/ST to $688/ST (-$30/ST), the Q4’19 HR future price has declined from $712/St to $681/ST (-$31/ST) and the Q1’20 HR future price has declined from $684/ST to $660/ST (-$20/ST). The backwardation of the HR futures curve has narrowed as the longer date prices have been slower to fall. The Mar’20 HR minus the Apr’19 HR spread has narrowed from -$53 to -$29 ($24/ST).

On the move down, OEM buyers have been reluctant to put on near date hedges, which could be a signal that participants think there is more downside opportunity and less concern prices will rise quickly in the interim, while the longer date buyers have underpinned the prices in Q3’19 and Q4’19. With mill lead times holding steady and a few market forecasters calling for higher HR prices in the near future due to increases in pig iron and iron ore prices, as well as mine issues in Brazil, what is certain is that uncertainty in the ferrous market is assured.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

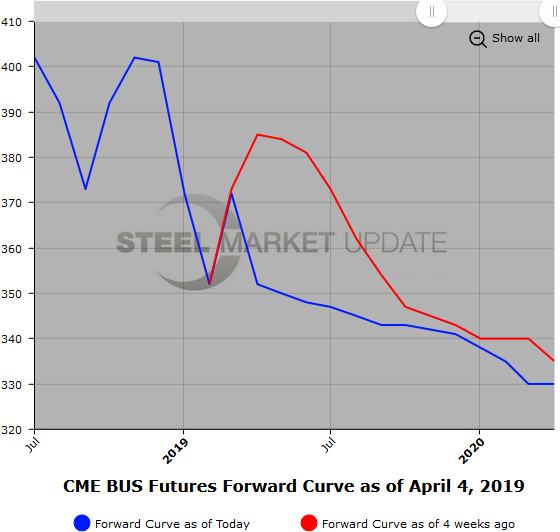

Weakness in the demand for obsolete scrap off the mid-Atlantic along with a milder winter has left the markets nervous about extra capacity. Latest shred prices have fallen into the mid $320/GT range for the front futures months with light trading. This trend lower is also in evidence in the prime scrap futures.

Q2’19 BUS futures prices have fallen by almost $30/GT as of yesterday’s settlement as compared to a month ago and were trading lower this morning. Q3’19 BUS prices have declined by $17/GT in the last month and Q4’19 prices have declined by $16/GT over the same period. With the exception of the nearby quarter, the rest of the curves declined was fairly equal.

Today, the nearby Q2’19 quarter was trading at roughly an average weighted price of $351/GT, which is roughly in line with the market expectation for the April spot settlement. 2H’19 BUS was last $343/GT bid and offered at $348/GT. The backwardation in the BUS curve through the end of 2019 is under $20/GT. Will prime scrap supply become tighter due to lower auto production forecasts, plant transitions and elevated auto inventories or will increased expectations for higher construction offset?

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

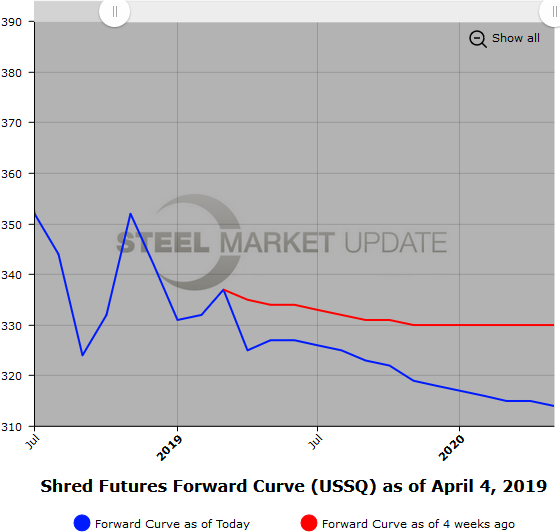

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.