Prices

October 31, 2019

Hot Rolled Futures: Momentum Builds in the Futures Market

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge at www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

The steel futures market has seen a flurry of activity. As U.S. mills announced price increases, buying activity driven by those looking to lock in forward prices or cover short positions drove activity.

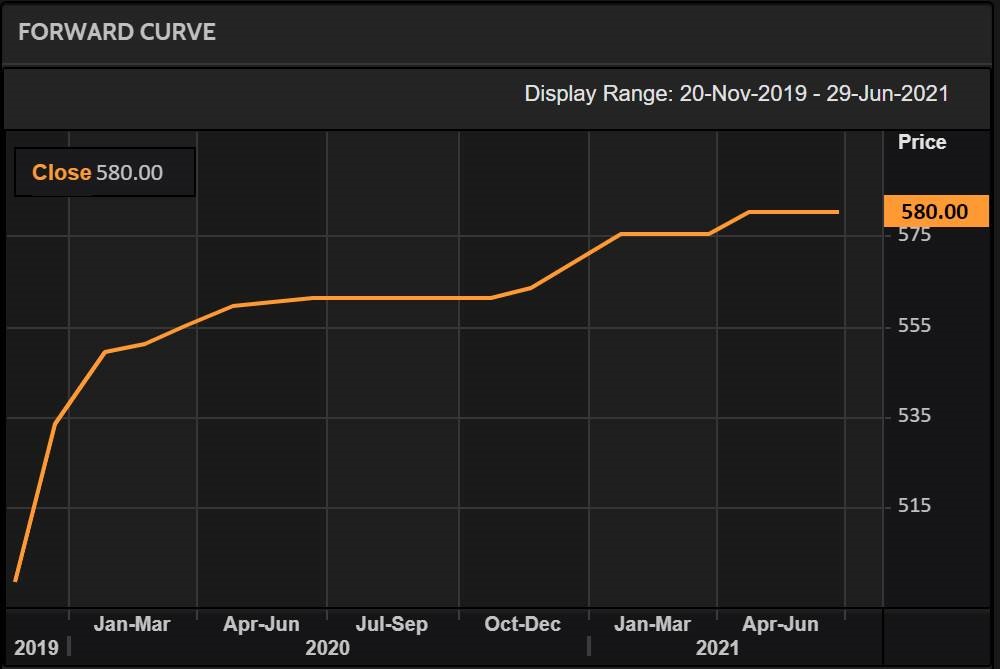

The interesting part of the shape of the curve today is that it retains a carry or a contango into the second half of 2020. This can be due to optimism for that period or a lack of conviction from sellers to express a view or put a trade on their books.

As some of you may recall from my last writeup, we had discussed that the curve steepening can provide some opportunities, especially for buyers of discounted physical spot. While the more optimistic outlook in U.S. HRC and U.S. scrap is reinforcing the sentiment of traders, ferrous scrap raw material markets continue to see a bid Internationally as well. In Turkey, bids on scrap are higher week over week. The activity in the scrap market to some extent is following the surprising action in the raw material space in China. The Chinese market, reeling from pollution control measures, has resorted to buying semi-finished products offshore. This has led traditional billet consumers to turn exporters of billet to China. This shift to semifinished has led to lackluster action on ore.

Iron ore markets have experienced a rangebound action as uncertainty on demand dominates headlines. Going into Q1’20, several international markets are still debating whether the worst is behind them or not. Given this sentiment, we won’t be surprised to see raw material and steel price volatility in international markets remain high. And as a consequence, for our very own steel markets to mirror the same.

Disclaimer: The information in this writeup does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information