Prices

February 25, 2021

HR Futures: Will China's Influence Outweigh Higher Interest Rates?

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

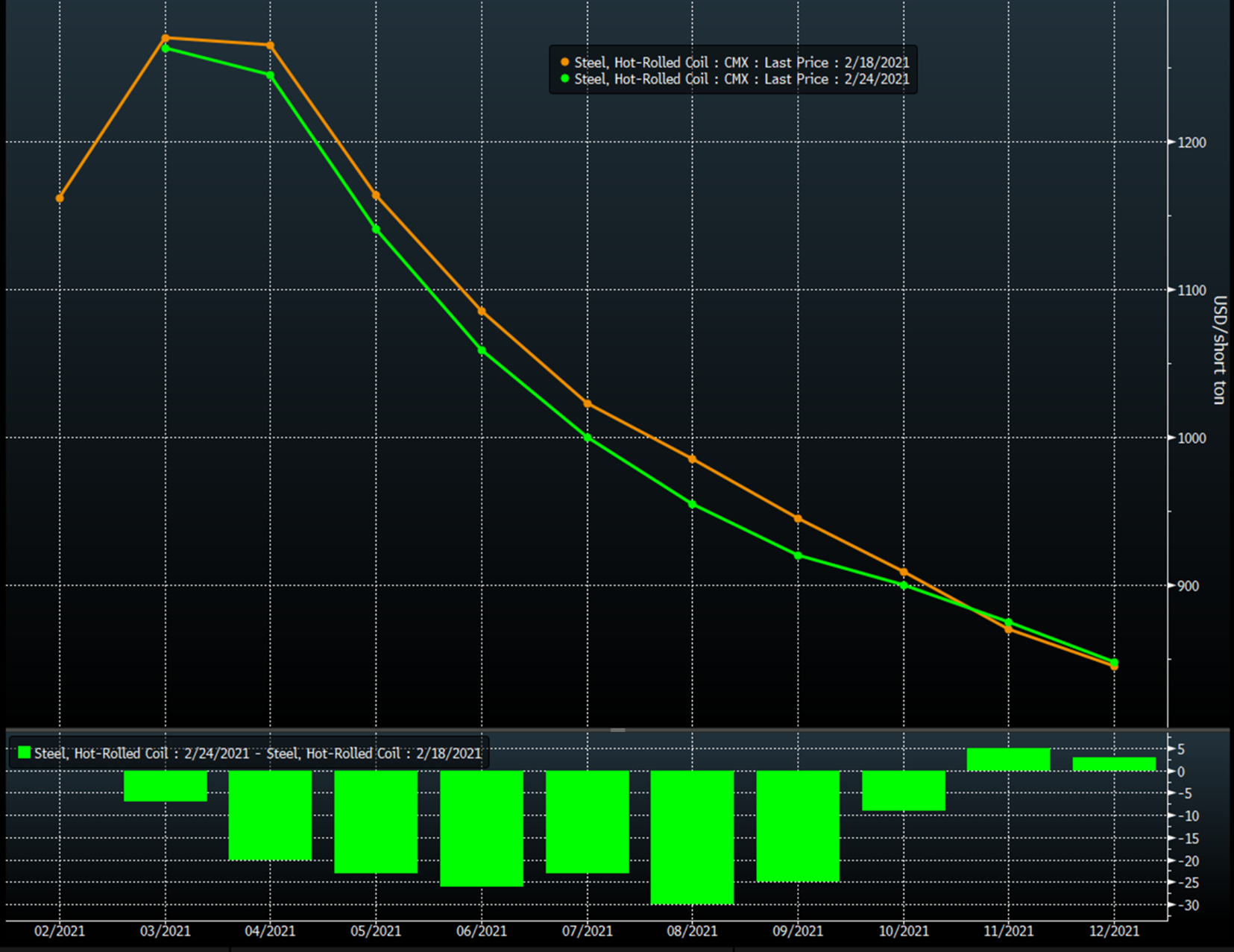

In a shocking development, the HRC curve actually moved lower week/week:

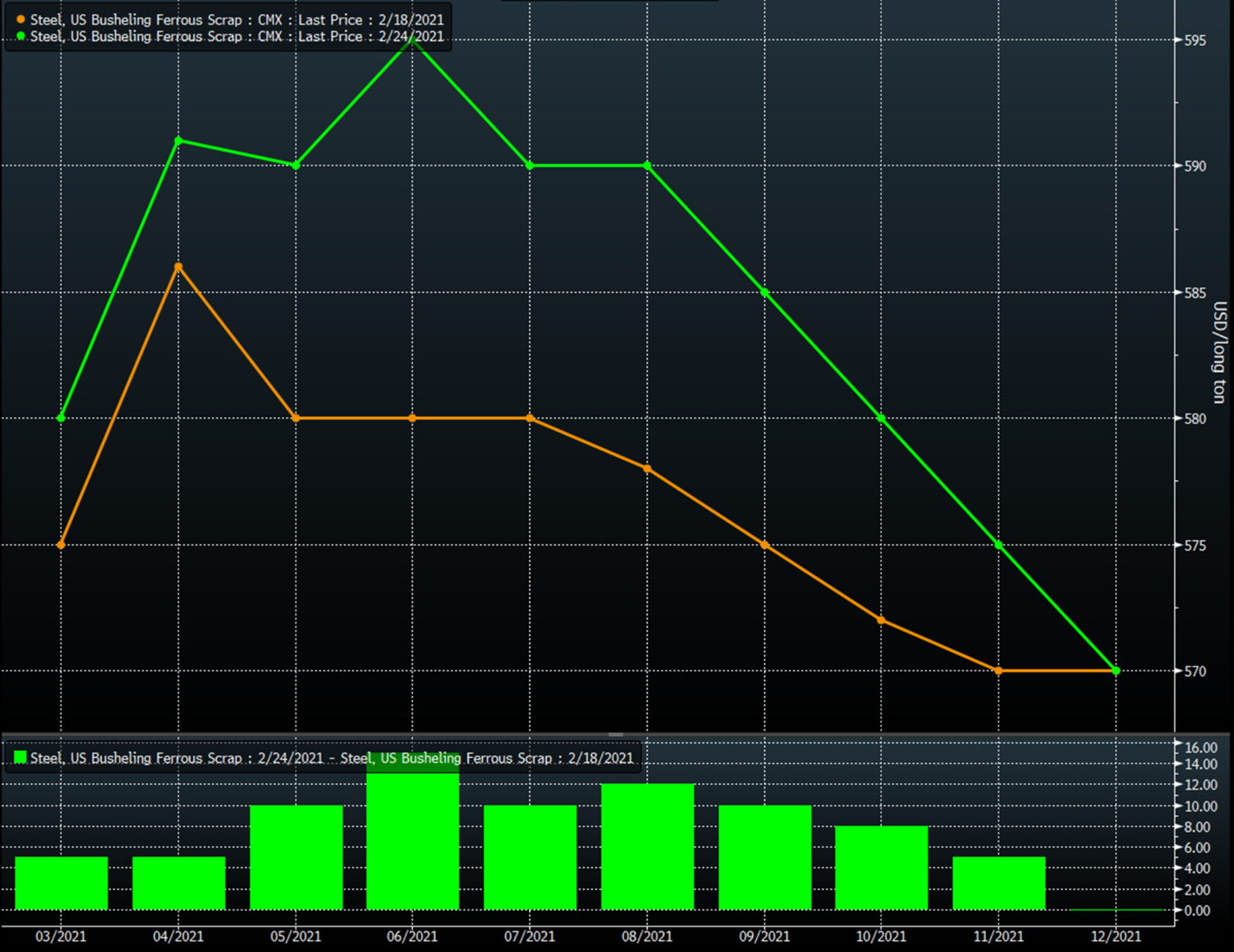

Some fears of the market topping out may be part of the reason, as well as reports of increased import bookings and a potential for auto-related demand to slow. The HRC futures market in the U.S. has seen strong volumes (nearly 500,000 tons traded in January) as the number of participants continues to rise. The downward slope of futures prices has stayed in place, as traders anticipate increased supplies from domestic and foreign mills, as well as the possibility of some changes on the Section 232 front. Scrap, on the other hand, strengthened week over week. We believe some of the crazy weather in the Midwest and South has tightened the supply picture, as cold and snow tends to influence collection rates for secondary scrap grades. In addition, some of the chip-related auto shutdowns may negatively impact the supply of prime grade busheling scrap. On top of that, we have ore prices on the rise again as we will discuss later. Net-net, the busheling scrap curve pushed higher.

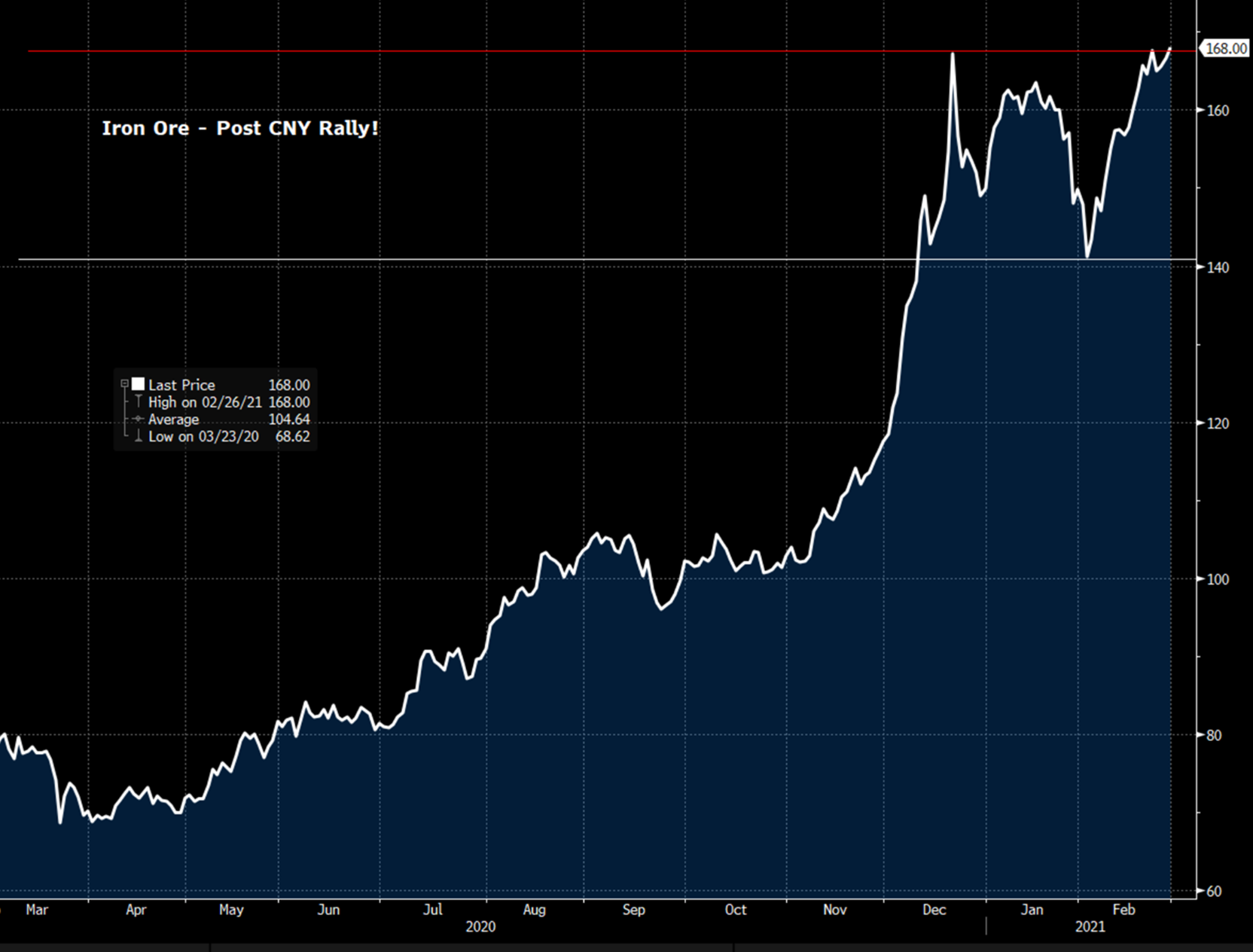

China has returned from the Chinese New Year (CNY) holiday with a vengeance. Ore futures had sold off down to the $140/ton level as the holiday approached, new strains of the virus caused more people to be quarantined, and traders feared that the economy may slow down. However, after CNY, ore prices surged as steel prices recovered. Some of the steel price recovery is due to current and proposed production cuts to control pollution, which you would think would hurt ore prices, but it hasn’t. In several cases, we’ve seen production cuts be predictably supportive of steel prices. But when mills have some production shut down, they prefer to run the operating furnaces on higher-quality imported ore from Australia and Brazil, so the result has been higher seaborne ore prices.

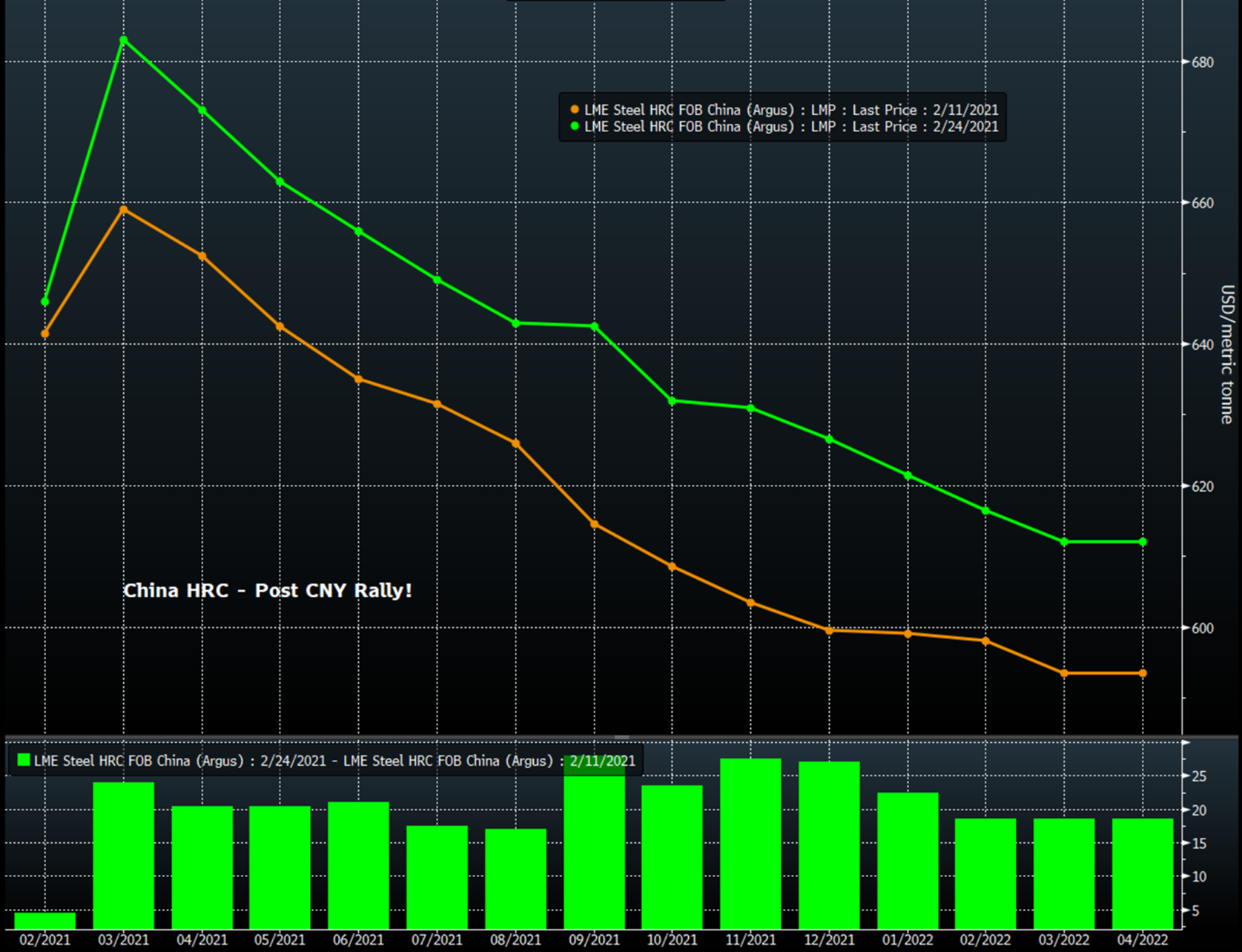

The chart below is of Chinese steel futures, and you can see that they’ve also moved higher from two weeks ago on better sentiment post-CNY. Some of the high frequency datapoints coming out of China over the holiday indicated that consumer demand remained very strong despite some of the travel restrictions. Some outside economists have stated that the economy should still be on pace to grow 6% in Q1.

All of these factors in China are generally still supportive of global steel prices. Higher Chinese domestic steel prices mean higher mill offers for Chinese exported steel. This tends to give other steel exporting countries the ammunition they need to also raise prices. In addition, higher ore prices are supportive of scrap as mills look at the relative cost levels of different inputs and incrementally use more scrap in their melt. In addition, we continue to hear of China buying scrap on the seaborne markets.

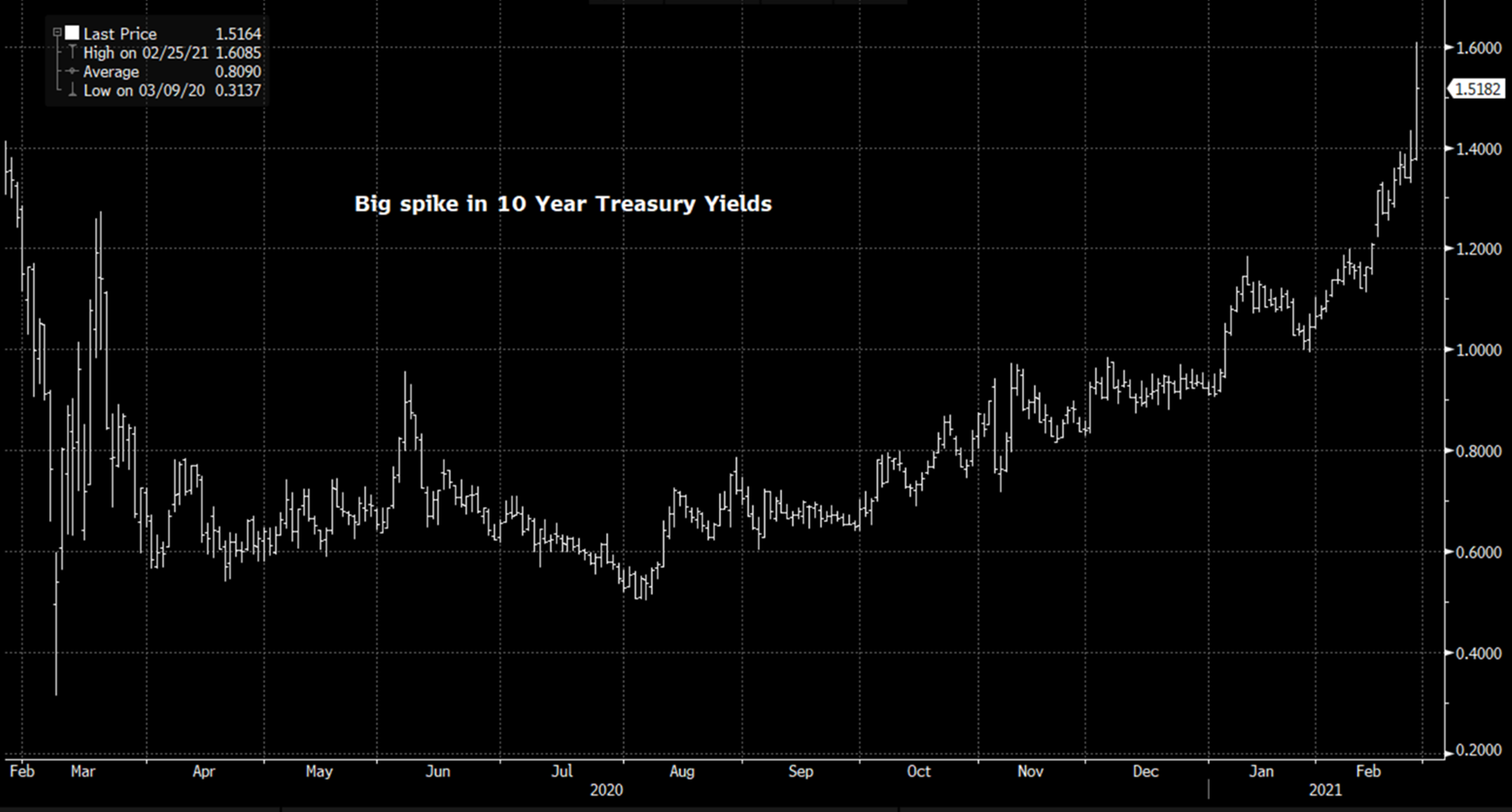

One cautionary note we would add: The higher interest rate on U.S. Treasuries has been getting a significant amount of attention this week. The chart below shows the rate on the 10-year U.S. Treasury note. You can see that we’ve had a huge increase in rates from the bottom, and it has been accelerating to the upside. This may be a reaction to the incredible level of federal spending that has already occurred, and it appears to have no end in sight. Yields are still very low relative to history, but this has been quite a move off the bottom! If rates get high enough, people will start to worry about the higher cost of money having a negative impact on economic growth here in the U.S.

Another question that we’ve heard in the market is whether or not having the forward HRC in such a huge backwardation (future month prices lower than spot month prices) would limit import flows. We believe that it indeed can have this effect. If you think of it this way – most decent sized OEMs or service centers get some discount off of an index. Thus, if you buy futures in a forward month, you are effectively locking in your mill “floating” price deal to a fixed number. So, if you were thinking of bringing in some imports to use in the third quarter, you’d need to compare that import price to the forward curve in Q3, less your mill negotiated discount. Taking last night’s settles, Q3 was at $958. So, if you just buy futures at that level, you are effectively locking in domestic tons at $958 less your discount (lets assume $30), or $928. Thus your import buy would need to be less than $928, and probably significantly, to make you prefer the imports. Why would you need a discount to $928? There is more delivery risk with imports, and maybe some potential supply chain challenges and other risks associated with buying from non-traditional sources. In many cases, traders who don’t yet have the material sold would look for an $80-100 spread of futures prices over their import buys to hedge the risk of bringing in material. Given the unprecedented backwardation we are seeing, that is a tall order.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information