Prices

October 7, 2021

Hot Rolled Futures: Market Pauses to Read the Tea Leaves

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

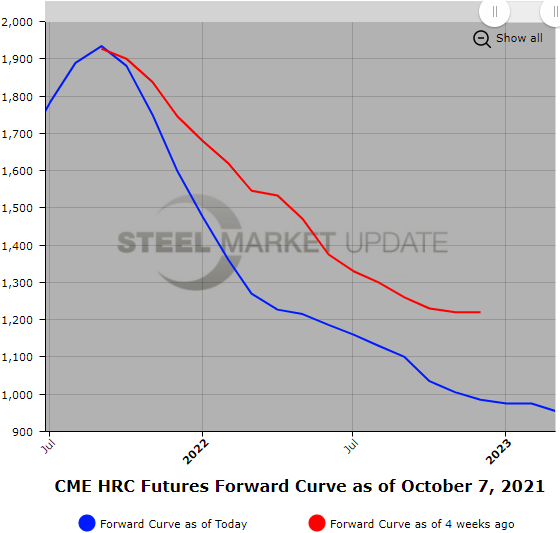

The hot rolled futures market was interesting this week as a strong reported decline in spot HR prices surprised many. The weekly HR index the CME uses to calculate the monthly index dropped $45/ST ($1,913/ST) this past week surpassing the entire HR price gain for the weekly indexes in September. Meanwhile, the forward curve settlements have not yet completely reflected the drop in spot in the near date forward months even as the backward steepness of the monthly curve increased in the mid-2022 quarters. The Q4’21 HR average for Sept. 29 settle to the Oct. 7 settle only declined by $5/ST due to the Dec’21 futures increasing almost $25/ST. The Q1’22 HR average for the same dates only declined $7/ST due to an $18/ST rise in Jan’22 HR settle to settle. Trading volumes remain healthy with almost 8,200 HR contracts traded in the last week. Open interest declined just over 5,500 contracts as the September month rolled off and has since added just under 1,000 contracts leaving it at almost 37,100 contracts.

The latest big price drop suggests the supply/demand imbalance due to Covid-19 disruptions has eased. Increased domestic steel mill production and increasing imports due to the big global price differential, as well as inventory value concerns, have seen buyers slow their pace of purchases, which has been reflected in lower outright futures purchases. Trading volumes remain brisk as more calendar spreads are being traded. Of note, the discount from the HR front forward month (Oct’21) to Dec’22 is almost $900/ST. The question is, will market forces move that price retracement closer to spot?

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

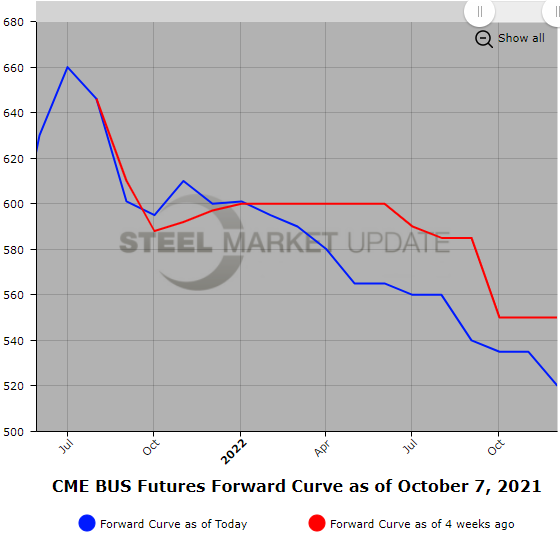

BUS settlement for October, which was anticipated to be down another $20-30/GT, looks likely to come in closer to sideways after some large surprise purchases. Current Nov’21 BUS was almost $20/GT lower just last Wednesday. How quickly markets can change. Recent 12-month BUS strip trades dipped as low as $570/GT, but have been edging back up as the outlook for November is brighter. However, continued softness in the export market makes it unlikely that there will be much upward pressure on primes other than the rush to beat winter.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

Editor’s note: Want to learn more about steel futures? Registration is open for SMU’s Introduction to Steel Hedging: Managing Price Risk Workshop to be held Nov. 2-3. You can get more information by clicking here.