Prices

April 14, 2022

Hot Rolled Futures: The HR Market Takes a Pause

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

As the Russia/Ukraine conflict continues to smolder the upward trend in spot HR prices appears to have stalled this week following an impressive $540/ST climb since the end of February.

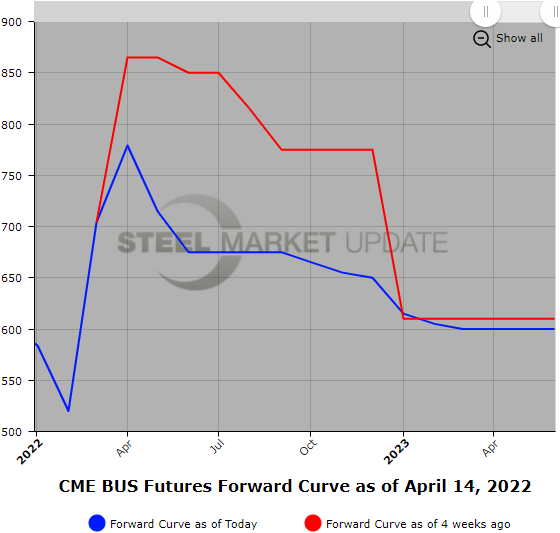

The strong upward velocity of the HR spot market led to a strong upward price move along the forward curve but especially in the nearer futures months. As of the April 12 settlements, the

Q2’22 HR average price was up $414/ST (40%), the Q3’22 HR average was up $337/ST (33%), and the Q4’22 HR average was up $287/ST (29%) from the February 25 settlements.

These numbers all reflect a pullback from mid-March highs, which were closer to a 60% rise due to the outbreak of war. The war has been a mixed bag with respect to open interest, but the

general trend has open interest moving lower.

That’s likely due to the combination of high volatility, which has led to considerably higher initial margin requirements, and shifting expectations regarding market demand and future price direction. HR futures trading has seemed a bit slower so far in April. But that is likely because we had a very brisk March with almost 35,000 contracts trading.

The progression of the war has shifted the shape of the forward curve, which was pretty flat, to a more steeply backwardated curve.

Feb 25th – Apr’22 settlement $1025/ST versus Dec’22 settlement $990/ST (-35/ST)

Apr 12th – Apr’22 settlement $1470/ST versus Dec’22 settlement $1279/ST (-191/ST)

With markets adjusting to metallics supply disruptions from the Black Sea, how soon will HR spot prices return to their pre-war trend? Imports are already pointing to lower prices for July delivery.

However, forecasting prices remains difficult given the ongoing global supply disruptions due to Covid lockdowns in China, high oil prices, and of course rising US interest rates and recession concerns.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

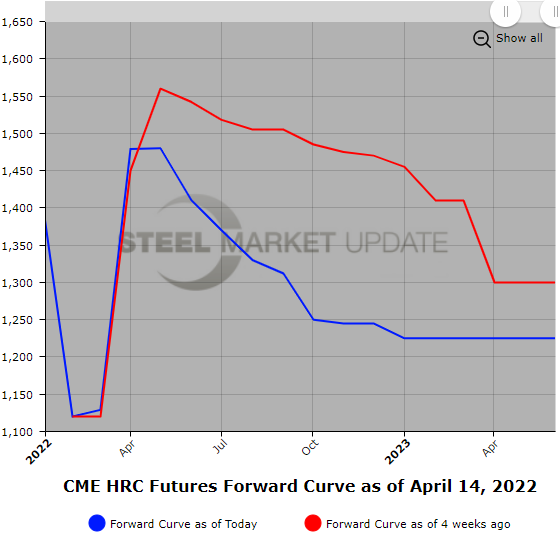

Scrap

BUS futures have also had a strong run up on the back of the expectations of supply disruptions due to the war. Early Apr’22 BUS expectations saw near date BUS futures hit $900/GT. But later sales brought the April BUS settlement price ($779/GT) back down to only a $75/GT increase over the prior settlement in March ($704/GT). However, BUS spot climbed almost $260 from the Feb settlement – so still a healthy price rise.

As of April 12, the May’22 BUS future was still $125/GT over the settlement from 25 Feb’22, and the latter half of 2022 BUS average settlement was over $80/ST above the pre-war price.

Basic pig iron prices spiked but have eased back from $1,200/ton. Issues remain on the timing that new sources can be found to fill the shortfall from the Black Sea.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.