Plate

October 31, 2023

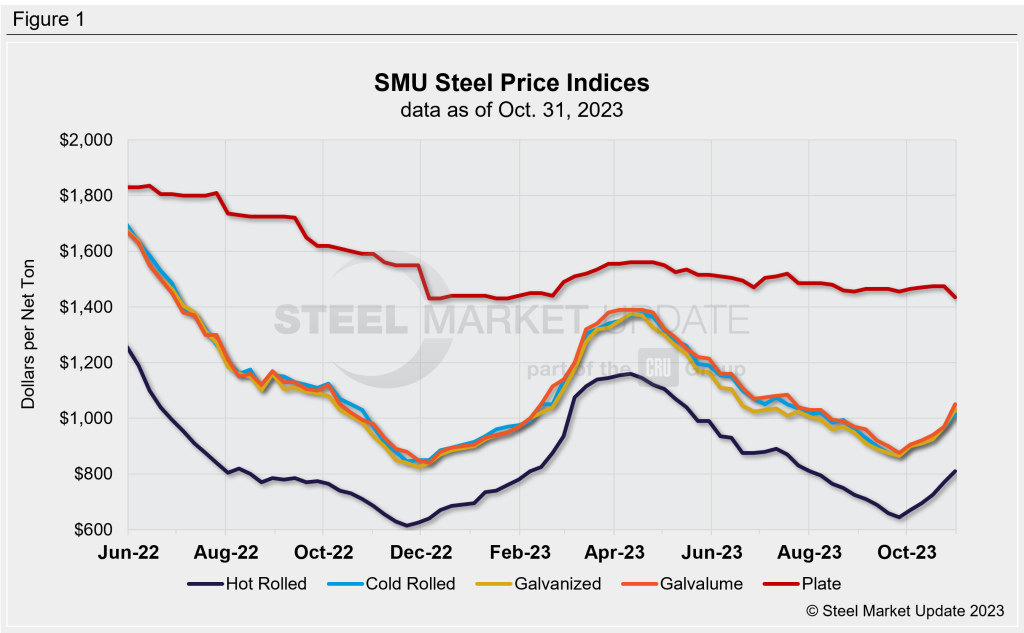

SMU Price Ranges: Sheet Surges on Limited Spot Availability, Plate Drops on Nucor Decrease

Written by David Schollaert & Michael Cowden

Sheet prices surged this week on limited spot tonnage and on the heels of steep price increases announced by domestic mills.

The question – for the balance of 2023 and perhaps into January 2024 – might be less one of price and more one of availability. With spot tons scarce, mills have been able to charge a premium, market participants said.

Case in point: SMU’s average hot-rolled coil price stands at $810 per ton ($40.50 per cwt), up $40/ton from last week and up $165/ton from a month ago.

In other words, HRC prices are above the $800/ton target announced by several domestic mills on Oct. 19. Some of those mills are now seeking at least $900/ton. (See SMU’s price increase calendar for the details.)

The gains were even more pronounced for cold-rolled and coated products. SMU’s base price for cold-rolled coil now averages $1,015/ton (up $45/ton week over week), galvanized stands at $1,030/ton (up $60/ton WoW), and Galvalume is at $1,050 per ton (up $80/ton WoW).

And certain mills are now seeking to push cold-rolled and coated base prices to as high as $1,150 per ton, market sources said.

The rapid rise in US prices means imports are more competitive. But they might not arrive until February or March. That means they are unlikely to relieve pressure on the domestic market in the short term, they said.

It was a different story in plate, where SMU’s average price was $1,435/ton, down $40/ton from a week ago. The drop follows a price decrease announced by Nucor on Monday.

SMU’s sheet momentum indicators continue to point upward. Our plate momentum indicator, in contrast, has shifted to lower from neutral.

Hot-Rolled Coil

The SMU price range is $770–850 per net ton ($38.50–42.50 per cwt), with an average of $810 per ton ($40.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range increased $30 per ton vs. one week ago, while the top end of the range moved up $50 per ton compared to the prior week. Our overall average is up $40 per ton WoW. Our price momentum indicator for HRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Hot Rolled Lead Times: 4–9 weeks

Cold-Rolled Coil

The SMU price range is $960–1,070 per net ton ($48.00–53.50 per cwt), with an average of $1,015 per ton ($50.75 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $20 per ton WoW, while the top end was $70 per ton higher compared to a week ago. Our overall average is up $45 per ton WoW. Our price momentum indicator for CRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Cold Rolled Lead Times: 6–10 weeks

Galvanized Coil

The SMU price range is $1,000–1,060 per net ton ($50.00–53.00 per cwt), with an average of $1,030 per ton ($51.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $60 per ton vs. last week, while the top end of our range was also up $60 per ton WoW. Thus, our overall average is up $60 per ton vs. the prior week. Our price momentum indicator on galvanized steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,097–1,157 per ton with an average of $1,127 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-10 weeks

Galvalume Coil

The SMU price range is $1,000–1,100 per net ton ($50.00–55.00 per cwt), with an average of $1,050 per ton ($52.50 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $60 per ton vs. last week, while the top end of the range was $100 per ton higher WoW. Our overall average was up $80 per ton compared to one week ago. Our price momentum indicator on Galvalume steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,294–1,394 per ton with an average of $1,344 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-12 weeks

Plate

The SMU price range is $1,380–1,490 per net ton ($69.00–74.50 per cwt), with an average of $1,435 per ton ($71.75 per cwt) FOB mill. The lower end of our range was down $70 per ton WoW, while the top end of our range was down $10 per ton compared to the week prior. Our overall average is down $40 per ton vs. one week ago. Our price momentum indicator on steel plate shifted from neutral to lower, meaning SMU expects prices will decrease over the next 30 days.

Plate Lead Times: 4-9 weeks

SMU Note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert