Analysis

December 3, 2023

Final thoughts

Written by David Schollaert

It’s no surprise why spot prices are on the rise: Mills have been announcing higher flat-rolled tags for the better part of the past three months, according to our steel mill price increase calendar.

A leading cause of the $305-per-ton rally since prices reached a recent bottom of $645 per ton in late September has been a combination of extending lead times (helped by maintenance outages and idlings) and limited spot availability. That dynamic has squeezed the spot market even more with limited tonnages available for December.

But even while Nucor has been targeting a base price of as much as $1,100 per ton for hot-rolled coil since Nov. 27, buyers seem to be resisting those levels as best they can, according to our check of the market last Tuesday. SMU’s HRC price stands at $950 per ton on average, up $15 per ton from the week prior.

Some of our data could still be pointing to why there’s increasing resistance to the present price rally as we near the final few weeks of 2023.

Steel Demand Index

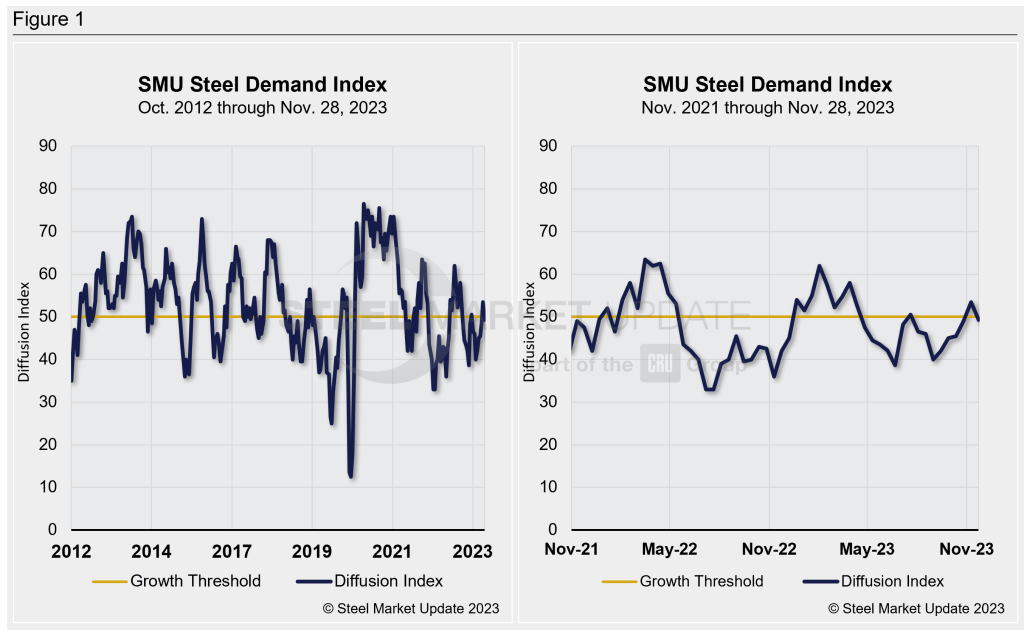

SMU’s Steel Demand Index has slipped back into contraction territory, now at 49.3, down 4.2 points from a reading of 53.5 at the beginning of November.

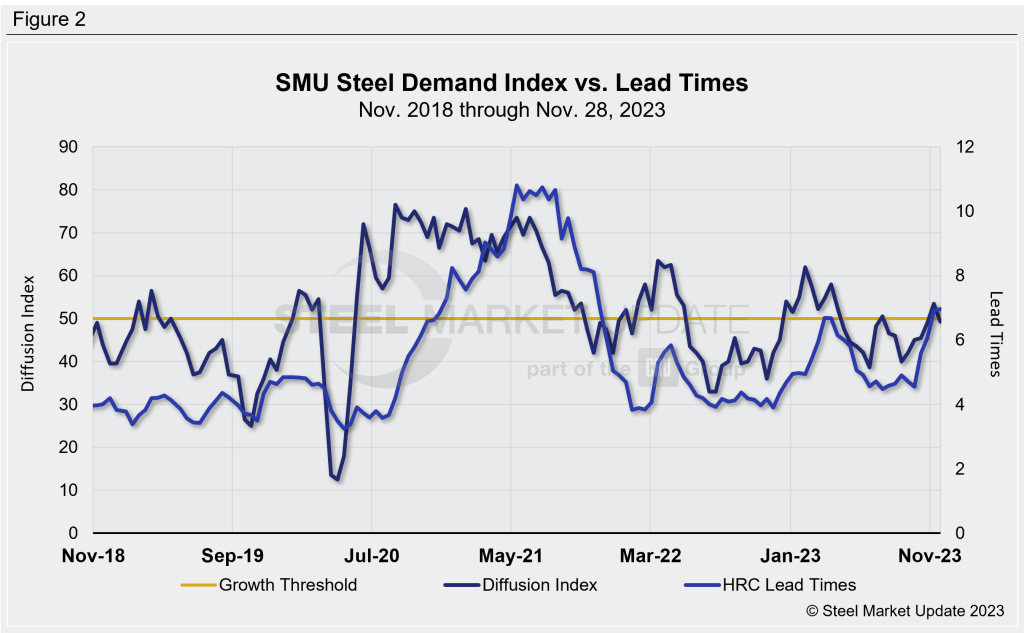

The index, which compares lead times and demand, is a diffusion index derived from the market surveys we conduct every two weeks. This index has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves.

An index score above 50 indicates rising demand and a score below 50 suggests declining demand. Detailed side by side in Figure 1 are both the historical views and the latest Steel Demand Index.

The measure had improved by more than 13 points back on Nov. 9 after reaching a recent low of 40 back in late August. Interestingly, the only time the index has moved into growth territory since late April has been for short-lived bumps when the market has responded to mill price hikes in mid-June and late September. This could potentially be an indication that the bump in demand has been driven by buyers trying to get out ahead of mill increases rather than an increase in fundamental demand.

SMU’s Steel Demand Index has been largely trending downwards and in contraction territory since early April.

Current state of play

While overall market sentiment is still somewhat bullish, there is growing talk of buyer resistance. A growing number of sources say they’ve been more reluctant to make HRC buys at current price points, especially with lead times extending well into 2024.

Many have noted that year-end buying has been completed, and some say that early Q1 buying has also already been secured. So what does that mean for lead times and prices as we near the year-end holidays?

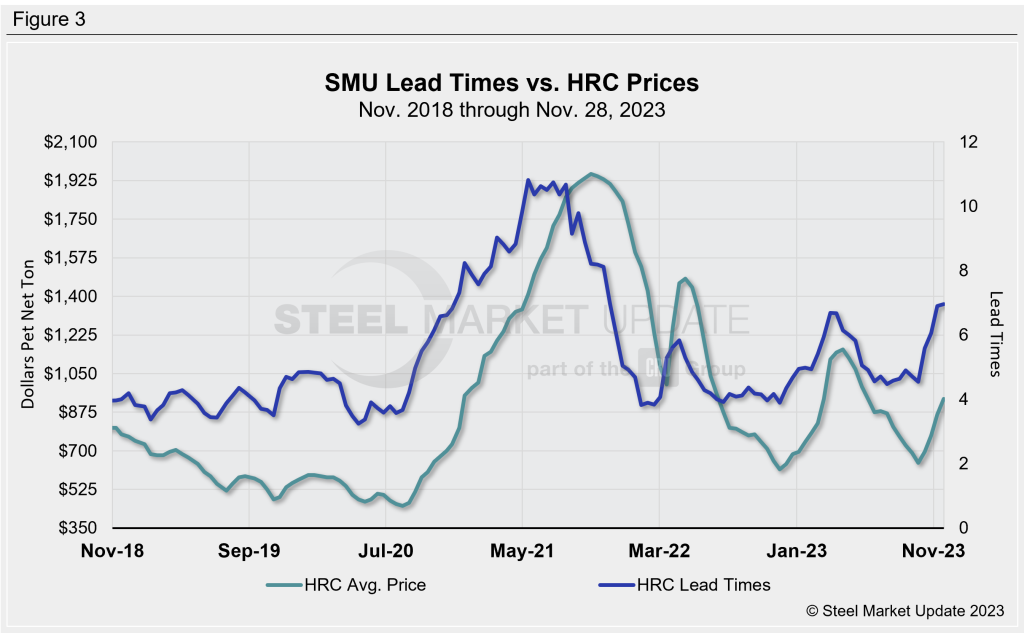

I’m not going to speculate, but keep in mind that SMU’s demand diffusion index has, for nearly a decade, preceded moves in steel mill lead times (Figure 2), and SMU’s lead times have also been a leading indicator for flat-rolled steel prices, particularly HRC (Figure 3).

What to watch for

There’s no surprise there: Bids for U.S. Steel were due this past Friday, the same day when an NDA between the Pittsburgh-based steelmaker and Cleveland-Cliffs Inc. allegedly expired.

We’re all waiting on bated breath for what the potential sale of U.S. Steel means for the flat-rolled steel sector.

And while Cliffs has garnered much attention – and rightly so, with potentially more consolidation whittling the number of major domestic steel producers to just three and Cliffs cementing itself as the primary supplier of steel to domestic carmakers (something the auto companies are not fond of) – U.S. Steel has said that “numerous” potential buyers have come forth. It has not named them.

Also, what does the potential sale mean for the indefinite idling of U.S. Steel’s Granite City Works near St. Louis? The initial idling was in response to lower demand because of the UAW strike. But the extended shutdown was to “ensure melt capacity” and to help “balance” its order book – put another way, lower demand.

Lead times will ultimately be a guide for where prices go, so keep a close eye on them. Our hot rolled lead times are averaging just under seven weeks, setting a new high for 2023 after eclipsing this year’s prior high of 6.69 weeks set in mid-March.

Tampa Steel Conference

The 2024 Tampa Steel Conference is less than two months away. It is one of the premier domestic steel conferences and a great compliment to the record-breaking SMU Steel Summit in August.

With just about 250 delegates already registered, we anticipate beating last year’s mark with more than 500 attendees.

The event runs from Sunday-Tuesday, Jan. 28-30, and will be at the JW Marriott Tampa Water Street hotel.

You can learn more about the agenda, explore networking opportunities, and register here.

Note: Demand, lead times, and prices are based on the average data from manufacturers and steel service centers who participate in SMU’s market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.