Analysis

May 23, 2024

Final thoughts

Written by Michael Cowden

Here’s something I didn’t expect to see this week: SMU’s Current Buyers’ Sentiment Index dropped to its lowest point since August 2020.

I can see why sentiment might have slipped. Rewind to March and people widely expected price to increase into April. Instead, prices fell.

The abrupt momentum shift, and inventory losses resulting from that, are causing some pain. And selling higher priced steel into a falling market is not something anyone enjoys.

I also don’t want to discount the continued impact of higher interest rates, inflation, and a tight labor market. That’s made things hard for a lot of businesses, perhaps smaller businesses in particular.

Why so blue?

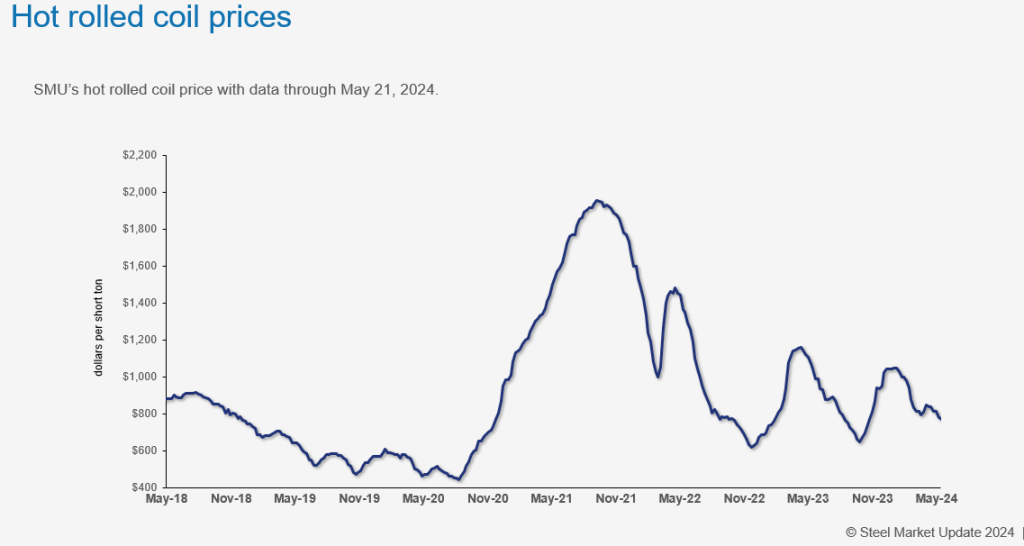

But is it really as bad as August 2020 – the scary, early days of the pandemic? Keep in mind that hot-rolled (HR) coil prices hit a 2020 low of $440 per short ton (st) in August 2020. That’s closer to a scrap price now than a finished steel price. (You can track both steel and scrap prices with our pricing tool.)

SMU’s HR price now stands at $760/st on average. Yes, that’s down $285/ton, or 27%, from the beginning of the year. But US mills are still profitable with every ton sold at those numbers. And I stress that’s an average price. Because some of you tell me that prices well below list are available. (Recall that list price for HR is $770/st for Nucor and $800/st for Cliffs.)

Even so, others tell me that $770/st is only available from certain Nucor mills. And still others have suggested that the $10/ton increase we saw from Nucor this week – after a sharp drop at the beginning of the month – might be a sign that a bottom is near. I’ve even heard rumors that mill increases could be possible.

I’m not sure I buy that. It would be a tall order. Lead times for most products are in June/July. It’s never easy to raise prices in the face of something as stubbornly predictable as the summer doldrums. But I wouldn’t be surprised if mills try to “hold the line.”

We saw something similar in June of last year. U.S. Steel led a round of price increases then. The announced increases didn’t actually increase prices. They did, however, slow the slide.

Lower highs and higher lows

Maybe I’m guilty of being “glass half full” here. But there seems to be some reason for optimism – or at least for less gloom than our survey results seem to reflect.

For starters, just take a look at prices over the last three years. You can see an obvious pattern.

True, the peaks aren’t as high. But the valleys aren’t as low. Is that such a bad thing?

Imports still trending high, but maybe not for long

We’ve written a lot over the last few months about how high flat-rolled steel imports have been in recent months.

The US imported 951,174 metric tons (mt) of flat-rolled steel in March, according to Commerce Department data. That figure rose to 977,759 mt in April – the highest level since 1.03 million mt in June 2022.

And the US was licensed to import 771,623 mt through May 21, that last date for which figures are available. That amounts to 36,744 mt per day. If that pace continues, we’re on pace to import another 367,440 mt this month – for a total of 1.14 million mt.

The high import volumes we’ve seen stem from a combination of high US prices late last year and early this year. They also stem from supply chain issues (notably delays at the Panama Canal) resulting in those imports arriving over a long time period than initially anticipated.

But will imports continue to trend up in the face of lower US prices and shorter domestic mill lead times? I have my doubts.

Cliffs opened its order book for July today. Imports ordered at what might be competitive prices now – especially for tandem products – might not arrive until September. That begs the age-old question, will today’s imports prices still be a good deal by the time they hit the docks?

Also, I’ve heard from you that problems with late deliveries when it comes to foreign steel were so bad that you plan to source more domestically – or at least regionally – going forward.

Summer doldrums or slowing demand?

If there is one thing that concerns me it’s that the number of people reporting that demand is declining continues to inch up.

We’ll release results of our full steel-market survey tomorrow. Approximately 70% say that demand is improving or stable. That’s great. But 30% say that demand is declining. That’s up from 25% in our last check of the market two weeks ago.

We saw something similar in the latter half of Q2 last year – when the number of people who said demand was declining peaked at 33%. Things improved from there.

So my question for you is this: Is the drop in sentiment that we’ve seen a reflection of the summer doldrums? Is it a realization that the boom times of the last three years couldn’t last forever? Or has the market really taken a turn for the worse?

I’d appreciate your feedback at info@steelmarketupdate.com.

In the meantime, thanks to all of you for your continued support of SMU.

Memorial Day

SMU will not send out a newsletter on Sunday, May 26. And our offices will be closed on Monday, May 27 in observance of Memorial Day. We will resume our regular pricing and newsletter service on Tuesday.