Steel market chatter this week

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

Economic activity across the US was largely static with some modest activity unfolding at a sluggish pace, according to the US Federal Reserve’s (The Fed) latest Beige Book report.

German Economy Minister Katherina Reiche expressed frustration with US levies on steel and aluminum products. The US contends the EU is unfairly targeting its big tech firms.

Wiley attorneys Alan Price and Ted Brackmeyer argue that significant changes to the USMCA and continued Section 232 tariffs on Canada and Mexico are needed to support American steelmaking.

You may have heard about traders “canceling” metal on the London Metal Exchange and shipping it out. Here's a guide to understand that process.

SMU sits down with Barry Zekelman to talk North American trade and the state of the US and Canadian steel industries.

US steel mills have received a boost from lower import levels because of sweeping tariffs this year. However, demand remained moderate in most sectors, aside from data center construction, after the summer.

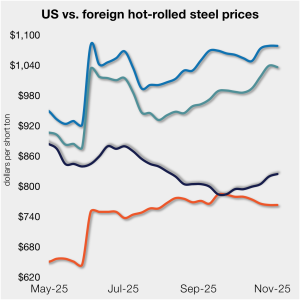

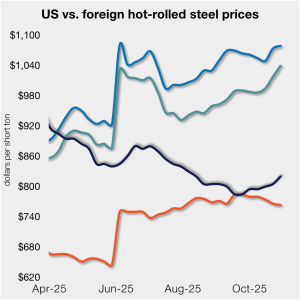

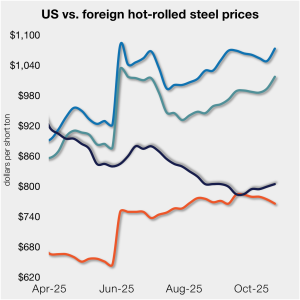

The gap between US hot band prices and imports narrowed slightly. But with the 50% Section 232 tariffs, most imports remain more expensive than domestic material.

Zekelman Industries said Canadians who report the use of foreign steel in active or future public construction projects are eligible for a CAD$1,000.00 (USD$711.62) payment.

US President Donald Trump and Chinese President Xi Jinping on Thursday had a much-anticipated meeting. Is it only a hiatus in the trade war, or did it really change the situation? I suspect the former, I but hope for the latter.

In dollar-per-ton terms, US product is on average $141/st less than landed import prices (inclusive of the 50% tariff). That’s down from $148/st last week.

It was only a matter of time before a shutdown happened. And, no, we aren’t talking about the federal government’s lapse in appropriations. On Oct. 9, Beijing announced a series of restrictions that will effectively shut down exports of rare earth elements, magnets, and certain downstream products vital to advanced manufacturing.

SMU’s average price for domestic HR coil moved $5 higher this week, while price movements in offshore markets varied. This dynamic...

Want to know the latest on Trump, tariffs, and trade policy - and the impact on both steel and aluminum? Then join SMU, AMU, and leading law firm Wiley for a Community Chat on Thursday, Nov. 13, at 11 am ET.

On Oct.10, President Trump announced major increases in tariffs on Chinese goods. The trigger was a new regime of export controls on rare earth metals and products using those elements, including magnets, capital equipment, and catalysts for catalytic converters in cars and trucks.

Genuine demand, they stated, will return when the market feels stable again.

Any steel imports into the EU that exceed the new, lower quota level would be subject to a 50% tariff, which represents a major increase from the EU’s current 25% out-of-quota tariff. This move would largely align the EU’s steel tariff rate with Canada and the United States.

More liberal access to the Northwest Passage could play into trade negotiations between Canada and the United States.

The boom in China’s direct steel exports has not stopped this year, even with a rise in protectionist measures globally. The increase is driven by...

Iron ore shipments from US Great Lakes ports fell sharply in September, per the latest from the Lake Carriers’ Association (LCA) of Westlake, Ohio.

here has been considerable activity in the export scrap market in the Mediterranean Basin over the last 10 days. Prices have inched up after recovering from a brief dip in September. Prices range from...

There is no doubt that the current government shutdown reflects the vast divisions between the extremes of American politics, society, and even geography. Almost all Americans agree that government is necessary, but voters disagree...

Trade groups cautioned that a prolonged shutdown could strain US industry.

Market chatter from steel buyers this week: prices steady to slightly higher, demand weak, inventories slow, and tariffs clouding the outlook.

The US International Trade Commission (ITC) finds that corrosion resistant steel (CORE) imports from 10 countries have caused material damage to domestic product producers, according to the ITC’s statement.

Rising Midwest and European premiums are giving Canadian aluminum producers a rare boost, restoring pricing power just ahead of key 2026 negotiations.

Following a 3% decline in June, the amount of steel shipped outside of the US edged up 1% in July to 623,000 short tons. July was the sixth-lowest monthly export rate since the COVID-19 pandemic, and...

Mexico is considering imposing steep tariffs on imports of steel, automobiles, and over 1,400 other products. Its target? Countries with which it does not have free trade agreements, mainly China, India, Thailand, and other South Asian nations.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

President Trump’s “reciprocal” tariffs under the International Emergency Economic Policy Act (IEEPA) were struck down again, this time on Aug. 29 by the Court of Appeals for the Federal Circuit (CAFC). The legal and policy mess continues, with the next stop being the US Supreme Court.