Prices

July 18, 2019

Hot Rolled Futures: How to Make Sense of the Curve

Written by Gaurav Chhibbar

SMU contributor Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Gaurav’s previous role, he was a trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. You can learn more about Metal Edge at www.metaledgepartners.com. Gaurav can be reached at gaurav@metaledgepartners.com for queries/comments/questions.

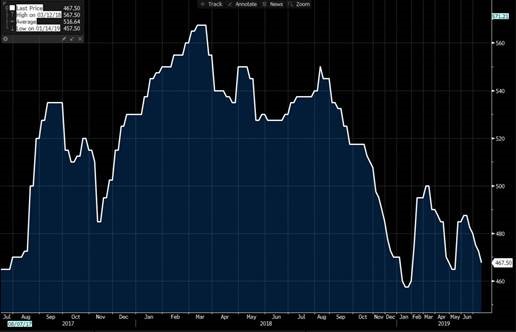

The U.S. HRC market has found buying interest come alive as mills see their lead times extend and find improvement in their order books. The buoyancy of the physical steel market is reflected in the futures curve, as well. Steel futures across the board have moved higher with the shape of the market now in a “contango.” A “contango” in commodity markets simply means a forward curve shaped such that the nearby prices are below the prices further out.

Contango markets are interesting from two aspects: 1.) They highlight that there are positive returns to buying today and selling in the future. 2.) They also indicate lack of hedging pressure from natural sellers such as those who may carry inventories. The chart below shows the orange line (curve as on 7/17) versus the green line (curve as on 7/3). The upward movement of the curve is driven by a combination of factors, such as optimism about future prices of steel, hedgers not selling aggressively, futures players covering shorts, amongst others.

The scrap market spot prices in the U.S. seem to be bottoming out (yellow). Early indications from scrap players in the industry put August scrap pricing at a premium to July. This will lend further support to the momentum that the U.S. mills are hoping to build in the market. With historic price spreads to scrap now in the rear view mirror, mills are expecting tighter spreads to raw materials going forward. The futures curve in HRC has moved up roughly the same in Q4’19 as the move in the Busheling scrap futures ($15 vs. $13 respectively).

It might be worthwhile to note that the optimism in the U.S. with regards to the steel prices is not felt in either spot or the futures market in other ferrous commodities. The spot steel market in Europe continues to be under pressure as lackluster demand from end users negates the expected positive drivers from production capacity cuts.

The S. European prices often find support as scrap moves higher. However, with N European steel demand languishing and the local trade flows in disarray, positive scrap price chatter had little to no impact on steel buyers’ willingness to pay more for steel. This has become an interesting market for us in the U.S. to watch as European mills are more favorably positioned to market their steel products into the U.S. despite the 25 percent Section 232 tariffs. To the extent that Europe remains weak, there will be a price at which U.S. buyers can turn to imports again, putting a cap on the upward movement of spot (or futures).

Revisiting Chinese markets, the sluggish steel sentiment hasn’t rubbed off on spot iron ore prices yet. The spot ore prices remain high, resulting in mill margins remaining under pressure. The forward curve in ore is steeply backwardated, reflecting what many believe is a delayed supply response from Brazilian mines impacted by shutdowns and disruptions.

To wrap up this update, I’d highlight to those cautiously watching the paper markets that it is crucial to look at your prolonged exposure on steel price commitments, both on the buy side and what you are obliged to sell at. Your next step should be to put those prices into perspective versus where the forward curve levels are. This should get you to an estimate of how much your future obligations are going to help you make or lose if you are without a hedge (physical or paper). This strategy is an integral part of planning a risk management strategy that helps serve customers better. This applies equally to OEM’s buying under long contracts from suppliers.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.