Prices

October 14, 2021

Hot Rolled Futures – Energetic Markets

Editor’s note: SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Before joining Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corporation, Cargill Steel Service Centers and Plateplus Inc. You can learn more about Metal Edge at www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com.

Energy in its broadest definition has seemingly dominated headlines as of late, whether it is the equity markets suggesting a rotation into the beleaguered sector due to underinvestment in exploration because of low crude prices, a shift in investment to green energy, or geopolitical factors acutely affecting supply and demand factors in places from China to Europe. West Texas Intermediate crude prices traded as high as $81.68/bbl today, while natural gas prices here in the U.S. rallied near $6/MMBtu before trailing off to close near $5.70/MMBtu. Most have likely already felt this impact at the gas pump or will likely feel these impacts during the winter months as heating bills rise.

Understandably the headlines are geared to the factors that impact the broader economy, but when you dive deeper into the factors impacting steel production they are just as stark. Several recent reports have highlighted the severity of energy shortages in places like China and Europe and the subsequent impact on steel production. Bloomberg reported that one of the biggest zinc producers, Nyrstar, in Europe will cut output at three smelters by up to 50% due to rising power prices and cost burdens associated with tighter environmental regulations. Spanish specialty steelmaker Sidenor announced it was reducing production by 30% between now and the end of the year due to onerous power costs they estimate have risen by 400% over the course of the year. We shared a similar graph a few weeks ago, but the below graph of metallurgical coal prices in China continues to rise and has quietly become the most expensive input required to make steel via the blast furnace process. Looking at estimates provided by the World Steel Association, 89% of blast furnace energy inputs come from coal, 7% from electricity and 3% from natural gas, versus EAF producers who obtain 11% of their energy input from coal, 50% from electricity and 38% from natural gas. The broader economic energy headlines, when paired with these estimates, suggest increasing energy costs will add further cost to steel production should these rising trends persist. Steel production is a very energy intensive endeavor, and these impacts could prove important for determining where steel prices may be headed.

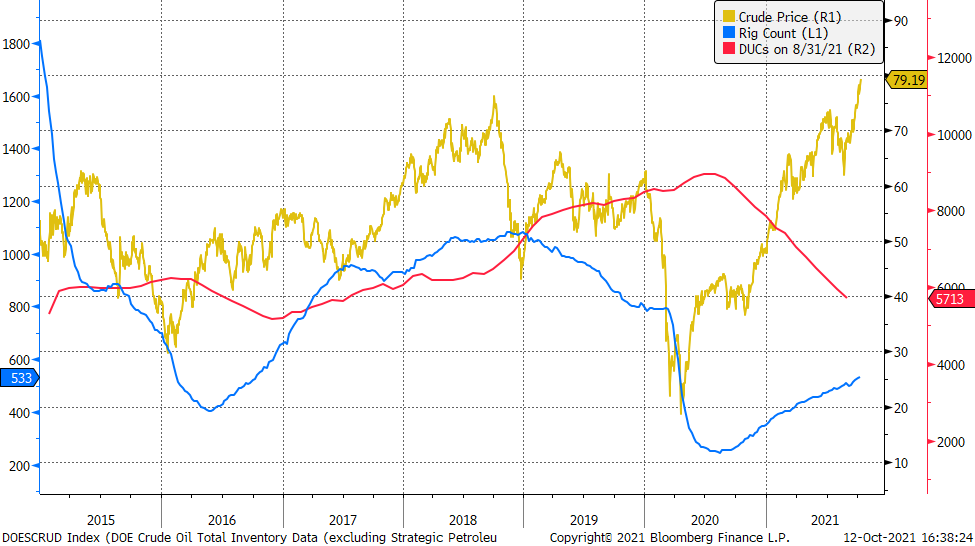

The energy landscape looks much more supportive in the U.S. with higher oil prices, declining drilled but uncompleted wells (DUCs) and rising rig counts, which could result in better demand from one of the few sectors that did not benefit meaningfully during the post-Covid economic recovery.

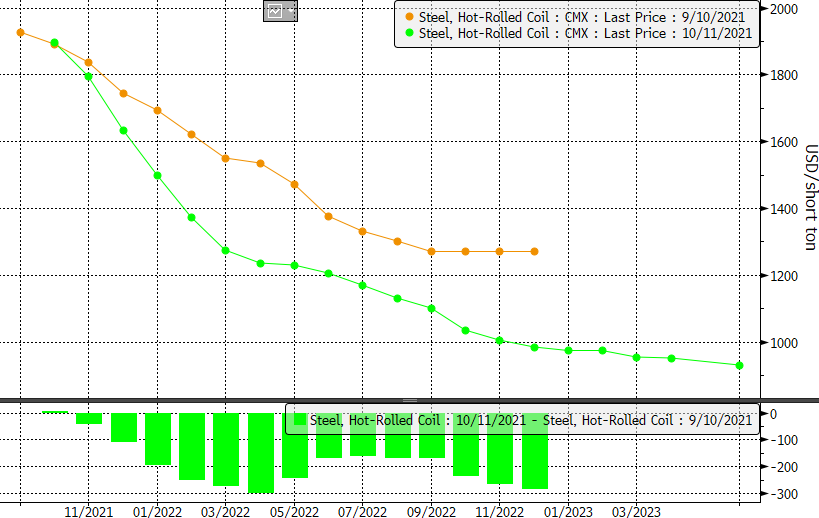

All of this leads me to the HRC futures analogy that energy in its simplest form exists in two states: kinetic and potential energy. Kinetic energy refers to the energy of an object in motion, while potential energy exists in a form awaiting to be released. The futures market has been exhibiting mostly kinetic behavior recently, whereby the upward moves seem to build upon themselves for a few days and the market drifts higher, then abruptly pivots and drops several days. These reversals seem to be brought about either by the inertia of a few compounding negative data points, or a brief arbitrage emerges and brings out the sellers looking to capitalize on an opportunity to lock in a margin that could otherwise be difficult to obtain if left unhedged and physical steel prices follow the downturn as suggested by the forward curve.

Despite the above chart illustrating that overall selling pressure has pushed the futures curve meaningfully lower month over month, we may be storing a fair amount of potential energy in the futures market that could have been the result of waiting for some sort of clarity to develop on contract discussions for 2022. It seems that the landscape around supply/contractual agreements is coming into clearer focus lately, which could unleash a flurry of activity now that mills, service centers, fabricators and OEMs have greater confidence on what to expect from a volume and floating price perspective. Further, buyers may begin to look to the forward curve to lock in fixed forward costs significantly lower than current spot levels.

For example, SMU reported on Tuesday import offers ranging from $1,360-$1,500/t for HRC on what most likely are February 2022 arrivals. Given the horror stories of delays in imports due to vessel availability or port congestion, one must wonder if we could see more interest in buying futures at something near the $1,360/t settlement price from Wednesday for February 2022. This transaction might be of particular interest especially if one assumes said buyer will likely have some sort of discount to a prevailing index and have the flexibility of waiting a few more months before specifying specific sizes and sending those orders to a domestic supplier. In contrast, even if you’re successful in securing the low end of the range SMU suggests is available from an import perspective, if you’re looking to hedge that import buy, you’ll probably be rolling some of the hedges into March at a price of $1,255/t, or essentially a locked in loss of -$95/t.

Another meaningful development in the steel supply chain occurred this week with Cleveland-Cliffs announcing its acquisition of Ferrous Processing and Trading, which consolidates a large scrap supplier in the Midwest under the largest flat rolled steel provider in the U.S. It remains to be seen how this impacts the regional availability of scrap in the near term, but it would appear this consolidation could support higher domestic scrap/steel prices.

In conclusion, the futures market continues to suggest a rapidly declining steel price environment between now and the middle part of Q2 2022, however the collective impact of what is occurring in the global energy complex will be important to watch as it relates to its impact on cost structures and supply.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.