Prices

November 18, 2021

HRC Futures – Let’s Get Ready to Rumble

Editor’s note: SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Before joining Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corporation, Cargill Steel Service Centers and Plateplus Inc. You can learn more about Metal Edge at www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com.

My 18-year-old son has become enamored with mixed martial arts (MMA) lately and enjoys watching UFC (Ultimate Fighting Championship) matches with his friends. I have watched a handful of these UFC fights over the years and would say they are not really my thing. Granted they are exciting, and action packed, but I would much prefer to watch an instant classic heavyweight fight from the Ali/Frazier era. Admittedly, many of these UFC fighters may be more athletic, tenacious and fearless than traditional boxers, but personally I have always appreciated the endurance and determination of traditional boxers as they battle toe to toe 10+ rounds into a fight.

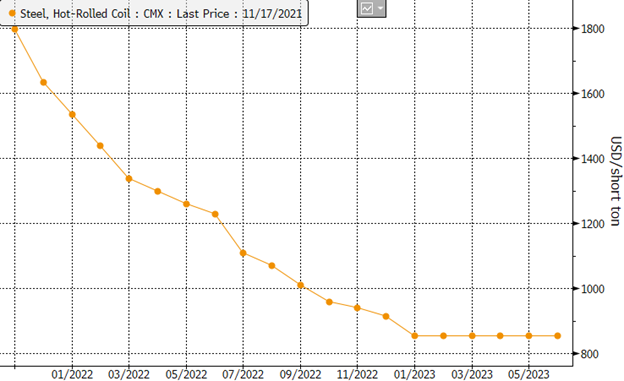

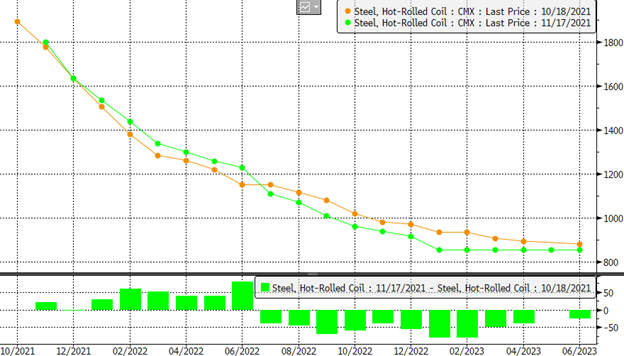

Why would we be making this odd analogy in a steel futures article? Well, it relates to the outlook on pricing in the steel market going forward, and the pace of decline as suggested by the forward curve. Instead of a quick five-round UFC-type knockout where HRC futures fall to the mat, the curve seems to suggest that the fight to the bottom will be a 12+ round heavyweight slobber knocker. It is hard for me to compare the recent 13-month price rally to a fight, as it seemed more akin to professional wrestling. The market is nearing its second full month of price declines on HRC, and conversations with most market participants suggest that more declines are on the horizon. But some hold the opinion that once lead-times push into 2022, we may see a moderating effect as new contract structures are enforced and buyers who worked hard to right size inventories for year-end re-enter the market and better match purchases to shipments. The forward curve is not subscribing to that theory as the chart below illustrates a steeply backwardated and lengthy 14-month period of decline.

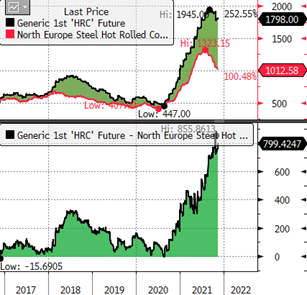

Until yesterday’s trading session we had not seen a meaningful downward move in HRC futures following the Section 232 resolution with Europe as we had seen in months prior where the rumors of potential repeal of tariffs with the EU would send the forward curve into freefall. International prices continue to hold a large advantage to U.S. prices, but they too hold risk given the extended delivery timelines, and the new complexities of a TRQ that could make it difficult for foreign mills and traders to determine whether their exports to the U.S. market are truly tariff-free as multiple exporters jockey to be first in line to maximize the country-specific quotas.

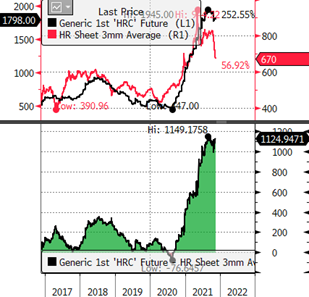

The above chart details the disparity in international prices relative to U.S. prices. Over my career, I have seen these types of spreads illicit a bit of retaliation from domestic mills by way of “foreign fighter” deals, whereby a mill quietly negotiates lower pricing than current spot levels in return for a substantial volume order to discourage domestic buyers from buying imports. In the event the domestic mills resort to this type of behavior, it is possible that the market could gap lower more quickly than the forward curve suggests. If that were the case, it may be worth having some inventory hedged to preserve the value of that investment and avoid the pain associated with rapidly declining prices.

We often author futures articles from the lens of an OEM, fabricator or service center, but the above scenario piqued my interest to consider utilization of HRC futures from a steel mill perspective. Foreign fighter deals can be a slippery slope as the steel market is not known to keep secrets very well. Whether these types of deals get picked up by any of the various steel indices or just set expectations of desperation from producing mills, it can have adverse effects on buyer sentiment and lead to more tentative buying behavior, neither of which is a terribly favorable outcome in an environment where the U.S. market is adding steelmaking capacity. We continue to remain in uncharted territory, where mill margins over input costs are at record levels and afford them the latitude to negotiate one-off deals as they see fit and still make very handsome profits. On the other hand, steel mills could utilize the forward curve to accomplish similar outcomes. In fact, we have seen some of this occur unintentionally over the last several months, as in many cases buying HRC futures in February or March of 2022 and tying to domestic supply was as cost-effective as buying imports. Meanwhile buyers of imports who would typically be keen to hedge were faced with locking in little to no profit in most cases.

This brings me back to the discussion around steel mills utilizing futures to help navigate foreign competition. In the event a steel mill sought to sell HRC futures at a lower level than current settlements and they have floating/indexed agreements with their customers, they would effectively be locking in a fixed margin above their input costs anonymously in financial markets, while allowing the physical transactions to float against indices that are not distorted by one-off deals. If these futures prices are competitive with foreign steel prices, their customers (if they are set up to trade HRC futures) can lock in their steel costs for these forward deliveries by buying the HRC futures contract, disincentivizing them to look offshore for cheaper prices and keep their tons flowing to their domestic suppliers. Nonetheless, this trading method will not help a steel mill fill a sudden gap in their order book, but the disparity in international prices may have robbed domestic mills of a portion of their current/future order book.

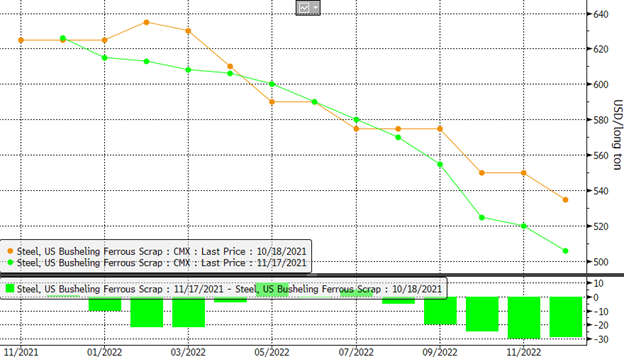

One last factor that is important to watch closely going forward is the relationship between scrap and iron ore. The chart below shows the scrap/ore ratio closing in on near-term highs as November scrap moved higher while international iron ore prices continue to grind lower on weak Chinese demand/production. While we acknowledge dynamics have changed in the scrap markets with more EAF capacity coming online, these ratios are suggesting scrap may be a bit overvalued in historic terms.

The changes in the scrap vs. iron ore ratio may be contributing some to the recent downward pressure in the BUS futures market in the nearby months as the chart below illustrates, which is somewhat odd as we typically see scrap prices supported during the winter months.

In conclusion, whether you are fearful of a rapid decline in steel pricing or are interested in locking in margins or providing longer-term fixed pricing to your customers, the HRC futures contract can be a valuable tool in navigating steel market uncertainty.

Regardless of whether this steel market turns out to be a five round UFC-type fight or a 12 round heavyweight bout, it pays to keep your gloves up and head on a swivel!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.