Prices

November 16, 2023

HRC Futures: Intricate Dynamics Shape Market

Written by John Medich

In the dynamic landscape of the steel futures market, a confluence of factors is shaping the current narrative. From tight supply fueled by low domestic production and import volumes to a rally led by hot-rolled coil (HRC) strength resonating across the ferrous complex, the market is navigating through intricate dynamics. Despite global prices lagging, presenting a window for import arbitrage, the anticipated material influx has not yet materialized. Yet, against this backdrop, technical momentum has notably decelerated, prompting a closer examination of the evolving dynamics that underpin the steel futures market.

Tight Inventories With Limited Supply = Rapid Price Appreciation

In recent columns, we have highlighted the current tight inventories within the steel industry. This scarcity, coupled with limited production, has resulted in a rapid surge in steel prices. Despite the prolonged attention given to the auto strike in recent months, its impact on steel prices has proven to be minimal. This is attributed to the resilience of mills, which remained disciplined and managed production levels effectively throughout the strike period.

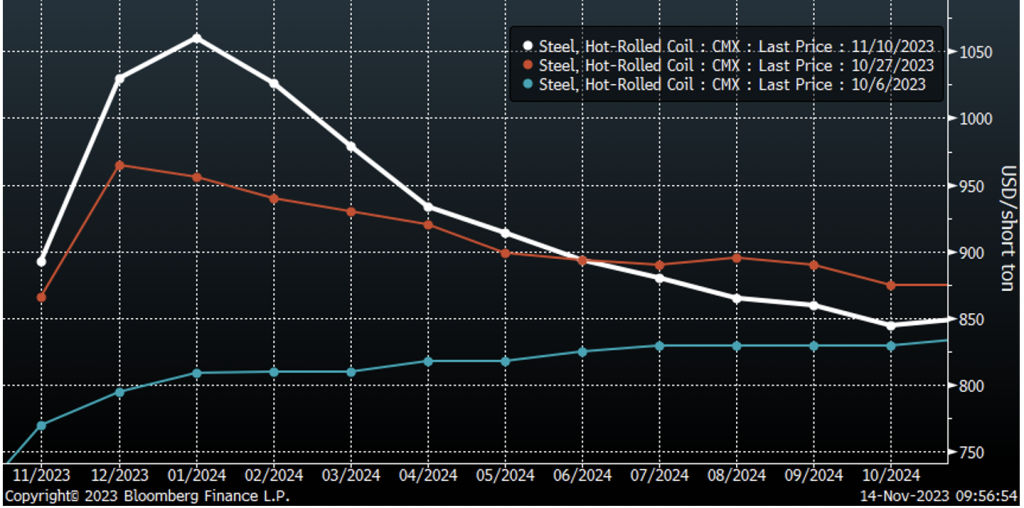

Crucially, the influence of import volumes has been subdued, contributing to the pricing power of domestic mills in recent weeks. Lead times, reaching the most extended levels since the historic 2021 rally, underscore the current scarcity of available steel. Capitalizing on this shortage, mills have confidently announced multiple price increases, prompting a leap in futures prices.

A notable development is the surge in January futures, soaring by over $250 since early October, and this upward momentum has been accompanied by robust trading volume. The aggregate volume across the HRC futures curve for the week of Oct. 23-Oct. 27 reached 211,200 tons (10,560 contracts), marking the highest levels since the rally observed this past spring.

The Ferrous Complex Is Rising….

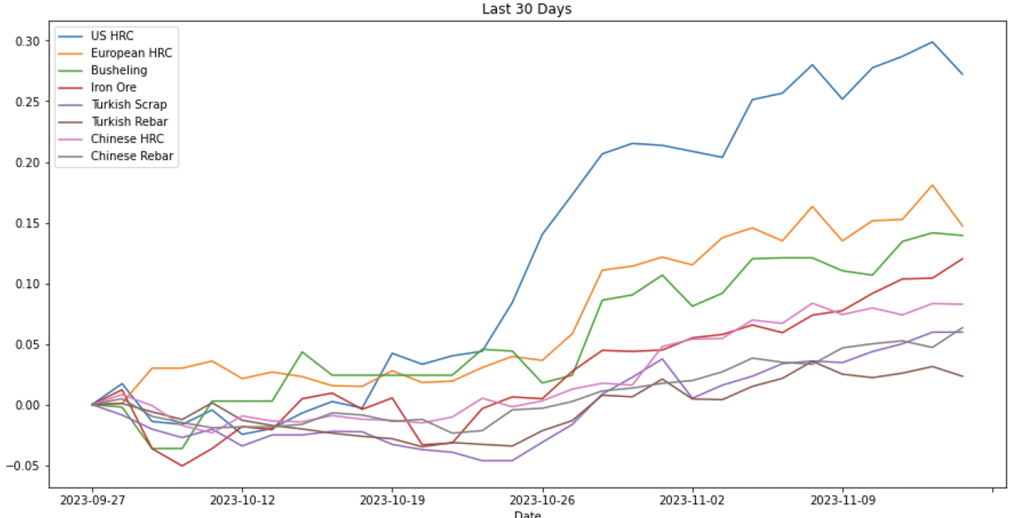

Zooming out to capture a broader perspective, the entire ferrous complex has unmistakably found substantial support and experienced notable upward movement in the past few weeks. Notably, the standout performer in this surge has been US HRC, surpassing all other ferrous products in our tracking portfolio by a significant margin. US HRC has exhibited exceptional strength, rallying by an impressive 27% over the last 30 trading days. In comparison, European HRC, the next closest contender, recorded a more modest increase of 15% over the same period.

But Global Prices, Particularly Out of China, Are Lagging

Conversely, some of the less robust performers within the ferrous complex include Chinese HRC and Chinese Rebar. The slowdown in Chinese total crude output by 6.8% in October is consistent with challenges faced by these products. Although recent stimulus efforts have bolstered optimism regarding China’s struggling property sector, the steel market has not witnessed a corresponding surge in demand. Instead, oversupply continues to exert downward pressure on prices.

Now, let’s look at past rallies; when steel prices increased in the US, we also saw significant increases in Europe and China. Although European prices are going up, they’re not rising as fast as they are in the US. In contrast, Chinese steel prices are not performing as well as those in other parts of the world.

Global Differentials (including Transport & Tariffs)

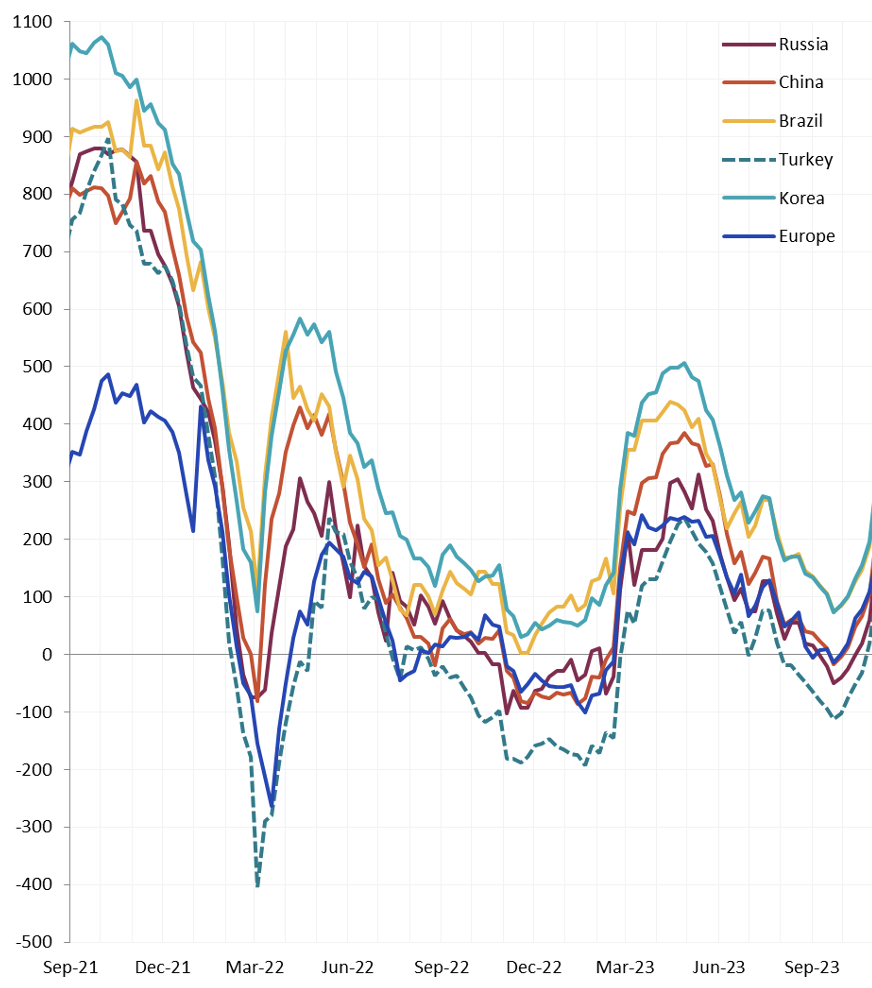

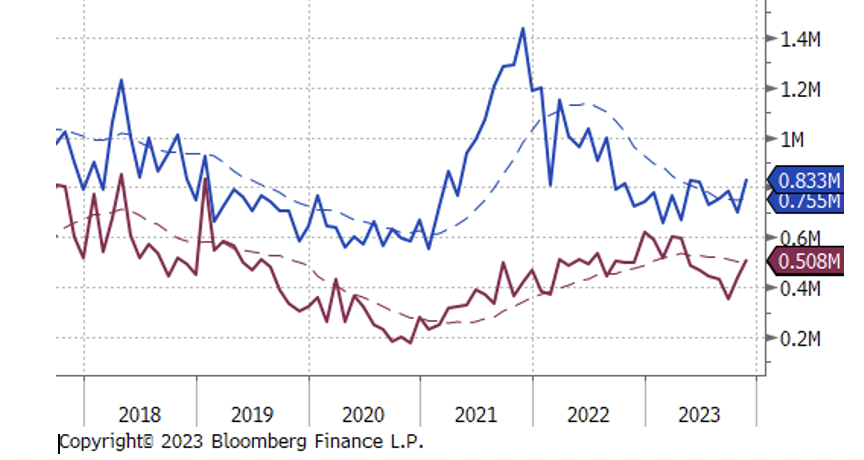

The Import Differential Has Opened, But Materials Have Not Yet Come In

To understand where steel prices might go next, it’s crucial to keep tabs on global prices and the amount of steel being brought in from other countries. Currently, global import differentials have widened significantly. We’re waiting to see if more steel from other countries enters the market, as this could impact the pricing power held by domestic mills.

Sheet Imports (blue) and Tube Imports (maroon)

Raw Material Costs Are Also Surging

There has been a significant uptick in scrap prices in recent weeks. Busheling futures have surged by over 16% since the beginning of October, providing some level of cost support to the ongoing rally. Concurrently, iron ore futures have mirrored this trend, with January futures experiencing an 18% increase since Oct. 10.

Currently, US HRC futures have shown stronger performance compared to these raw materials, although they haven’t reached unsustainable levels when compared to recent rallies. The current spread between 3rd-month HRC and BUS (Busheling) futures stands at $519, just below the three-year average of $579.

This suggests that while HRC futures are outperforming, the current levels are within a reasonable range.

Spread Between HRC and BUS 3rd-month Futures

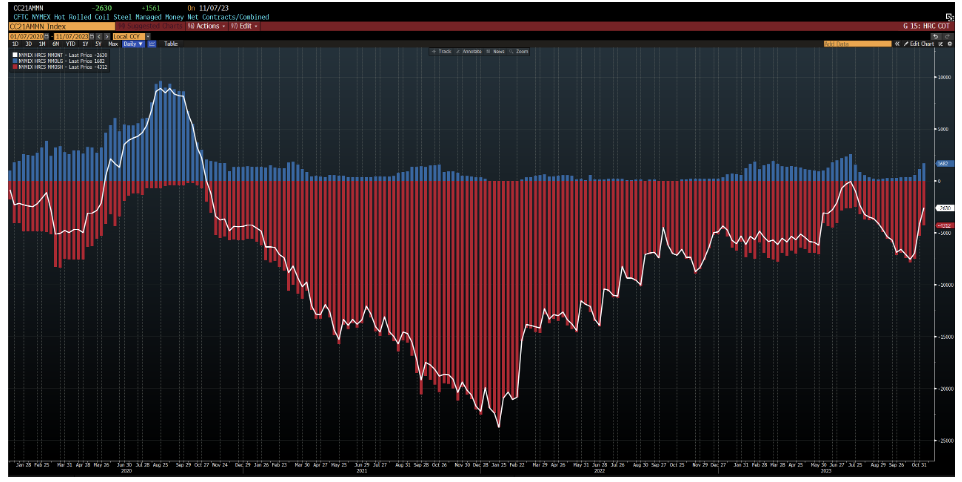

Short Positions Have Been Forced To Cover…

Now, let’s delve into the technical aspects of the futures market. As we’ve discussed, the trading volume for HRC futures has been exceptionally robust in recent weeks, coinciding with a sharp upward trajectory in futures prices. During this period, short positions were compelled to be closed out. Money managers have significantly reduced their short positions over the past few weeks, opting to add fresh length in each of the last three weeks. It’s worth mentioning that money managers have not held a net long position since November 2020.

Money Manager Net Long/Short Positions

Which Leaves Less Potential for a Short-Covering Rally.

Although money managers still maintain net short positions, the potential for further upside in a short-covering rally is somewhat limited, given that a considerable number of shorts have already closed out their positions. This dynamic suggests that the market may be approaching a point where the potential for additional short covering is diminishing.

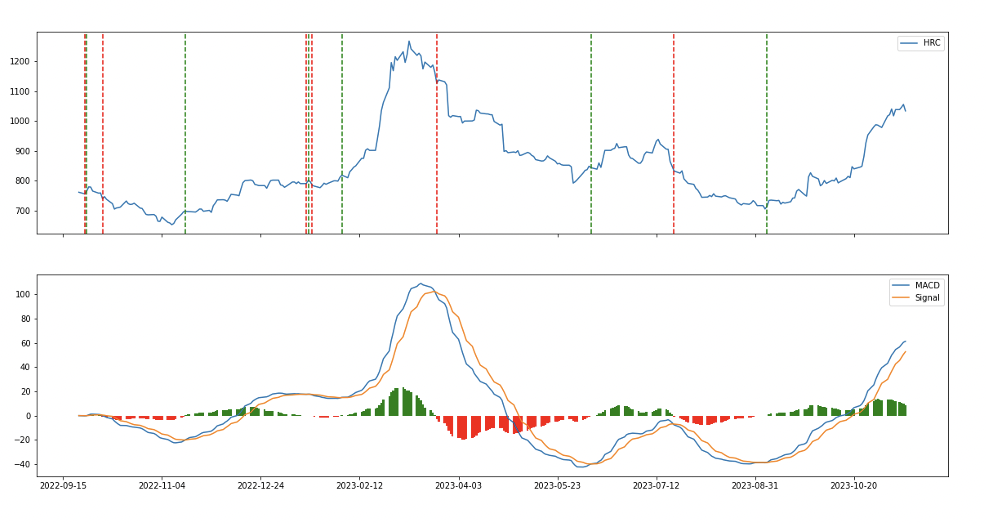

MACD Histogram for HRC Futures

Technical Momentum Indicators Have Softened Over The Past Two Weeks…

Another crucial aspect to consider in HRC futures is momentum. The momentum driving this rally has unquestionably waned in the past two weeks. Our rate of change measure has declined from 21.7 on November 1st to just 5.3 on Nov. 15. Additionally, our Moving Average Convergence Divergence (MACD) histogram measure, providing insights into the strength and direction of a trend, has dropped from 16.09 to 0.364.

Coinciding With Lower Volumes, and Adding Conviction to Softening Technical Factors

It’s important to note that both measures remain in positive territory but have significantly weakened over the past two weeks. Adding to this, futures volume has decreased in each of the past two weeks, aligning with the same period during which momentum indicators have softened. This consistency suggests an overall softening in the technical momentum supporting the ongoing rally.

As the steel futures market continues to navigate through supply constraints, global price dynamics, and shifting technical momentum, the industry stands at a critical juncture. Keeping a vigilant eye on these multifaceted factors will be imperative in gauging the trajectory of the market in the days to come.

About Flack Global Metals

In 2010, Flack Global Metals (FGM) was founded with the mission to reinvent how metal is bought and sold. Over 13 years later, the company has evolved into a hybrid organization combining an innovative domestic flat-rolled metals distributor and supply chain manager, a hedging and risk management group supported by the most sophisticated ferrous trading desk in the industry known as Flack Metal Bank (FMB), and an investment platform focused on steel-consuming OEMs called Flack Manufacturing Investments (FMI). Together, these entities deliver certainty and provide optionality to control commodity price risk in the volatile steel industry.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Flack Global Metals or Flack Metal Bank should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.