Analysis

January 2, 2024

Final thoughts

Written by Michael Cowden

SMU doesn’t do forecasts. We leave that to our colleagues at CRU. But we’re pretty good at surveys, and we’ve got a great group of readers.

That’s why we decided to ask you what’s in store for 2024. The results are below, along with some insightful comments in italics. (You can also find the results here.)

What’s in store for 2024

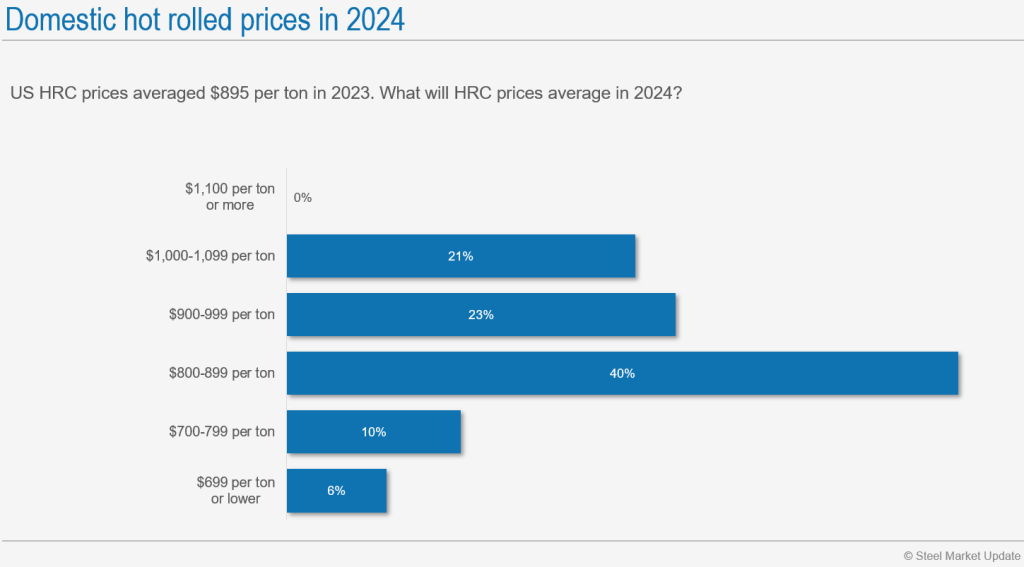

For starters, many of you think US HRC prices will be roughly the same as they were last year, or perhaps slightly higher. Only 16% predicted steep declines:

- “Global prices will migrate back to normal margins over raw materials with the US keeping its ‘traditional’ premium of $100 to $150.”

- “I do not think things are much different next year, outside more capacity coming on.”

- “I feel supply will outpace demand, and prices will be into the $600s by the third quarter – making the average in the $800s.”

- “We’re obviously going to start at about 2023 numbers, but I do see things drifting lower in the 1H.”

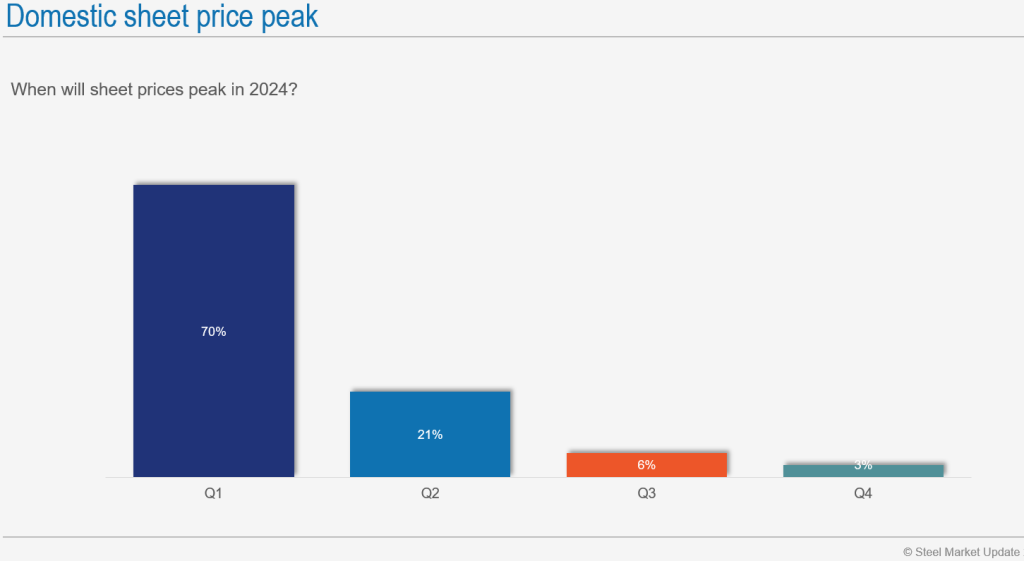

There was a broad consensus that prices would peak in the first quarter:

- “There are still some macro concerns looming, along with new capacity, returning capacity, and import. Q1 should be the top.”

- “Offshore supply will come and stocks will be high vs. demand.”

- “There is not enough demand, and mills are choosing to take down time.”

- “I think we will have a couple cycles this year: Q1 and late Q3.”

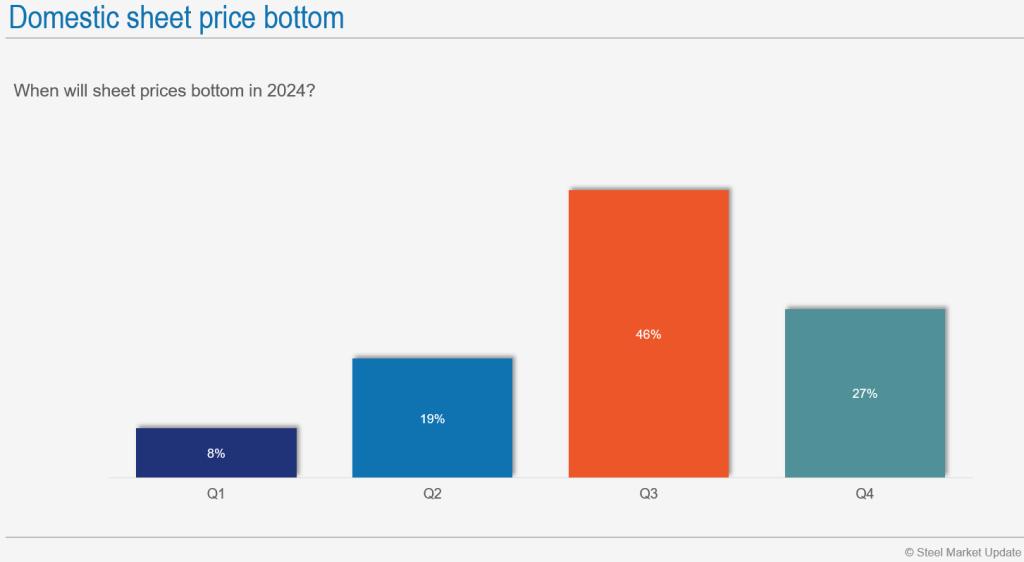

In fact, many of you think that prices, after peaking in Q1, won’t bottom until Q3 – which is what we saw in 2023:

- “Early Q1 price will be high (carry-over from 2023), but will then dip. Small rise in Q2, low through Q3, up again in Q4.”

- “We appear to be returning to more typical seasonal movements. Mills will want prices up by Q4 for contract talks.”

- “Mirror of last year.”

- “I feel that they (prices) will begin to rebound after the election.”

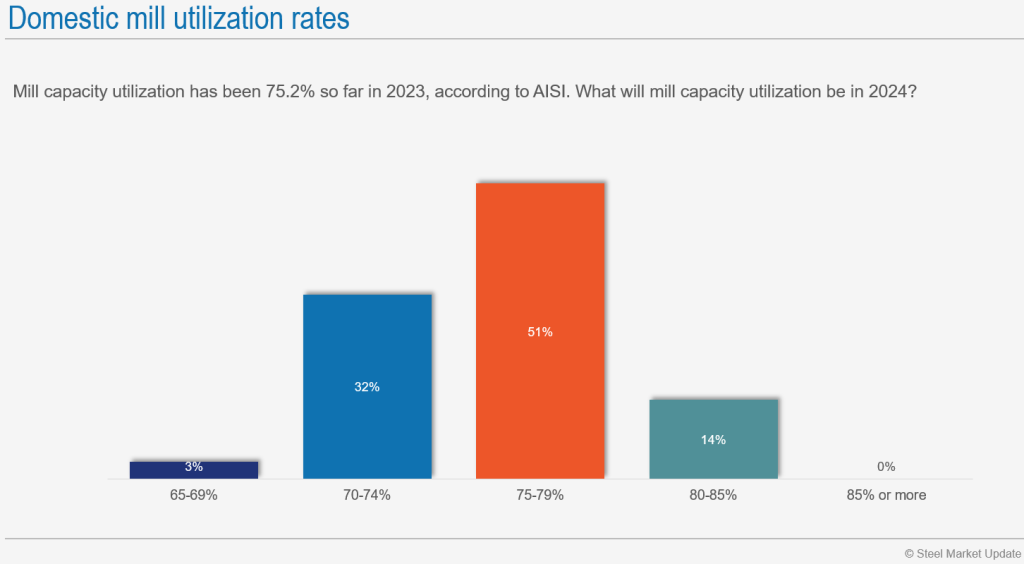

Similarly, many of you predict that mill capacity utilization will be 75-79%, at or slightly above 2023 levels.

- “Mills don’t want to over-supply the market.”

- “Looking like there may be weak demand for at least the start of 2024. Mills have already been under 75% for a number of months.”

- “With added supply and what I feel will be reduced demand, utilization will be lower.”

- “Mills are finding their ‘new normal’: Happy to make less steel and more money.”

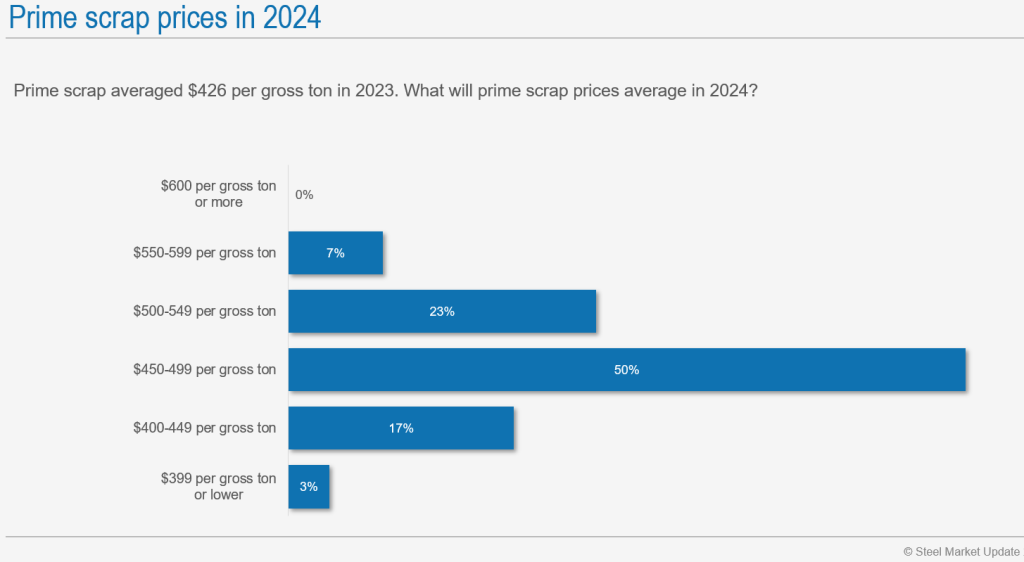

On the scrap side, consensus was that prime scrap prices might be marginally higher than they were last year. That could tighten profit margins at the margins. But it’s a far cry from prime becoming the next precious metal.

- “Green steel initiatives and mill steel expansions, along with reduced manufacturing scrap production, mean scrap markets will see the demand-vs-supply imbalance increasing pricing from historic norms.”

- “Potentially lower growth but increased market share of scrap vs. iron ore (because of more EAFs coming online).”

- “More mini-mill capacity should keep scrap prices up.”

- “This one is very hard to say, so I’ll chicken out and just say ‘overall, level.'”

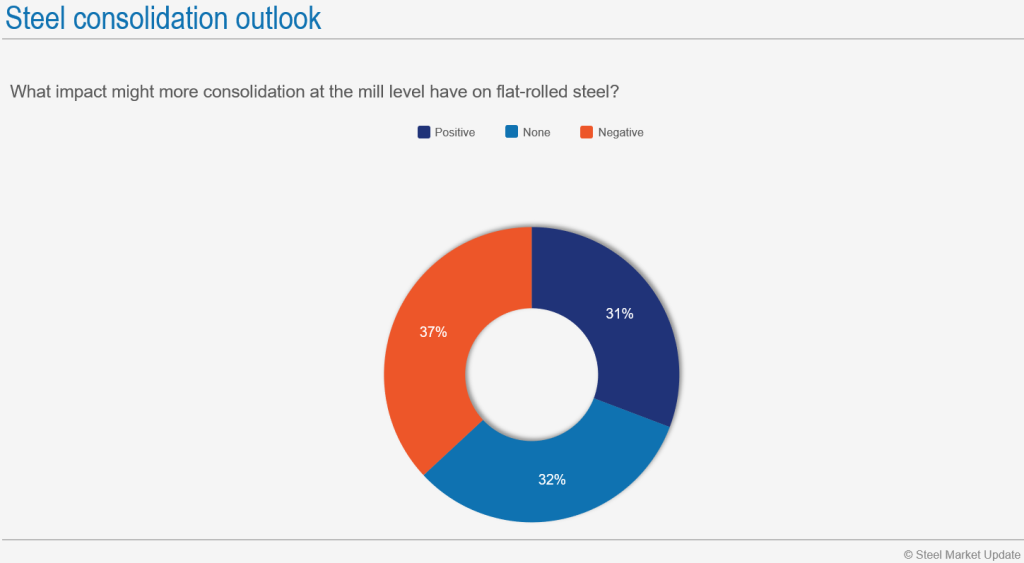

Opinion was evenly split on whether additional consolidation at the mill level would be good for the steel industry. But more saw such consolidation as negative rather than as positive.

Note, too, that additional consolidation is unlikely if Nippon Steel succeeds in buying U.S. Steel for more than $14 billion:

- “Consolidation would typically mean higher costs to customers.”

- “Consolidation in the integrated sector, one would think, would drive closure of excess capacity in order to pay for the acquisition.”

- “Positive for (domestic) prices but imports will become a bigger player.”

- “The question is what is necessary, what will make us as an industry better and enable us to control costs and be mutually beneficial and benefit everyone in the market place? … What is fair and what will enable the buyers to be able to continuously buy steel and perhaps make more products that people could utilize everyday out of steel?”

And, finally, my favorite question – one to which there are no corresponding charts: What is something that will impact the market in 2024 that nobody is talking about yet?

- “Consolidation, not just at the mill level, but at the service center level. Seems like many large service centers have cash to spend.”

- “China. Unless their economy surprises to the upside, they will be a drag on the global economy and suppress prices.”

- “Consumer debt levels may halt economic growth mid- to late 2024.”

- “The election cycle is going to be huge.”

- “The potential effects of the presidential election and any resulting governmental gridlock. It appears we are relying heavily on government-funded projects to support the steel economy for the next several years. What impact would a major change or delay to full funding have on steel?“

My thoughts

It surprised me that most people predicted that the new year would look roughly like 2023. But that’s not uncommon in our surveys. People often predict that the future will look like the past.

So why did it surprise me this time? Well, we could have a newsy year given tensions in the Middle East – ones already impacting shipping, an upcoming presidential election, and with the proposed sale of U.S. Steel to Nippon Steel becoming a political football.

Perhaps steel prices will be a bastion of stability in an otherwise volatile news year? That would be something different!

Tampa Steel Conference

I’m looking forward to getting the latest on these and other subjects at the Tampa Steel Conference. The event, a joint production between SMU and Port Tampa Bay, will run Jan. 28-30 at the JW Marriott Tampa Water Street. It’s not too late to register. You can do so here.