Prices

February 22, 2024

HRC futures: 'Normalcy' not seen on near-term horizon

Written by Daniel Doderer & Sean Kessler

Over my years of observing the steel market, there’s been a recurring belief that current market disruptions in either the physical spot market or steel futures are temporary anomalies, destined to fade, and that normalcy will soon return. However, the events of the first few weeks of 2024 served as a stark reminder that this expectation seldom materializes, and that the US steel market is still the most volatile steel market in the world.

In the beginning of the year, the spot physical market and futures market were firmly above $1,100 per short ton (st) for the second time in the previous 12 months. Steel mills were full of optimism and vigor, announcing successive hikes and pushing out lead times. However, enthusiasm was short lived as the futures market experienced a sharp and sudden decline, catching many participants and observers off guard. Futures prices plummeted through the psychologically significant threshold of $1,000/st and periodically found support at $900, giving the market a moment to digest what just happened.

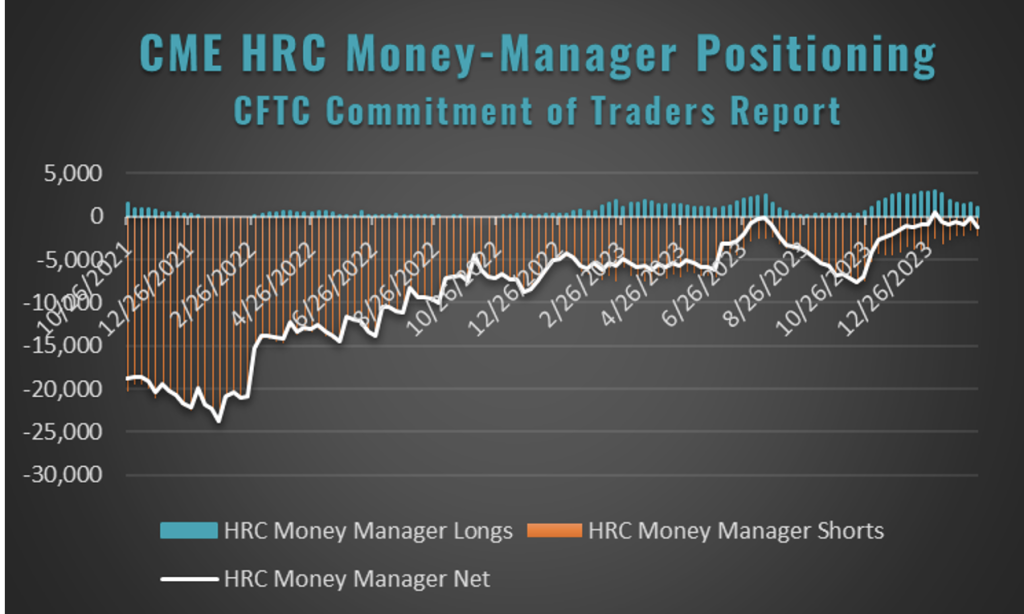

Initially, the blame for this sudden downturn was directed towards the financial players. However, data published by the Commodity Futures Trading Commission (CFTC) painted a different picture. Contrary to popular belief, financial players have been largely absent from the hot-rolled coil (HRC) steel market in recent times. Total open interest held by money managers as a percentage of the total market open interest has dwindled into the low single digits from over 30% in the fourth quarter of the previous year.

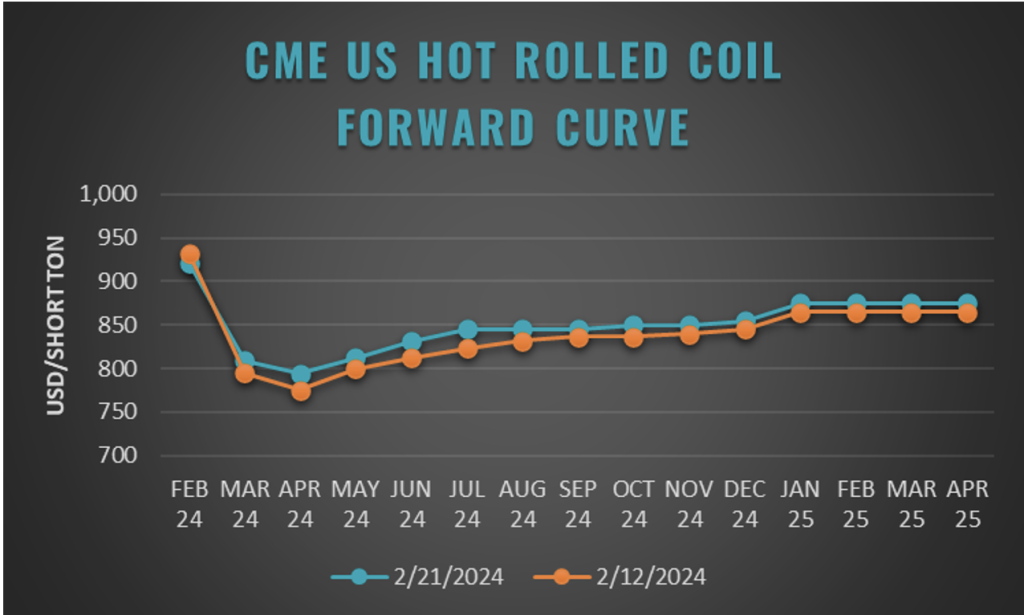

As market participants searched for clues, evidence of weakness in the physical market became more widely observed and the futures market took another sharp leg lower, now testing $800/st. Importantly, spot market indices followed suit, confirming the downtrend initially observed in the futures market.

While $800/st HRC steel seemed farfetched for many a month ago, it’s now looking like a realistic possibility. And for those who think this is the new floor, I’d like to remind readers that the nearby futures curve was trading below $700/st ~5 months ago, just before domestic mills began announcing price hikes.

The sharp drop in the nearby futures curve has shifted the forward curve into contango for the first time since the middle of October, implying a well-supplied physical market.

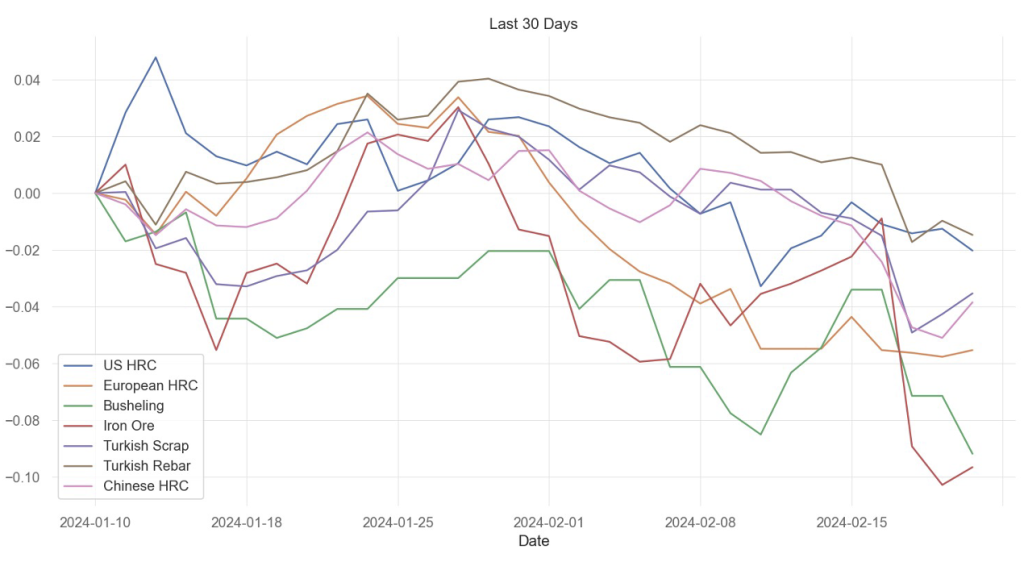

Fundamentally, several factors have contributed to the recent downtrend and the case for a rebound is looking increasingly difficult in the near term. In recent weeks, domestic production has increased, imports are arriving at an accelerating pace, domestic lead times have collapsed, and macro demand indicators continue to signal a sluggish first quarter. Furthermore, there have been notable declines in input costs and associated products, including iron ore, steel scrap, and European and Chinese HRC.

While the recent downturn can be discouraging to some, it also presents an opportunity for stakeholders to reassess their strategies and adapt to the evolving market dynamics. Navigating these uncertain times requires vigilance, adaptability, and a keen understanding of market trends.

Stay tuned.