Market Data

April 11, 2024

SMU survey: Sheet lead times contract, plate pushes out

Written by Laura Miller

The market appears to be taking a pause after the heavy buying that occurred in March.

Mill lead times for sheet contracted this week, with hot-rolled (HR) coil’s production time showing the smallest contraction from our last check of the market.

Meanwhile, lead times for plate continued to push out further, according to an analysis of SMU’s survey results this week.

Could contracting sheet lead times be an early indicator that demand is starting to slip? Steel buyers participating in SMU’s surveys continue to indicate solid demand, but what do you think?

We’d love to hear your thoughts, too. If you’re not already participating in our surveys, what are you waiting for? Shoot us an email at info@steelmarketupdate.com and let us know you want to take part in our surveys. And a big thank you goes out to the buyers who continue to participate.

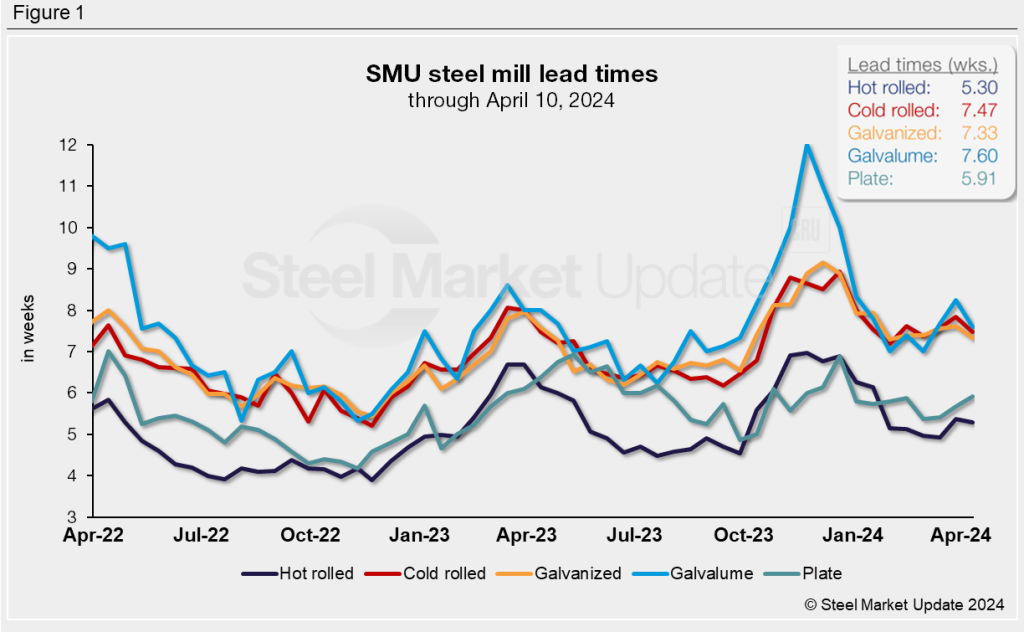

Lead times by product

Hot-rolled coil: 5.30 weeks

In this week’s check of the market, steel buyers reported HR lead times between four and seven weeks. This week’s average of 5.30 weeks is just slightly shorter than the 5.36-week lead time reported two weeks prior. HR lead times began the year at 6.26 weeks and have been hovering around five weeks since the start of February.

HR price: $810-860/short ton

Cold-rolled coil: 7.47 weeks

The range of lead times reported for CR sheet was five to 10 weeks. The average of 7.47 weeks pulled back by 0.37 weeks, or by 5%, from our March 26 market check. CR lead times started the year off at eight weeks and have remained below that threshold since.

CR price: $1,100-1,200/st

Galvanized coil: 7.33 weeks

Steel buyers said lead times for galvanized sheet are between five and 10 weeks, with an average of 7.33 weeks. Compared to two weeks ago, that average contracted by 0.29 weeks, or by 4%. Galvanized lead times have also been below eight weeks since the start of the year.

Galvanized price:$1,100-1,170/st

Galvalume coil: 7.60 weeks

Steel buyers reported lead times for Galvalume from seven to nine weeks. The average of 7.60 weeks contracted by 0.65 weeks, or by 8%, from the last market check. Galvalume lead times were highly extended for most of the fourth quarter, but started 2024 at an average of 8.33 weeks and have since remained between that point and seven weeks.

Galvalume price: $1,090-1,180/st

Plate: 5.91 weeks

Plate was the one product we track to see an uptick in lead times this week. Buyers said production times for plate are between four and eight weeks. Plate lead times pushed out by 0.25 weeks from our last market check to an average of 5.91 weeks. That’s the longest the average has been since the week of Dec. 20, 2023. Lead times for plate have been slowly pushing out since hitting a recent bottom of 5.38 weeks at the end of February.

Plate price: $1,160-1,290/st

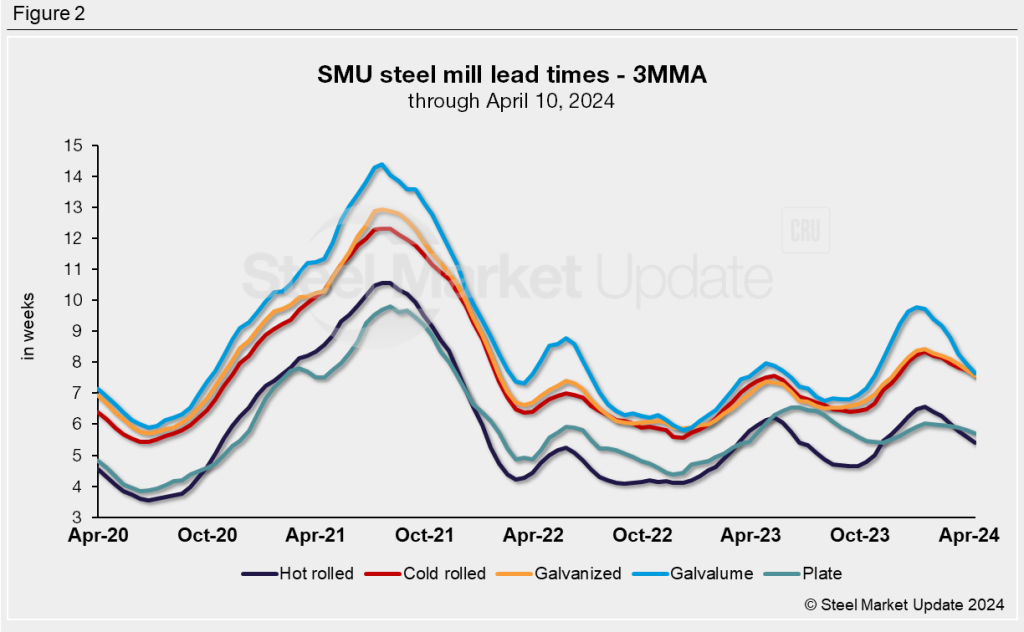

3MMA lead times

Looking at the three-month moving averages (3MMA) of lead times can smooth out the variability seen in our biweekly readings.

On a 3MMA basis, lead times for all products fell back once again, a trend HRC, CRC, galv, and plate have been following since mid-January. Galvalume’s 3MMA has been falling back since starting the year at 9.79 weeks.

From the March 27 market check, the 3MMAs fell back slightly, to 5.40 weeks for hot rolled, 7.58 weeks for cold rolled, 7.56 weeks for galvanized, 7.63 weeks for Galvalume, and 5.70 weeks for plate.

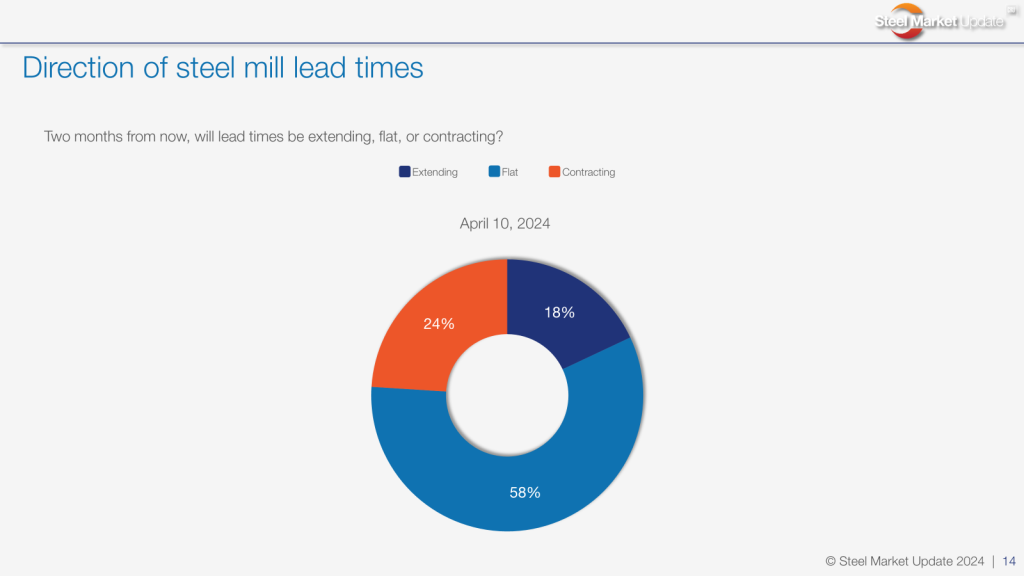

SMU’s survey says…

In this week’s survey, SMU again asked steel buyers if they think lead times will be extending, flat, or contracting two months from now. Here are the results and responses to that question:

Flat – 58% (down from 65% two weeks ago)

“New normal.”

“Hot roll lead times [are] already fairly short.”

“There will not be big movements in next two months.”

“After extending, they will flatten out.”

“Flat to contracting.”

Contracting – 24% (vs. 26%)

“Mills will keep supply short, but I think they won’t be able to run on such reduced capacity for long.”

“Summer doldrums, imports, new capacity … all the buzzwords are pointing towards contracting domestic lead times in a few months.”

Extending – 18% (up from 9%)

“Pricing increase with extended lead times.”

Look for SMU’s next lead time update on Thursday, April 25.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.