Analysis

April 18, 2024

Final thoughts

Written by David Schollaert

To the surprise of many — myself included — flat-rolled steel prices appear to be in a holding pattern… again. This is not familiar territory for hot-rolled (HR) coil, at least not over the past few years.

Its pricing volatility (as my colleague Michael Cowden has noted in past columns) may rival the elastic moves seen in crypto more than we’d like to believe. Flat-rolled steel pricing hasn’t been for the faint of heart lately – and the Surgeon General may add HR coil pricing to its list of warnings.

“SURGEON GENERAL’S WARNING:

Quitting the HR coil market now

greatly reduces serious risks to your health.”

But all kidding aside, the only times we’ve seen apparent pricing stability over the past few years – and I mean just two to four weeks of somewhat stable pricing – has been when tags have either reached their peak or valley and are at an inflection point.

In fact, we just saw this in March when the pause came largely in response to a pricing notice blitz from mills. Tags almost immediately began inflecting up after declining for roughly eight straight weeks.

Nucor’s new pricing

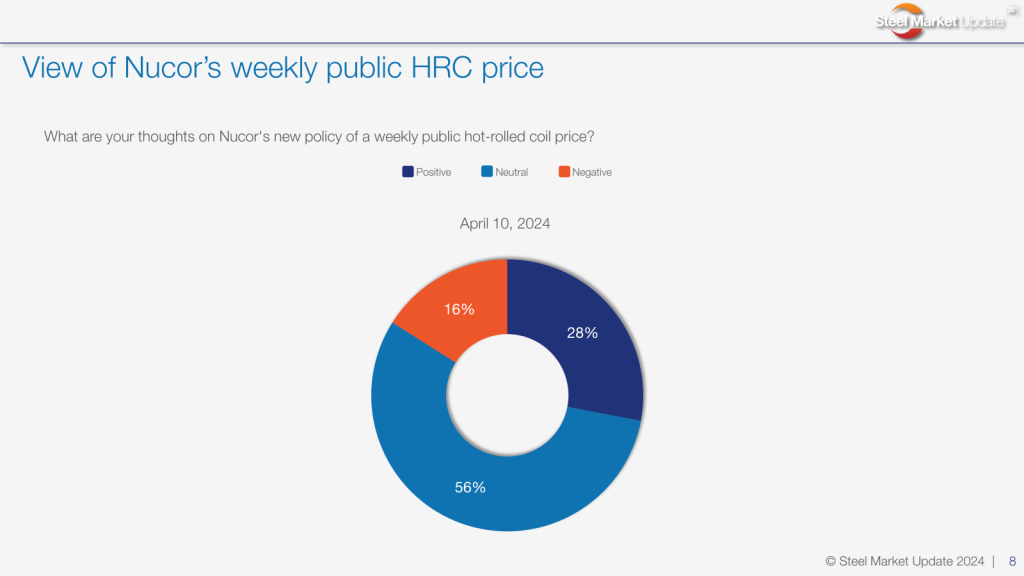

Nucor appears to be trying to ease some of the recent pricing volatility by publishing a weekly spot price. And it may succeed, but the verdict is still out and only time will tell.

But for now, it has not only been the major talking point across the industry, but it also appears to have halted the upward pricing momentum recently ignited by repeated mill hikes in March – it poured cold water on $900 per short ton (st).

And if you take a closer look at what Nucor has sent out to customers lately, the Charlotte, N.C.-based steelmaker’s HR coil price has fluctuated by just $10/st since its pricing notice on March 7 (you can track mill pricing notices here).

Just a glance at the review mirror

But potentially, the real question might be whether or not the recent – and maybe short-lived – upward momentum was indeed warranted.

The timing worked and we’ve seen this trend a good bit. Prices are moving down and at a given point mills announce a price floor and plan for a rebound. The move hasn’t always been successful, but it’s often been helped when big volumes at discounted levels are moved just before a price notice.

And it was working. We saw service center inventories inflate a bit in March, according to SMU’s most recent report. The amount of flat-rolled steel on order rose with opportunistic, large-volume deals at the bottom of the market. Prices had moved from a recent low of $795/st, on average, in mid-March to $845/st by April 2. Several sources were reporting transactions nearing $900/st that week.

There was even talk of whether another round of increases would come.

But now we’re looking at prices holding for a second week and some sources suggest we’ll see prices ease before we see them move up again.

Indicators say what?!?

Demand fundamentals don’t appear to have shifted significantly, though unfortunately, we can’t always say the same for sentiment.

At SMU we don’t forecast, but we do watch a few other indicators to help us navigate some of these dynamics.

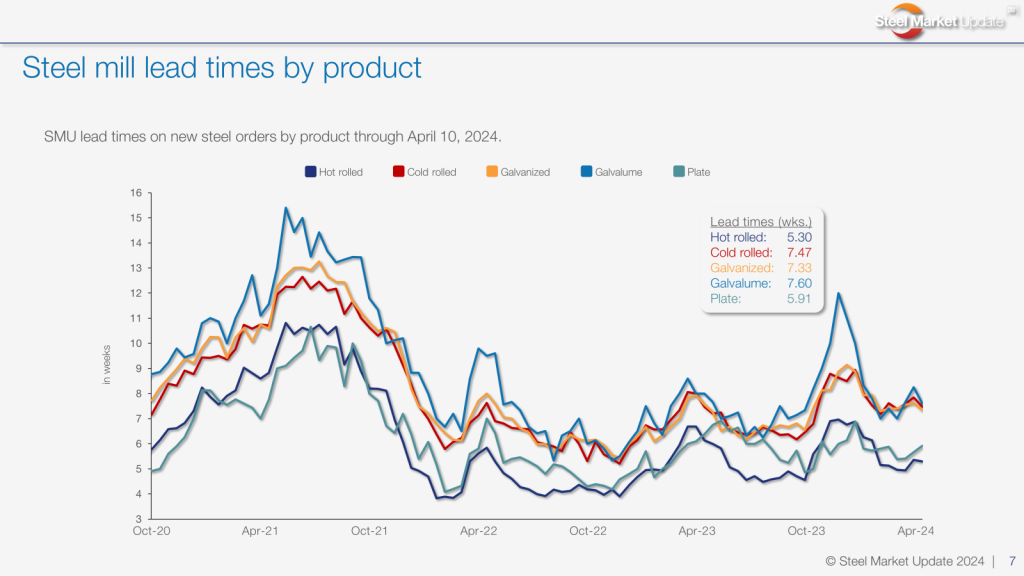

Lead times appear to be stable. They have been roughly around five weeks on average since the first week of February:

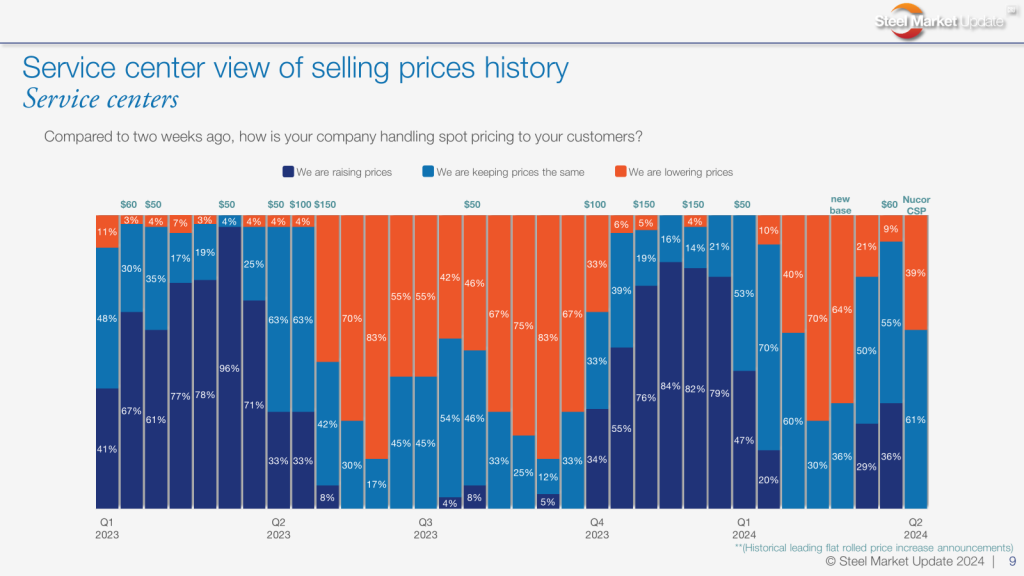

Service centers shifted their pricing approach after Nucor’s initial spot pricing on April 8, according to SMU survey respondents. Where once 30% or more were raising their prices after repeated mill notices in March, they are no longer doing so. But rather now 39% were lowering prices.

While reaction to Nucor’s new HR coil pricing practice is still very much mixed and most surveyed by SMU were neutral on its impact on the HR market (don’t worry, we will be asking that question again next week to see if the appetite has changed three weeks in – so be on the look out for it next week), it’s seems pretty clear that not only are buyers watching and reacting to these announcements, some have been using its published spot price for lower tags themselves.

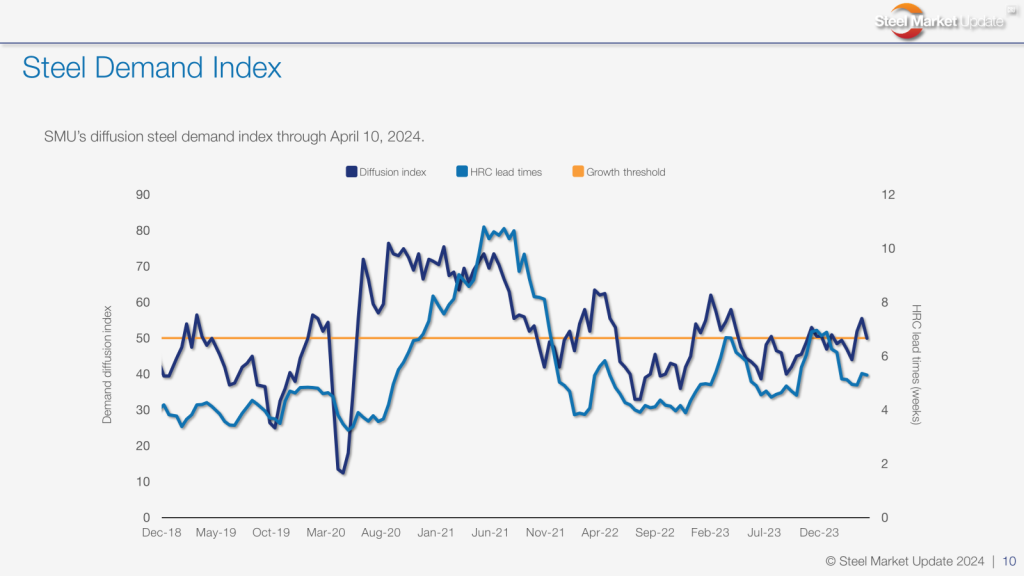

Lastly, SMU’s steel demand Index slipped some in our latest analysis. While it remains in growth territory with a reading of 50, it fell six points from the prior reading at the end of March.

And there is a bit of a cautionary tale with the past couple of readings. Since late-April 2023, the only times the index moved into growth territory was for short-lived bumps when the market responded to mill price hikes in mid-June, late September, and November. Could history be repeating itself?

Where things go from here is anyone’s guess, but at SMU we’ll be closely monitoring how it all plays out. Soon enough we’ll find out if prices are indeed holding, will resume their upward more, or if they edge lower.

Let me know what you think! Will prices hold or resume the upward move and continue inching up? Or will prices start slipping again, waiting for more robust demand, especially as we move through spring and summer?

And, as always, thanks to all of you for your continued support of SMU!

Note: The SMU Steel Demand Index, which compares lead times and demand, is a diffusion index derived from the market surveys we conduct every two weeks. This index has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves. An index score above 50 indicates rising demand, and a score below 50 suggests declining demand.