SMU's February at a glance

Steel prices continued to ease lower throughout February, following a loss of upwards momentum in the middle of January.

Steel prices continued to ease lower throughout February, following a loss of upwards momentum in the middle of January.

The news in the West was that a mill in the Rocky Mountain region made a significant reduction in their usual purchase program, while still another small mill in the region also apparently reduced their buying program for February.

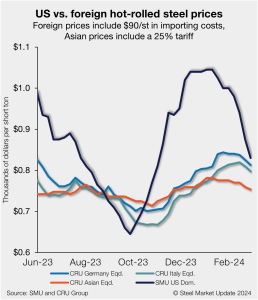

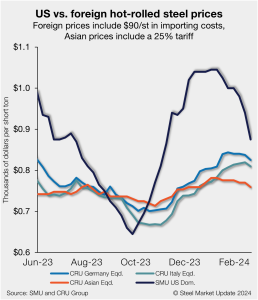

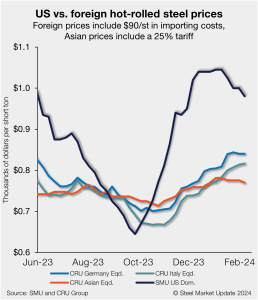

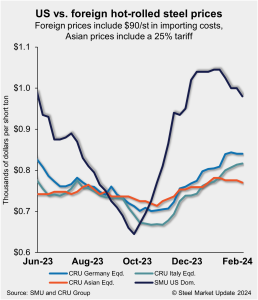

The premium US hot-rolled coil (HRC) held over offshore product for roughly five months has nearly vanished. Domestic hot band prices continue to run downhill at a high rate, erasing a $300/st gap they had over imported HRC just two months ago.

Steel mill lead times shrunk by an average of 0.3 weeks, according to our latest market survey, now nearing levels last seen in September of last year.

Steel buyers generally found mills more willing to negotiate spot pricing on the products SMU surveys this week, according to our most recent survey data.

US hot-rolled (HR) coil prices have fallen further this week, working their way to $800 per short ton (st) on average – a mark not seen since late October.

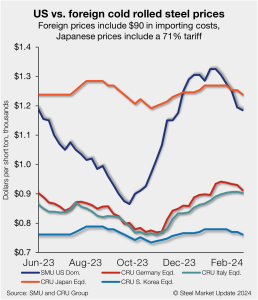

Foreign cold-rolled coil (CR) remains much less expensive than domestic product even as prices in the US have declined at a rapid pace over the past month, according to SMU’s latest check of the market.

Olympic Steel’s earnings jumped in the fourth quarter, even as the company dealt with "significant" price volatility in hot rolled for full-year 2023.

Over my years of observing the steel market, there's been a recurring belief that current market disruptions in either the physical spot market or steel futures are temporary anomalies, destined to fade, and that normalcy will soon return. However, the events of the first few weeks of 2024 served as a stark reminder that this expectation seldom materializes, and that the US steel market is still the most volatile steel market in the world.

The premium US hot-rolled coil (HRC) held over offshore product is disappearing in a hurry. Domestic hot band prices continue to fall at a fast clip, erasing a nearly $300/st gap they had over imported HRC just two months ago. All told, US HRC prices are now 8.8% more expensive than imports. The premium is […]

Steel Market Update’s Steel Demand Index has moved lower, having remained in contraction territory for the better part of the past two months, according to our latest survey data.

Falling steel prices at present are not a symptom of demand but of imports arriving into the US and to some parts of Mexico, Ternium’s CEO Maximo Vedoya said this week.

US hot-rolled (HR) coil prices have fallen below $900 per short ton (st) on average for the first time since early November. SMU’s HR price stands at $875/st on average, down $65/st from a week ago and down $170/st from the beginning of the year.

Everyone knows the old saying that “a picture is worth a thousand words.” Just because it’s a cliché doesn’t mean that it’s wrong. A lot of inked has been spilled trying to figure out why prices are falling now. I thought it might be as simple as this: Market dynamics in the fourth quarter (UAW strike, companies buying ahead of an anticipated post-strike price spike, etc.) pulled forward restocking activity that typically happens in the first quarter.

What's the steel market talking about at present?

It’s no secret that HRC futures have been particularly volatile over the past several years. The most recent instance was the outsized break in the March futures contract early this week. For companies procuring raw material in anticipation of higher prices or even to get ahead on future purchase orders from customers, understanding the relative price of that raw material versus the hot-rolled coil futures curve is important.

US hot-rolled coil (HRC) prices moved lower again this week, remaining largely on a downtrend since mid-January. The result has caused domestic tags to lessen their price premium over imported products week on week (w/w).

The spread between hot-rolled coil (HRC) and prime scrap prices narrowed further this month, according to SMU’s most recent pricing data.

Mill lead times for flat-rolled steel were mostly stable over the past two weeks. With several mills slow to come out of outages and upgrades, cold rolled and coated lead times have been holding up better than hot rolled.

Friedman Industries posted lower earnings in its fiscal third quarter but was upbeat on the next quarter due to the effect of increased hot-rolled coil prices.

The percentage of sheet buyers finding mills willing to negotiate spot pricing rose or remained relatively flat on the products SMU surveys, while plate slumped, according to our most recent survey data.

Algoma Steel has restarted its blast furnace and resumed steelmaking at its mill in Sault Ste. Marie, Ontario.

Flat Rolled = 60.3 Shipping Days of Supply Plate = 63.4 Shipping Days of Supply Flat Rolled US service center flat-rolled steel supply declined in January, though less than expected because of a weaker-than-normal seasonal increase in shipments to start the year. At the end of January, service centers carried 60.3 shipping days of supply […]

The pace of sheet price declines accelerated this week as steel buyers said that domestic mills were competing against each other while also coping with higher-than-expected import volumes. “They are getting rid of the fluff. When you can pit 2-3 mills against each other, the fat margins get cut,” one industry source said.

Steel prices stabilized in early January before they began to inflect lower midway through last month. Tags peaked at $1,045 per short ton (st) during the first week of January, even as some mills tried to push prices higher, to no avail. Hot-rolled coil (HRC) prices ended January at an average of $1,000/st, declining by $45/st during the month.

US hot-rolled coil (HRC) prices were again lower this week, pushing the price premium domestic hot band carries over imported products lower vs. the prior week.

What are folks in the steel industry talking about? SMU polled steel buyers on a variety of subjects this past week, including domestic steel prices, import offers, buying activity, and more. Rather than summarizing the comments we received, we are sharing some of them in each buyer’s own words.

Domestic steel shipments increased in December on-year but were down from the previous month, according to the latest data released by the American Iron and Steel Institute (AISI).

Algoma Steel reported a wider loss in its fiscal third quarter amid lingering impact from the United Auto Workers (UAW) strike and “heavy seasonal maintenance.” Additionally, the Canadian steelmaker said it has completed repairs at it blast furnace and “restored partial coke-making capabilities” after a previously reported incident on Jan. 20.

Sheet prices fell across the board this week as SMU’s hot-rolled (HR) coil price slipped below $1,000 per short ton (st) on average for the first time since November.