CRU: Sheet prices stable w/w in most areas of the world

Steel sheet prices in many regions of the world were steady week over week in the week ended April 17.

Steel sheet prices in many regions of the world were steady week over week in the week ended April 17.

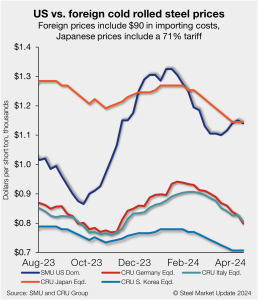

Foreign cold-rolled (CR) coil remains less expensive than domestic product, according to SMU’s latest check of the market.

Here’s a roundup of the latest news in the global aluminum market from our colleagues at CRU. Biden calls for tripling of Chinese steel and aluminum tariffs President Joe Biden is calling on the US Trade Representative (USTR) to consider increasing the existing section 301 import duty on Chinese steel and aluminum three-fold. The current […]

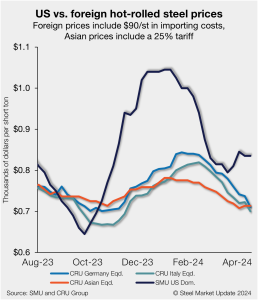

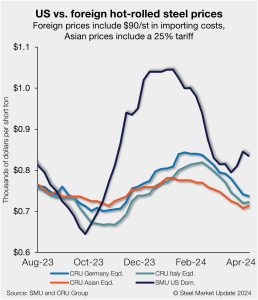

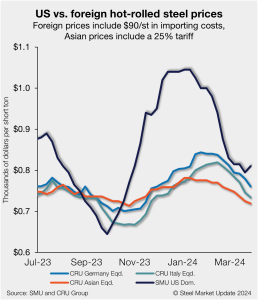

US hot-rolled (HR) coil has become gradually more expensive than offshore hot band in recent weeks, as stateside prices have stabilized while imports moved lower.

The Biden administration on Wednesday announced measures to support the domestic steel industry.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

The steel market appears to be finding a new, higher normal with the shocks of the pandemic and the Ukraine in the rearview mirror. The good news: a more profitable and consolidated post-Covid US steel industry has been able to invest in operations. That includes efforts to decarbonize. The bad news: That “new normal” could be tested. Because it’s not just domestic sheet prices that have been volatile. Geopolitics are too.

Last week was a newsy one for the US sheet market. Nucor’s announcement that it would publish a weekly HR spot price was the talk of the town – whether that was in chatter among colleagues, at the Boy Scouts of America Metals Industry dinner, or in SMU’s latest market survey. Some think that it could Nucor's spot HR price could bring stability to notoriously volatile US sheet prices, according to SMU's latest steel market survey. Others think it’s too early to gauge its impact. And still others said they were leery of any attempt by producers to control prices.

Total domestic aluminum mill products orders in March were up 0.2% compared to March 2023, according to the latest “Index of Net New Orders of Aluminum Mill Products” released by the US Aluminum Association (AA). This is much lower than the growth of 9.3% year over year (y/y) reported in February.

The Department of Commerce (DOC) has issued new rules to combat evolving "unfair" trade practice — including the unfair trade of steel products. They go into effect on Wednesday, April 24.

To ease trade tensions with the United States, the economy ministry in Mexico is preparing measures to strengthen definitions on steel being shipped into the country. Mexico has faced accusations it is being used as a route for steel and aluminum produced in Asia to be sent on to the US, so-called triangulation.

The market appears to be taking a pause after the heavy buying that occurred in March.

For those of you old enough to remember The King and I, the April scrap market seems to be a puzzlement. While it is now clear that everything went sideways, one could clearly make an argument for prices to have been down.

The United Steelworkers (USW) union is calling out Nippon Steel for already prioritizing its Japanese operations at the expense of American workers despite forging ahead with its proposed plan to purchase U.S. Steel.

US hot-rolled (HR) coil has become increasingly more expensive than offshore hot band as stateside prices have moved higher at a sharper pace vs. imports.

The latest SMU Community Chat webinar reply is now available on our website to all members. After logging in at steelmarketupdate.com, visit the community tab and look under the “previous webinars” section of the dropdown menu. All past Community Chat webinars are also available under that selection. If you need help accessing the webinar replay, or if your company […]

The apparent supply of steel in the US fell 6% from January to February, according to data compiled from the Department of Commerce and the American Iron and Steel Institute (AISI).

They say all’s fair in love and war. But that doesn’t seem to be the case in steel. Being deemed “unfair” could get you slapped with shiny new Section 232 tariffs these days. Then again, “unfair” implies a judge. And people on opposing sides seldom agree with the judgment. Such seems to be the current case between the US and Mexico.

Steel import licenses through March have now reached a nine-month high according to the latest data from the US Commerce Department.

Mercury Resources CEO Anton Posner will be the featured speaker on SMU’s next Community Chat webinar on Wednesday, April 10, at 11 a.m. ET. The live webinar is free. You can register here. A recording of the webinar and the slide deck will be available only for SMU members.

Sheet prices continue to inch higher. That’s a welcome development for many. But it’s also a far cry from the price surge many predicted about a month ago. Remember the theory that supported a spring surge: Sheet prices would soar on a combination of mill outages, stable-to-strong demand, restocking, mill price increases, and (potentially) trade action against Mexico as well.

The US Department of Commerce’s International Trade Administration (ITA) has revised upwards the antidumping duty (AD) rates on imports of cold-rolled steel flat products from two South Korean producers.

On Monday and Tuesday of this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

After stabilizing in our last check of the market, production times for flat-rolled steel have begun to push out further, according to steel buyers responding to SMU's market survey this week.

Steel companies in Mexico have lined up capex plans totaling $5.7 billion in the next three years. The focus is on replacing imports with domestic production, said David Gutierrez, outgoing president of sector association Canacero. “The investments are aimed at reducing imports, strengthening national production, and ensuring that the benefits stay in the country,” he was quoted as saying at Canacero’s annual congress by regional news service Business News Americas.

The Biden administration this week announced landmark industrial funding to support potentially transformational industrial decarbonization projects. In total, thirty-three projects across eight industrial sectors will receive up to $6 billion in federal funds from the US Department of Energy’s (DOE) Office of Clean Energy Demonstrations (OCED).

After reaching a seven-month high in January, steel imports fell back 3% in February, according to preliminary Census data released earlier this week.

US hot-rolled coil and offshore hot band moved further away from parity this week as stateside prices have begun to move higher in response to mill increases.

A container ship collided with the Francis Scott Key Bridge in Baltimore on March 26, causing it to collapse. This has blocked sea lanes into and out of Baltimore port, which is the largest source of US seaborne thermal coal exports. The port usually exports 1–1.5 million metric tons (mt) of thermal coal per month. It is uncertain when sea shipping will be restored. But it could be several weeks or more. There are coal export terminals in Virginia, though diversion to these ports would raise costs.

SMU’s sheet prices firmed up modestly this week, even as CME hot rolled futures declined. What gives? My channel checks suggest that demand remains stable and that buyers have returned to the market following new HR base prices announced by mills earlier this month. I’m looking forward to seeing whether lead times, which have stabilized, will start extending. SMU will have more to share on that front when we release updated lead time figures on Thursday. As for HR futures, what a reversal! As David Feldstein wrote last Thursday, bulls expected mill price increase announcements. And we briefly saw the May contract climb as high as ~$1,000 per short ton (st).