Nucor surprises with $65/ton price drop for HRC

Nucor started off May with a bang, dropping its weekly base spot price for hot-rolled (HR) coil by $65 per short ton (st) this week.

Nucor started off May with a bang, dropping its weekly base spot price for hot-rolled (HR) coil by $65 per short ton (st) this week.

Is it just me, or does it seem like the summer doldrums might have arrived a little early? I could be wrong there. It’s possible we could see a jump in prices should buyers need to step back into the market to restock. I’ll be curious to see what service center inventories are when we update those figures on May 15. In the meantime, just about everyone we survey thinks HR prices have peaked or soon will. (See slide 17 in the April 26 survey.) Lead times have flattened out. And some of you tell me that you’re starting to see signs of them pulling back. (We’ll know more when we update our lead time data on Thursday.)

The election campaign is white-hot right now, and the Biden administration is touting its protectionist message. Just this past week, the Office of the US Trade Representative (USTR) touted this message. In a release entitled “What They are Saying,” USTR quoted many of the usual protectionist groups praising government action against Chinese steel exports and shipbuilding. Consuming industries in the United States, which employ many times the American workers as the industries seeking trade protection, were not mentioned.

US announces new import duties on aluminum extrusions The US Department of Commerce has placed preliminary antidumping (AD) duties of 2-600% on imports of aluminum extrusions from 14 countries. The rates are: “[The findings] show just how widespread dumping practices are globally and highlight the importance of strongly enforcing the antidumping laws to shield US […]

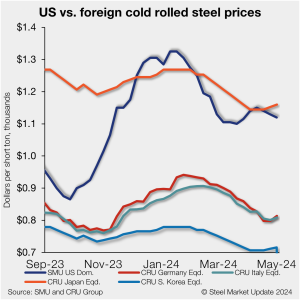

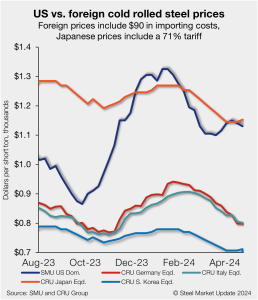

Foreign cold-rolled (CR) coil remains much less expensive than domestic product even as domestic prices continue to decline, according to SMU’s latest check of the market.

Olympic Steel logged lower earnings in the first quarter of 2024, but the company said all three of its segments contributed to profitability.

Brazil’s chamber of foreign trade, Camex, has approved quotas on imports of 11 steel products and a 25% levy on shipments 30% above a product’s average import volume between 2020 and 2022.

As we approach “buy week,” a term industry veterans use to refer to steel mill scrap buying time and an excuse to remain in the office, we have seen a variety of slants on the May market.

Everybody has a plan… until they’ve dealt with volatility in the HRC market. While Mike Tyson’s original quote was about getting punched in the mouth, it’s unlikely the ex-champ has gone many pricing rounds with hot-rolled coil.

U.S. Steel posted slightly lower Q1’24 earnings as stronger earnings from its sheet mills were partially offset by a weaker performance from it tubular division. All told, the Pittsburgh-based steelmaker reported Q1’24 earnings of $171 million. That's down 14.1% from $199 million in Q1’23 on sales that fell 6.9% to $4.16 billion in the same comparison.

“One thing we know for certain, however, is that when we write our next column, things will have certainly shaken loose.” – Daniel Doderer, April 4, 2024. Above is a good reminder that whenever someone is “certain” of anything, you should probably look at that line of thinking with a healthy dose of skepticism.

Northwest Pipe’s profits more than doubled in the first quarter on-year, as the company expects a strong remainder of the year in both its steel pressure pipe and precast segments.

ArcelorMittal posted a narrower Q1’24 profit compared to Q1’23 but remained optimistic about steel's long-term demand prospects.

Russel Metals’ earnings fell in the first quarter, but the Toronto-based metals distributor sees steel prices stabilizing in the near term and staying above historical averages.

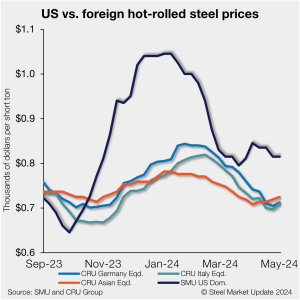

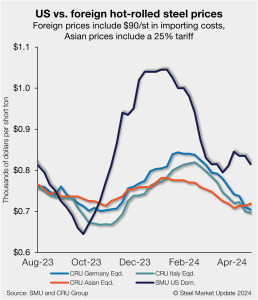

US hot-rolled (HR) coil price premium over offshore hot band has tightened on the back of lower domestic tags, though stateside HR coil remains markedly more expensive than imports.

On Monday and Tuesday of this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

Hold-rolled (HR) prices held roughly steady this week after slipping for much of April. I don’t have any spicy quotes to offer about mostly flat prices. Besides, a lot of the questions I’ve gotten recently have been about demand. Some of you tell me that it’s still stable or improving. Others tell me that it’s suddenly dried up.

Sheet prices were flat or moderately down again this week – underscoring the shift in momentum we’ve seen over the last month. The exception was hot-rolled (HR) coil, which was largely unchanged from last week.

Ryerson swung to a loss in the first quarter of 2024, but the company’s chief executive sees less volatility in the sheet steel market.

The Chicago Business Barometer slipped further in April, now at the lowest measure recorded since November 2022.

Nucor Corp. announced that its plate mill group would cut prices for as-rolled, discrete, and normalized plate with the opening of its June order book. The Charlotte, N.C.-based steelmaker said in a letter to customers on Monday, April 29, that tags would be lowered by $90 per short ton (st). That would bring its base price to roughly $1,200/st.

Nucor lowered its weekly base spot price for hot-rolled (HR) coil by $10 per short ton (st) this week.

What a difference a month makes. In late March, it seemed like the US hot-rolled (HR) coil market was poised to cycle upward. Large buyers had re-entered the market and placed big orders earlier in the month. Several outages were underway or upcoming. And expectations were that lead times would continue to extend. Cliffs said […]

Constellium reported its latest quarterly results for Q1'24. Adjusted Ebitda came in at €137 million (USD$147 million), down 8.6% year over year (y/y) amid revenue of €1.7 billion (USD$1.8 billion), down 12% y/y. Shipments totalled 380,000 metric tons (mt) in Q1, representing a drop of 2% y/y.

Foreign cold-rolled (CR) coil remains much less expensive than domestic product, according to SMU’s latest check of the market.

If successful in its overtures to Anglo American, BHP will create the world’s largest diversified miner by a country mile. The rationale for this merger is scale and in mining, size matters.

Week-over-week trading activity in US steel derivatives markets was relatively muted, with prices maintaining their downward direction since the beginning of the month. Bids have materialized at the lower end of this range in the May, as the nearby backwardation continues to roll on - just as we saw with April being a premium over May.

I’ve gotten some questions lately about whether the huge gap between domestic hot-rolled coil (HR) prices and those for cold-rolled (CR) and coated is sustainable. I remember being asked similar questions about the wide spread between HR and plate that developed in early 2022. I thought at the time that there was no way that spread could hold. Turned out, I was wrong. That was humbling. And so I’m not going to make any bold predictions this time.

Sheet steel buyers said mills are more willing to talk price on spot orders, according to our most recent survey data.

US hot-rolled (HR) coil remains more expensive than offshore hot band, though with a tighter premium as prices stateside and abroad have ticked lower in recent weeks.