Prices

June 27, 2019

Hot Rolled Futures: Have We Found a Bottom?

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

From 7/11/2018 up to this Wednesday, 6/26/2019, the HR index that the CME uses to settle the HR futures contract has dropped from $918/ST to $505/ST. A healthy $413/ST retracement to levels not seen since Nov. 16, 2016, which by the way was not the lowest price at the time but was within $10/ST. The June 2019 HR contract settled at $555.25 on the CME, an $83.15/ST drop from the May 2019 HR settlement ($638.40). Recent news such as the steep HR index declines the last two weeks and U.S. Steel’s announcement of production capacity reductions at its Gary facility along with price increase announcements by Nucor and a number of other mills this week have helped shift sentiment in the near term. We have seen some very wide price ranges in some of the nearer futures months intraday suggesting that there are divergent opinions regarding the nearby valuations, which could be a signal that overcapacity concerns persist. We are going to have to wait and see if the July HR index in fact can reach the high $538/ST average where it was last valued.

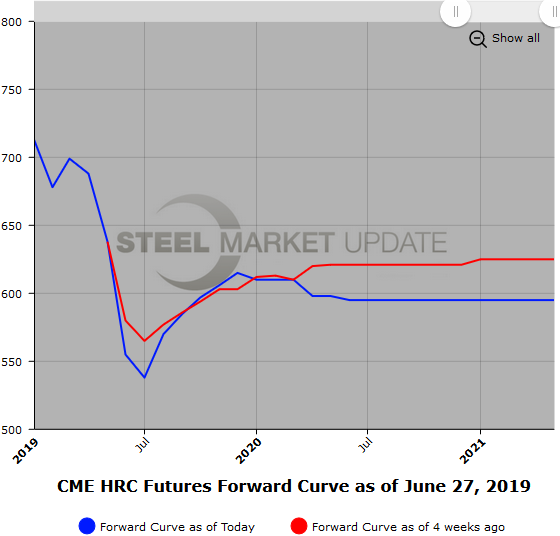

Certainly, the forward curve reflects some expectation of a healthy price bounce. Yesterday, the Aug’19-Dec’19 futures strip traded at an average price of $600/ST, which represents an $85-95 premium over this past week’s HR spot indexes. Today, Sep’19 HR futures were bid $587/ST, which reflects a steep premium to HR spot just over $500/ST. However, the contango from Jul’19 HR future (spot plus one month) to Jun’20 HR future has remained fairly steady at $53-$58/ST.

With the exception of the Jul’19 HR future, most of the months are little changed from the end of May.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

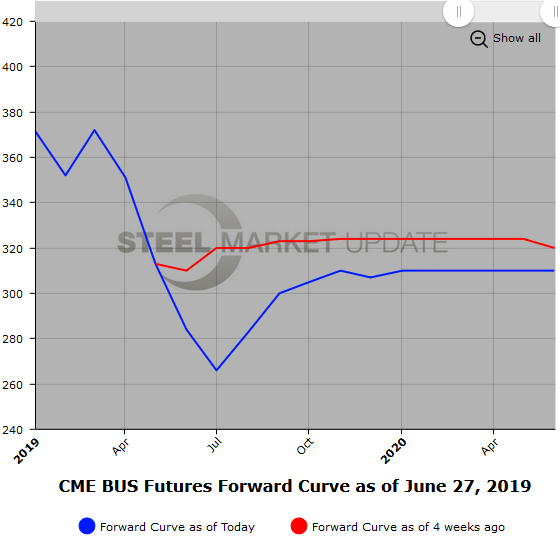

Initial discussion had Jul’19 BUS declining about $30/GT, but recent comments suggest that might come in a bit. Jun’19 BUS settled at $281.73 and the latest Jul’19 future traded at $266/GT. Current offers in Jul’19 BUS only reflect a $10-$12 discount to Jun’19 settle. The futures curve has shifted lower since the end of May, with 2H’19 BUS down on average $33/GT and the 1H’20 BUS prices down on average $17/GT. However, the curve remains upward sloping the further forward you go into the future. The Jul’19 BUS to Jun’20 BUS contango is about a $45 premium. With the recent steep scrap price declines, we have observed more buyers asking for offers along the BUS curve. The HR versus the BUS spread has been running from $290 to $310 for the Q3’19 through Q1’20, but has been less active at these lower levels with fewer interested sellers.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

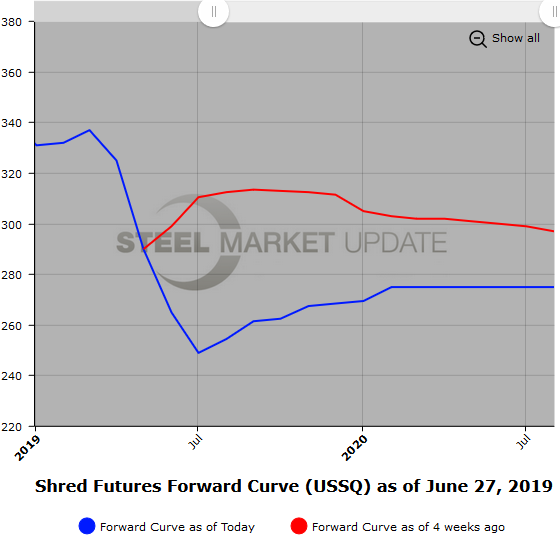

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.