Prices

November 30, 2023

HRC futures: The most wonderful time of the year

Written by Dave Feldstein

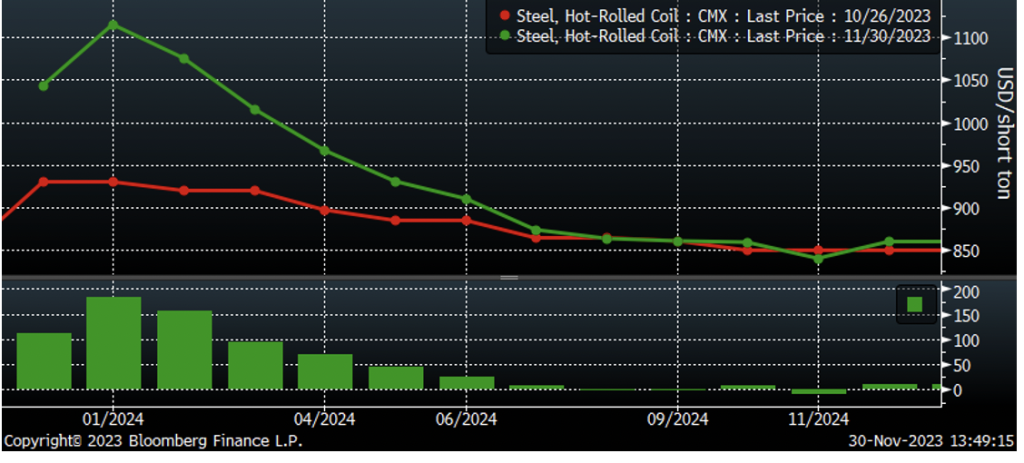

Oct. 26 was my previous Steel Market Update contribution. The night before, Ford and the United Auto Workers (UAW) union announced they had reached a tentative agreement for a new labor contract. Tentative agreements with GM and Stellantis would follow a few days later. And the contracts have all been ratified. Since Oct. 26, the months of December through March have rallied $113, $185, $156 and $95, respectively.

CME HRC futures curve $/st

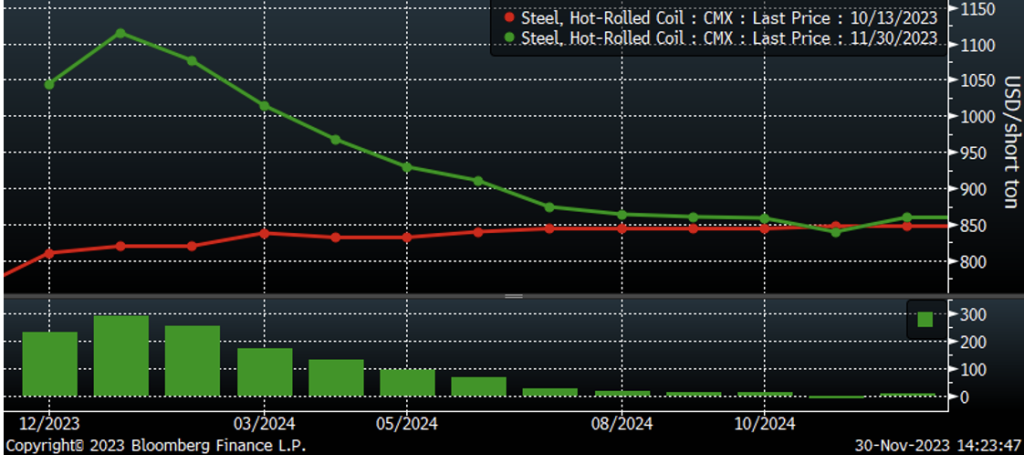

The 32-day old rally is making higher highs, with the January future jumping to $1,120 on Monday in response to Nucor’s latest price increase announcement. The January future is implying that not only will the mills capture all of this week’s price increase to $1,100, but also to expect at least one additional price increase to come.

January CME HRC future $/st

After 32 trading days, what has happened? The January future has rallied almost $295, having gone from $10 above the December future on Oct. 13 to $71 above the December future today. However, farther out on the curve, not much has changed. What has resulted is a steeply backwardated (downward sloping) curve indicating tight supply at the moment, which fits with the jump in HR lead times and tight service center months-on-hand data.

CME HRC curve $/st

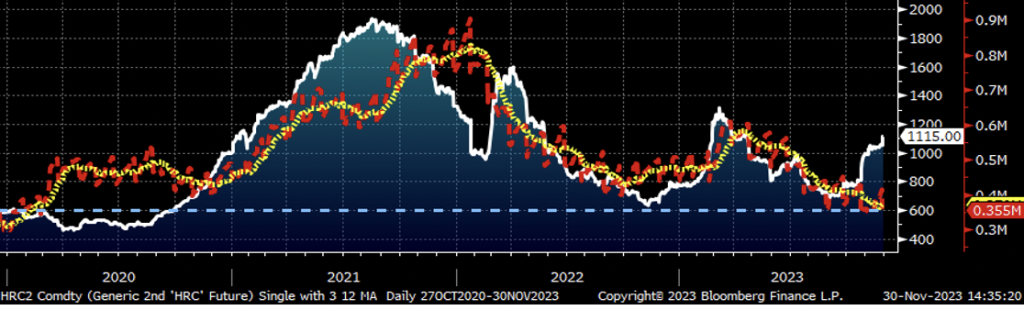

What doesn’t make much sense is the sharp drop in open interest that is the number of outstanding futures contracts, or tons in this case, across the Midwest HRC futures curve. Open interest currently sits at only 355,000 tons, which is where the dashed blue line sits. OEMs are not locking in steeply discounted forward prices, while service centers, importers and steel mills appear to be complacently sitting on the sidelines.

Rolling second month CME HRC future $/st and open interest (red) (22-day m.a. ylw)

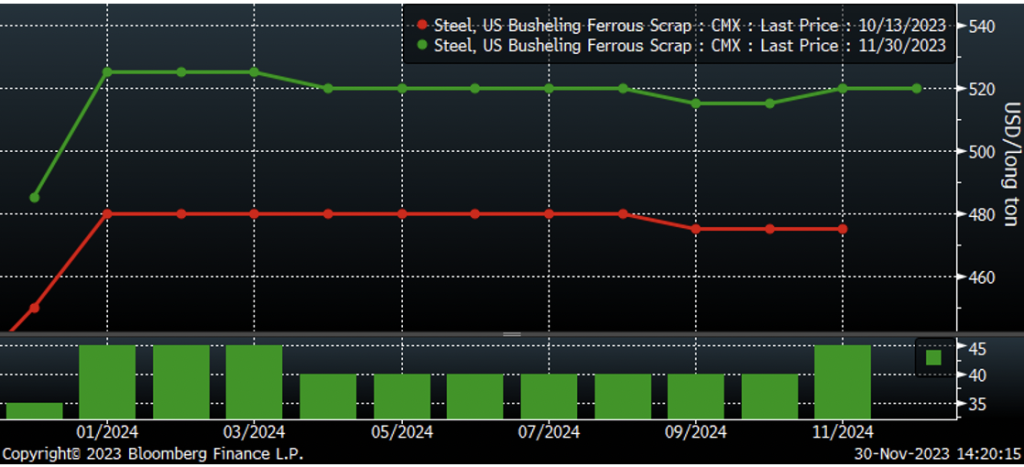

Over those same 32 days, busheling futures have rallied $35-45, with the flattish shape of the curve unchanged for the most part. At $525 per ton, the metal spread sits at $590 in January, $551 in February and $425 in March. Smoke ‘em if you got ‘em, steel mills. All right, all right, all right! It’s gonna be a Happy New Year, indeed, but similar to HRC, open interest in busheling futures is near its lowest level in two years! Why don’t the mills lock in their scrap? OEMs, service centers, importers and mills are all riding the wave. Apparently, that’s just how we roll in hot rolled. Get it? How we… roll?

CME busheling futures curve $/lt

There are plenty of risks ahead. Yesterday, CNBC’s David Faber announced U.S. Steel has attracted five interested buyers with final bids in the auction due on Friday. Earlier today, the European Union announced it is weighing concessions over Section 232 tariffs, allegedly fearing a Trump return to office. There have been three massive rallies in the futures market so far this year, so the heightened volatility is in and of itself a reason to mitigate price risk. How about an unplanned disruption at a domestic steel mill? What would that do to the market? What about a winter storm that cripples Southern mills?

Tomorrow brings a slew of data, including the ISM Manufacturing PMI. This morning, the Chicago Business Barometer Index did its best Spud Webb impression, jumping 11.8 points to 55.8!

MNI Chicago Purchasing Managers Index

Maybe you or one of your co-workers or customers have said “this is crazy” in reference to the price surge of the past few weeks. Just remember, it’s not crazy, it’s just hot rolled. Expect the unexpected! What is your firm doing about it? What does the open interest tell us? Apparently, most commercial market participants, both buy and sell side, expect to rush into the market beating everyone else to the punch. That sounds like a good plan. Remember, “Iron” Mike Tyson said, “Everybody’s got a plan until they get punched in the mouth.”

There are some serious upside risks to think about. There are some serious downside risks to be concerned about as well. Of course, I failed to mention the unknown risk, not to be confused with the risk that shall not be named. The bottom line is just because it is December doesn’t mean your firm can ignore the move that is coming in 2024. Remember, burying your head in the sand is not a strategy.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.