Analysis

March 5, 2024

Final thoughts

Written by David Schollaert

Flat-rolled steel prices have been running downhill in a hurry since the beginning of the year. In some ways, it’s no surprise because other indicators have also been pointing lower for some time.

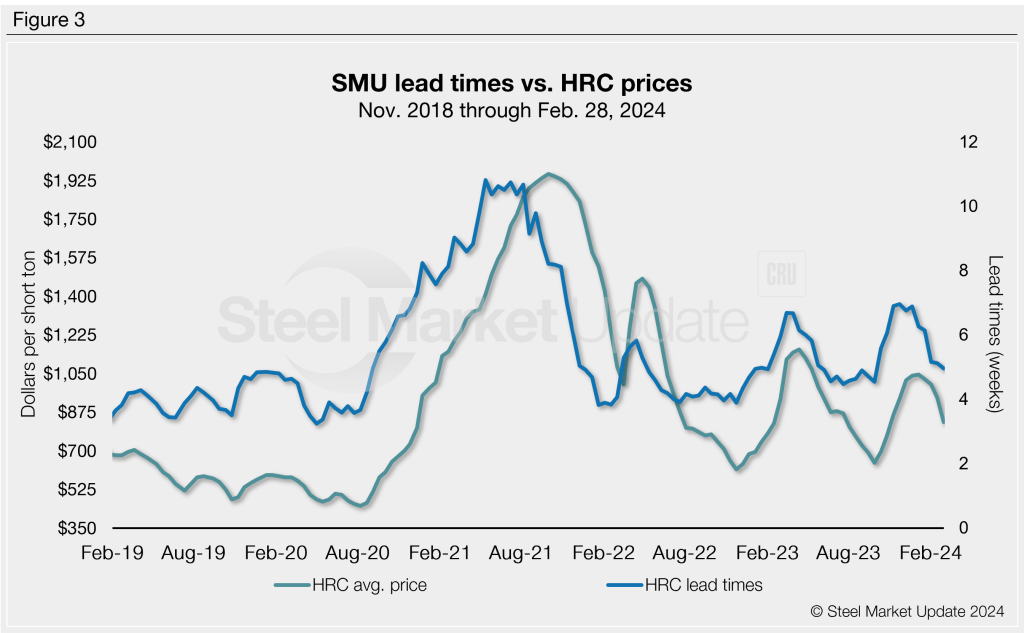

Lead times have been contracting since the beginning of the year and are now below the five-week mark for hot-rolled (HR) coil for the first time since September. Mills are more willing to negotiate lower prices, and early reports seem to indicate that scrap might settle lower again in March.

Hot-rolled coil prices are now $815 per short ton (st) on average, and could be sub-$800/st soon if the current pace of declines continues. That would be a level not seen since mid-October. Tandem products have followed a similar trend. Cold rolled, galvanized and Galvalume all fell again this week. Plate also dropped on the back of Nucor’s $90/st price-cut late last week.

When will prices bottom? A solid number of you expect it will happen between now and April. We don’t do forecasts at SMU. So I figured I’d instead highlight some of the other data we’ve been looking at.

Steel demand index

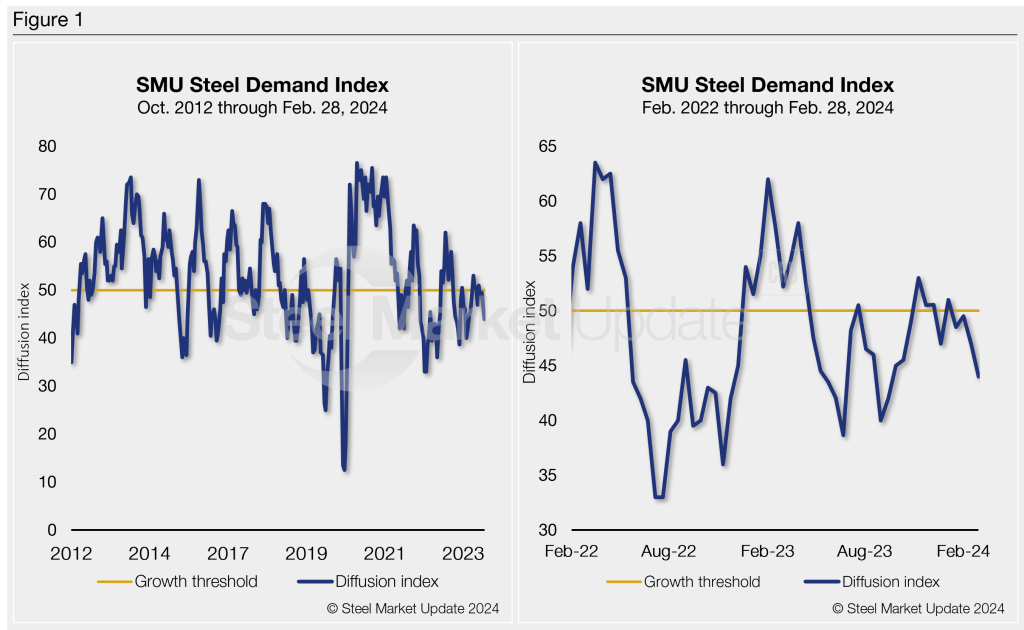

SMU’s Steel Demand Index has been in contraction territory since mid-January. The index – now at 44 – is down three points from a reading of 47 in mid-February and at a five-month low.

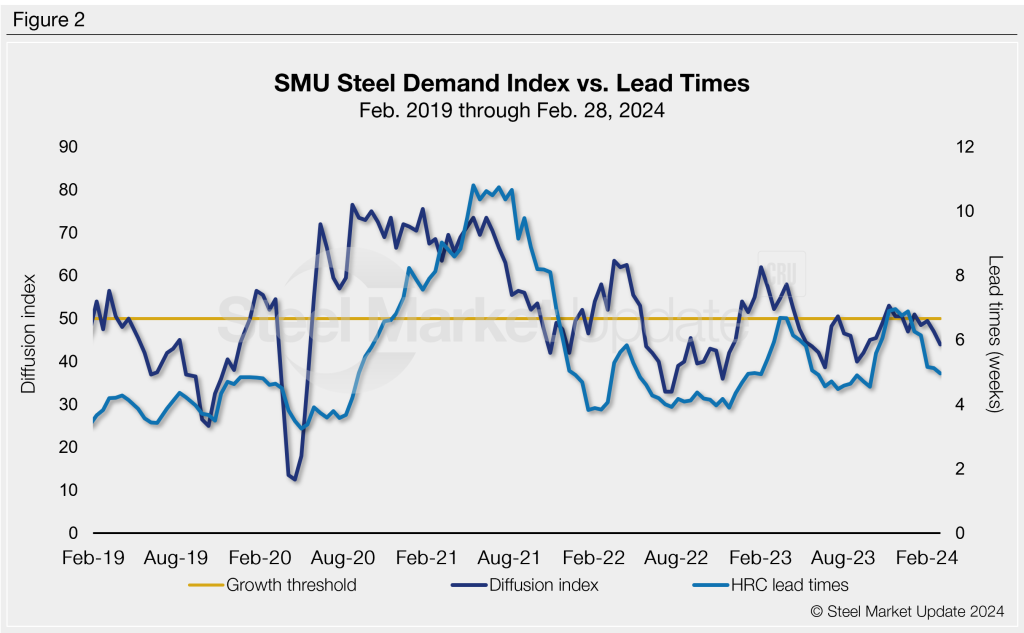

The index, which compares lead times and demand, is a diffusion index derived from the market surveys we conduct every two weeks. It has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves.

An index score above 50 indicates rising demand, and a score below 50 suggests declining demand. Detailed side by side in Figure 1 are historic data and the latest Steel Demand Index.

Our index has been in contraction territory for the better part of the past two months. When tags were rallying on the heels of repeated mill price hikes last fall, it was a different story. The index was in expansion territory from early November until late December. But generally speaking, it has been down more often than not over the last year.

Again, it’s important to note that SMU’s demand diffusion index has for years preceded moves in steel mill lead times (Figure 2). And SMU’s lead times have themselves been a leading indicator for flat-rolled steel prices, particularly HRC (Figure 3).

What to watch for

While lead times have been moving lower, upcoming outages could temporarily stop the bleeding and serve as a price tourniquet. EAF sheet mills have week-long maintenance programs upcoming later this month and next, and we’ve heard of some rolling week-long outages at an integrated mill.

Will these outages have a major impact on pricing and product availability? Or will they provide only temporary relief should demand disappoint as we move closer to Q2? Let me know what you think!

SMU Community Chat

Worthington Steel President and CEO Geoff Gilmore is the featured speaker on Wednesday’s Community Chat. He’ll join Michael Cowden at 11 am ET for the live webinar to discuss the current steel market and the outlook for the key end markets Worthington Steel serves. It’s free to attend. You can register here.

Steel 101 Workshop

Our next virtual Steel 101 is less than two weeks out – on March 19-20. The course offers an introduction to steel making and market fundamentals and is a great way to expand your career development in steel.

If that timeline doesn’t work, we also have two in-person Steel 101s later this year. One is on June 11-12 in Fort Wayne, Ind., featuring a tour of SDI Butler. Another in-person Steel 101 is scheduled for Oct. 8-9 at SDI Columbus. (You can learn more about Steel 101 and register here.)

As always, your business is truly appreciated by all of us associated with Steel Market Update.